SLB (SLB) Is Up 5.3% After ChampionX Deal And Tela AI Launch - What's Changed

- SLB recently closed its US$7.80 billion acquisition of ChampionX and launched Tela, an AI assistant integrated across its energy technology platforms, while also declaring its next quarterly dividend and scheduling its fourth-quarter 2025 earnings call.

- Together, the ChampionX deal and Tela launch highlight SLB’s push to combine production optimization with digital tools and AI, potentially reshaping how the company serves energy operators globally.

- We’ll now examine how the launch of Tela as a new AI layer across SLB’s platforms might influence its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SLB Investment Narrative Recap

To own SLB, you need to believe hydrocarbons will remain central to global energy while operators keep paying for efficiency, digitalization and production optimization. The ChampionX acquisition and Tela AI launch both support that story, but the key near term catalyst is still how quickly SLB can translate this combined offering into higher margin digital and production services, while the biggest current risk is execution missteps or delays in integrating ChampionX’s operations and realizing the targeted cost and revenue synergies.

Against that backdrop, the closure of the US$7.80 billion ChampionX deal is the most relevant recent milestone, because it materially expands SLB’s production optimization and chemicals footprint at the same time Tela is being rolled out as an AI layer across its platforms. Together, they potentially increase SLB’s exposure to more OPEX driven, less cyclical production activity, which could partially offset softer short cycle spending and volatility in North American drilling activity.

Yet while the story sounds compelling, investors should still be aware that integration risks around ChampionX could...

Read the full narrative on SLB (it's free!)

SLB's narrative projects $38.7 billion revenue and $4.9 billion earnings by 2028. This requires 2.9% yearly revenue growth and about an $0.8 billion earnings increase from $4.1 billion today.

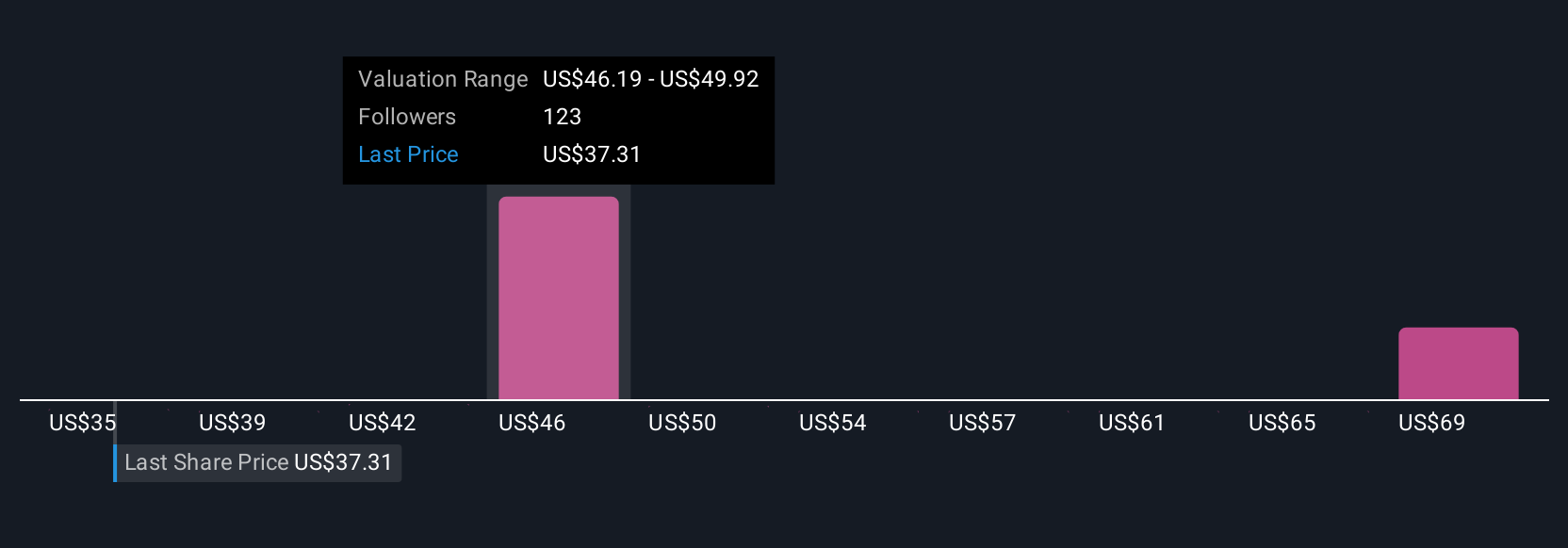

Uncover how SLB's forecasts yield a $45.31 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently place SLB’s fair value between US$36 and about US$91.94, showing a very wide spread of views. Set against this, the company’s growing push into digital tools like Tela and production oriented services with ChampionX could matter a lot for how resilient SLB’s results prove over time, so it is worth weighing several different perspectives before deciding where you stand.

Explore 14 other fair value estimates on SLB - why the stock might be worth just $36.00!

Build Your Own SLB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SLB research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SLB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SLB's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com