How Record AI‑Fueled Q3 Results and a 52% Dividend Hike Will Impact Amphenol (APH) Investors

- Amphenol recently reported record third-quarter 2025 results, with sales rising very large year-on-year and adjusted earnings per share up sharply, largely driven by booming AI data center demand and a strong Communication Solutions segment, while also announcing a 52% increase in its quarterly dividend from January 2026.

- The company is further reshaping its business mix through aggressive acquisitions, including a pending US$10.50 billion purchase of CommScope’s Connectivity and Cable Solutions unit financed partly by a US$7.50 billion notes offering, deepening its exposure to AI infrastructure, communications networks, and defense markets.

- We’ll now examine how Amphenol’s record AI‑driven quarter and sharply higher dividend outlook affect the company’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Amphenol Investment Narrative Recap

To own Amphenol, you need to believe the company can keep turning AI data center demand and higher electronic content across industries into durable earnings, without overstretching on acquisitions or capital spending. The record third quarter and raised 2025 guidance reinforce the AI-driven growth story in the near term, but they also heighten the risk that recent demand and margins prove “pulled forward” and more volatile than they currently appear.

The stand‑out announcement here is the pending US$10.50 billion purchase of CommScope’s Connectivity and Cable Solutions unit, funded in part by a US$7.50 billion multi‑tranche notes offering. This deal directly ties into the key catalyst of AI infrastructure and communications network build‑outs, but it also magnifies the existing risk around acquisition integration, balance sheet leverage, and the sustainability of Amphenol’s margin profile if sector growth slows.

Yet behind the record AI quarter and richer dividend outlook, investors should be aware of how quickly “pulled forward” demand could unwind if...

Read the full narrative on Amphenol (it's free!)

Amphenol's narrative projects $26.9 billion revenue and $5.1 billion earnings by 2028.

Uncover how Amphenol's forecasts yield a $147.99 fair value, a 7% upside to its current price.

Exploring Other Perspectives

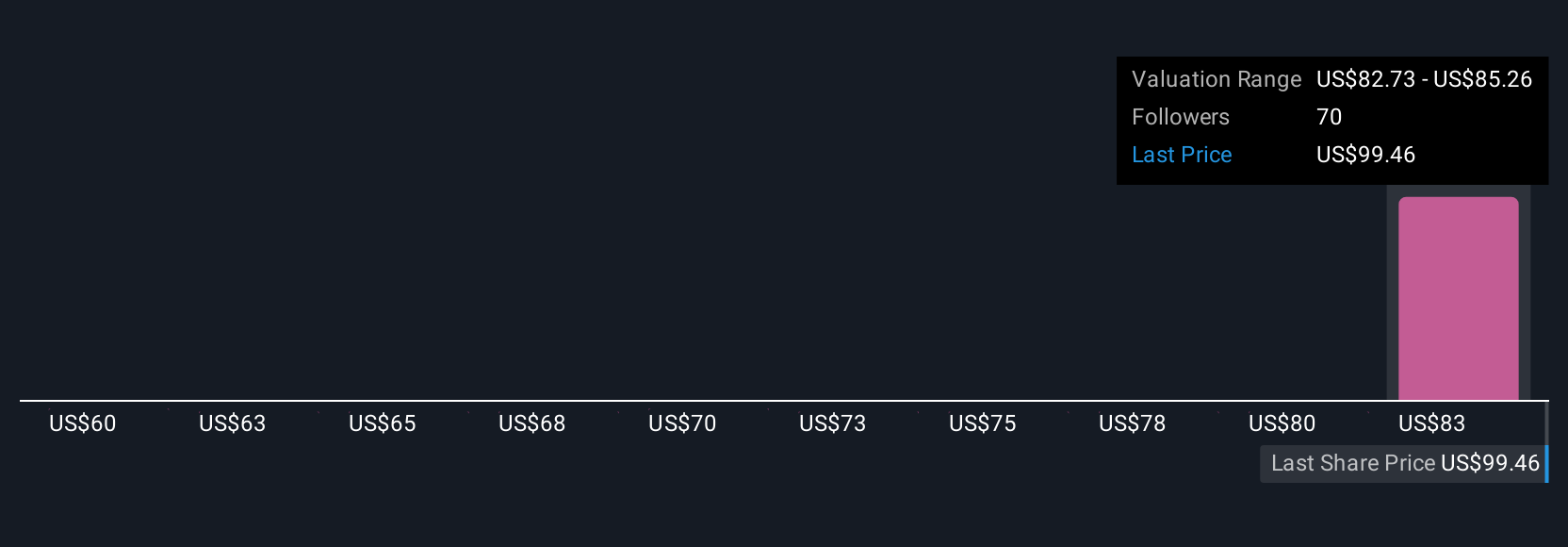

Six fair value estimates from the Simply Wall St Community span roughly US$60 to about US$148, showing how far apart individual views can be. Against that backdrop, the company’s record AI driven quarter and enlarged acquisition pipeline raise important questions about how sustainable today’s growth and profitability profile really is over time, so it is worth weighing several different opinions.

Explore 6 other fair value estimates on Amphenol - why the stock might be worth as much as 7% more than the current price!

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com