3M’s PFAS Exit and Earnings Momentum Could Be A Game Changer For 3M (MMM)

- In recent months, 3M has maintained strong earnings momentum with double-digit adjusted EPS growth, twice raised its 2025 guidance, and continued progressing toward its planned exit from PFAS manufacturing by the end of 2025.

- These steps suggest 3M is working to balance operational improvement with efforts to limit long-term legal and reputational risks from PFAS and other legacy issues.

- We’ll now examine how 3M’s improving earnings outlook and PFAS exit plan could reshape its investment narrative for long-term investors.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

3M Investment Narrative Recap

To own 3M today, you need to believe its recent earnings recovery, portfolio simplification, and PFAS exit can steadily rebuild cash generation while legal and ESG liabilities are contained. The latest Scotch holiday marketing push is positive for brand visibility but does not materially affect the key near term catalyst of sustaining double digit adjusted EPS growth, nor does it change the biggest current risk, which remains the uncertainty around ongoing PFAS and other legacy litigation.

Among recent developments, 3M’s decision to raise full year 2025 guidance, with organic sales growth now expected to exceed 2% and free cash flow conversion above 100%, is more relevant for investors than the Scotch campaign. That guidance upgrade directly supports the earnings momentum narrative, while also highlighting the tension between returning cash to shareholders through dividends and buybacks and preserving balance sheet flexibility ahead of potential future PFAS related cash outflows.

Yet beneath the improving earnings guidance, investors still need to be aware of the unresolved PFAS cases and the possibility that...

Read the full narrative on 3M (it's free!)

3M's narrative projects $26.1 billion revenue and $4.7 billion earnings by 2028. This requires 2.0% yearly revenue growth and roughly an $0.8 billion earnings increase from $3.9 billion today.

Uncover how 3M's forecasts yield a $174.94 fair value, in line with its current price.

Exploring Other Perspectives

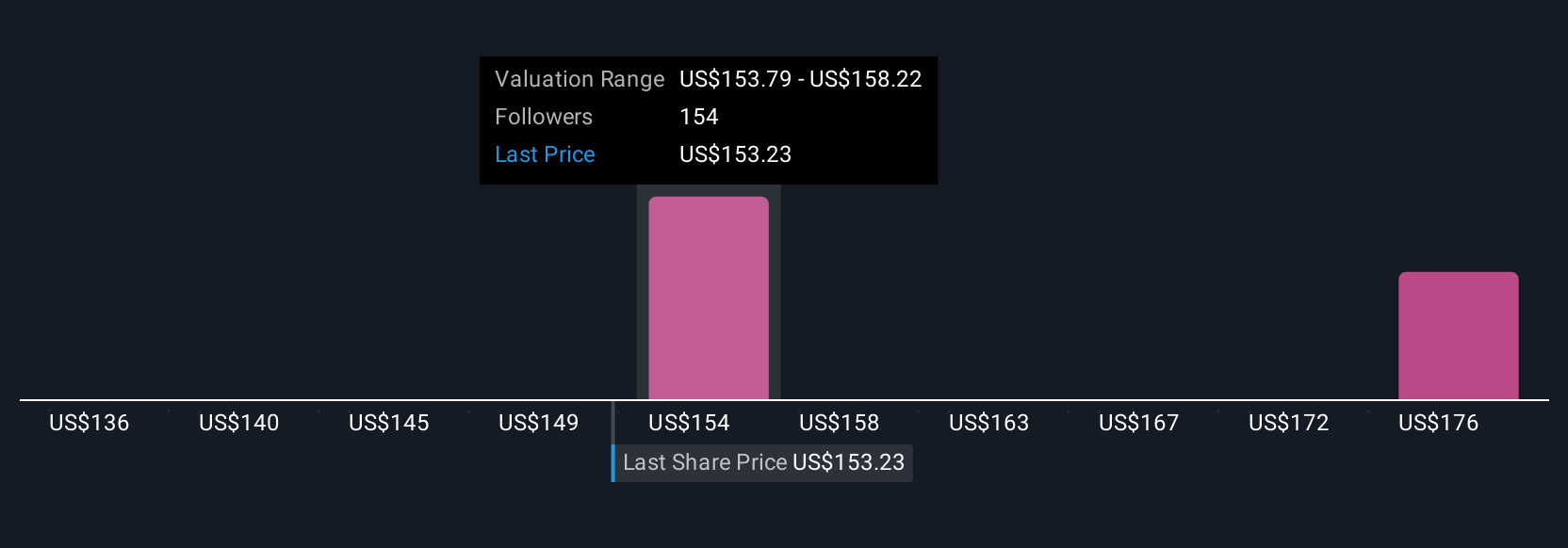

Seven fair value estimates from the Simply Wall St Community span roughly US$142 to US$193 per share, underlining how far apart individual views can be. Set against this spread, the unresolved PFAS litigation risk could materially influence how you interpret these valuations and why it may be worth weighing several different viewpoints before forming a view on 3M’s long term prospects.

Explore 7 other fair value estimates on 3M - why the stock might be worth 18% less than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com