Is Dole’s (DOLE) Intermarché Push a Real Test of Its Branded Europe Strategy?

- Dole has recently launched a nationwide in‑store promotional campaign with Intermarché, covering 834 supermarkets across France to raise brand visibility and support its fresh produce portfolio in Europe.

- This partnership with France’s third-largest food retailer gives Dole broader access to everyday shoppers across the country, potentially reinforcing its branded positioning in the EMEA fresh produce market.

- Next, we’ll examine how this broad Intermarché rollout fits into Dole’s longer-term push toward higher-margin, branded fresh produce growth.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dole Investment Narrative Recap

To own Dole, you need to believe it can steadily turn a low margin, commodity heavy fruit business into a more resilient, branded fresh-produce platform. The Intermarché rollout modestly supports that story by broadening branded visibility in a key European market, but it does not change the nearer term focus on managing weather related cost pressure and the ongoing risk from commodity price and disease shocks in bananas and pineapples.

The recent refinancing of Dole’s corporate credit facilities, including a US$600,000,000 multicurrency revolving credit line and new term loans, is more consequential for current catalysts than the French promotion itself. Together, the cleaner balance sheet structure and the push into higher margin branded products frame how much financial flexibility Dole retains if extreme weather, capex needs, or compliance costs rise faster than expected.

Yet while brand reach in Europe is expanding, investors should be aware that Dole’s heavy reliance on bananas and pineapples still leaves...

Read the full narrative on Dole (it's free!)

Dole's narrative projects $9.1 billion revenue and $163.0 million earnings by 2028.

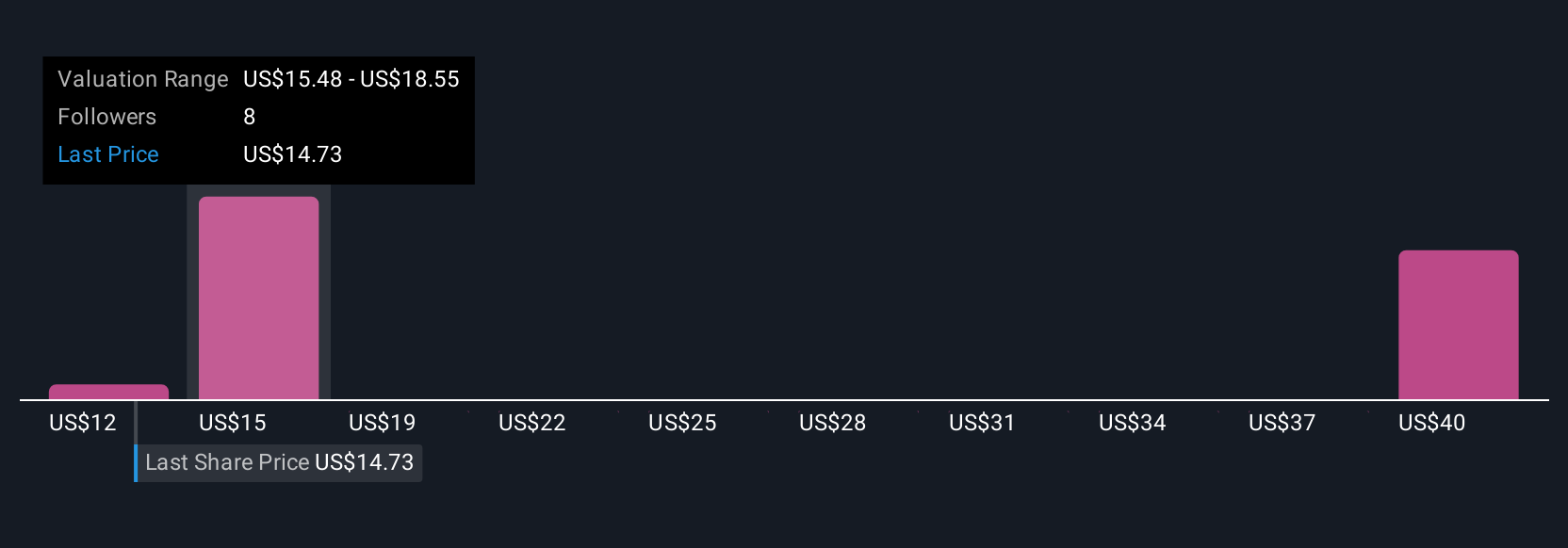

Uncover how Dole's forecasts yield a $17.83 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates span roughly US$17.83 to US$31.45 per share, underlining how far apart individual views can be. When you weigh this against weather driven cost risks and Dole’s push into higher margin branded produce, it becomes even more important to compare several independent perspectives before forming your own view.

Explore 2 other fair value estimates on Dole - why the stock might be worth just $17.83!

Build Your Own Dole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dole research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dole's overall financial health at a glance.

No Opportunity In Dole?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com