How AEP’s US$3.5 Billion Equity Raise And US$72 Billion Plan Has Changed Its Investment Story

- In late November 2025, American Electric Power Company, Inc. filed a US$3.50 billion at-the-market follow-on common stock offering, while also outlining a US$72.00 billion capital investment plan and updated five-year operating earnings guidance.

- Beyond raising new equity, AEP’s combination of a large-scale spending program and explicit long-term earnings targets gives investors clearer visibility into how future growth may be funded and delivered.

- Next, we’ll examine how AEP’s US$72.00 billion capital investment plan reshapes its existing investment narrative and risk-reward profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

American Electric Power Company Investment Narrative Recap

To own AEP, you need to be comfortable backing a large regulated utility that is leaning into heavy grid and generation investment while depending on regulators to keep returns attractive. The new US$3.50 billion at the market equity program supports its US$72.00 billion capex plan, but also raises the short term risk of earnings per share dilution, making execution on its largest projects and regulatory approvals even more important.

The most relevant recent update is AEP’s long term operating earnings growth target of 7 to 9 percent, underpinned by its US$72.00 billion capital investment plan and an expected 10 percent annual rate base increase. This connects directly to the new equity raise, since a larger rate base is intended to support higher earnings over time, while the expanded spending program adds to existing risks around supply chain costs, project delays and regulatory outcomes.

Yet behind this large investment story, investors should be aware of how much depends on shifting regulatory decisions in Ohio...

Read the full narrative on American Electric Power Company (it's free!)

American Electric Power Company's narrative projects $24.6 billion revenue and $4.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and about a $0.5 billion earnings increase from $3.6 billion today.

Uncover how American Electric Power Company's forecasts yield a $128.68 fair value, a 8% upside to its current price.

Exploring Other Perspectives

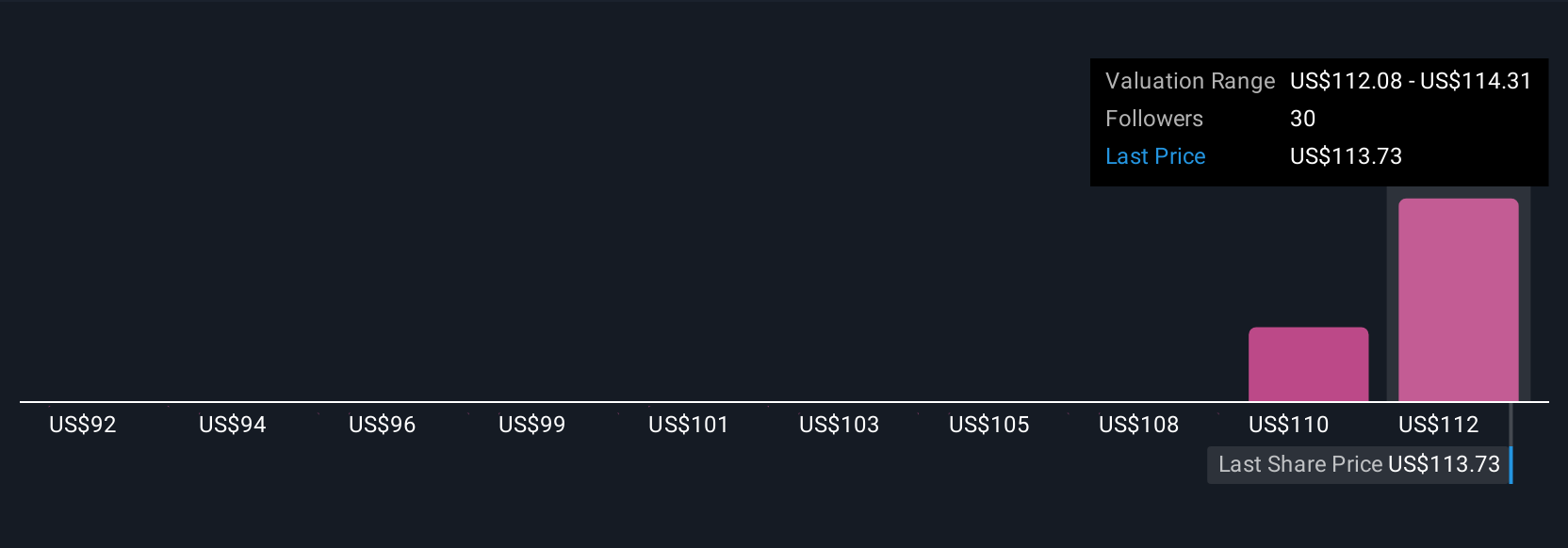

Three fair value estimates from the Simply Wall St Community span roughly US$92 to US$128.68, showing how far apart individual views on AEP can be. Against this backdrop, reliance on a huge US$72.00 billion capital plan to support earnings growth means those differing opinions reflect real uncertainty about how smoothly AEP can fund and recover such spending over time.

Explore 3 other fair value estimates on American Electric Power Company - why the stock might be worth 23% less than the current price!

Build Your Own American Electric Power Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Electric Power Company's overall financial health at a glance.

No Opportunity In American Electric Power Company?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com