Has Molina Healthcare’s 52% Slide Created a Compelling 2025 Valuation Opportunity?

- If you are wondering whether Molina Healthcare is a beaten-down bargain or a value trap at current levels, this breakdown will help you consider whether the market is mispricing the stock.

- The share price has slipped to around $149, with returns of 0.5% over the last week and 1.4% over the last month. However, a slide of 48.1% year to date and 52.0% over the past year has clearly reset expectations and risk perceptions.

- Recently, investors have been reacting to shifting policy and reimbursement headlines around Medicaid and managed care, which tend to move sentiment sharply for Molina and its peers. In addition, evolving discussions about healthcare regulation and state budget pressures have added another layer of uncertainty that helps explain the sustained share price weakness.

- Despite that, Molina currently scores a solid 5/6 on our valuation checks, suggesting the market may be overly pessimistic. This sets up an interesting discussion of DCF, multiples, and other methods, followed by a more intuitive way to think about what this stock is really worth.

Find out why Molina Healthcare's -52.0% return over the last year is lagging behind its peers.

Approach 1: Molina Healthcare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today, using a required rate of return. For Molina Healthcare, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flows available to shareholders in $.

While the latest twelve months Free Cash Flow is negative at about $573 Million, analysts expect a sharp turnaround. Projections show Free Cash Flow rising to roughly $847 Million in 2026 and $1,127 Million in 2027. Simply Wall St then extrapolates further growth to around $1.70 Billion by 2035. These discounted cash flows sum to an estimated intrinsic value of about $649 per share.

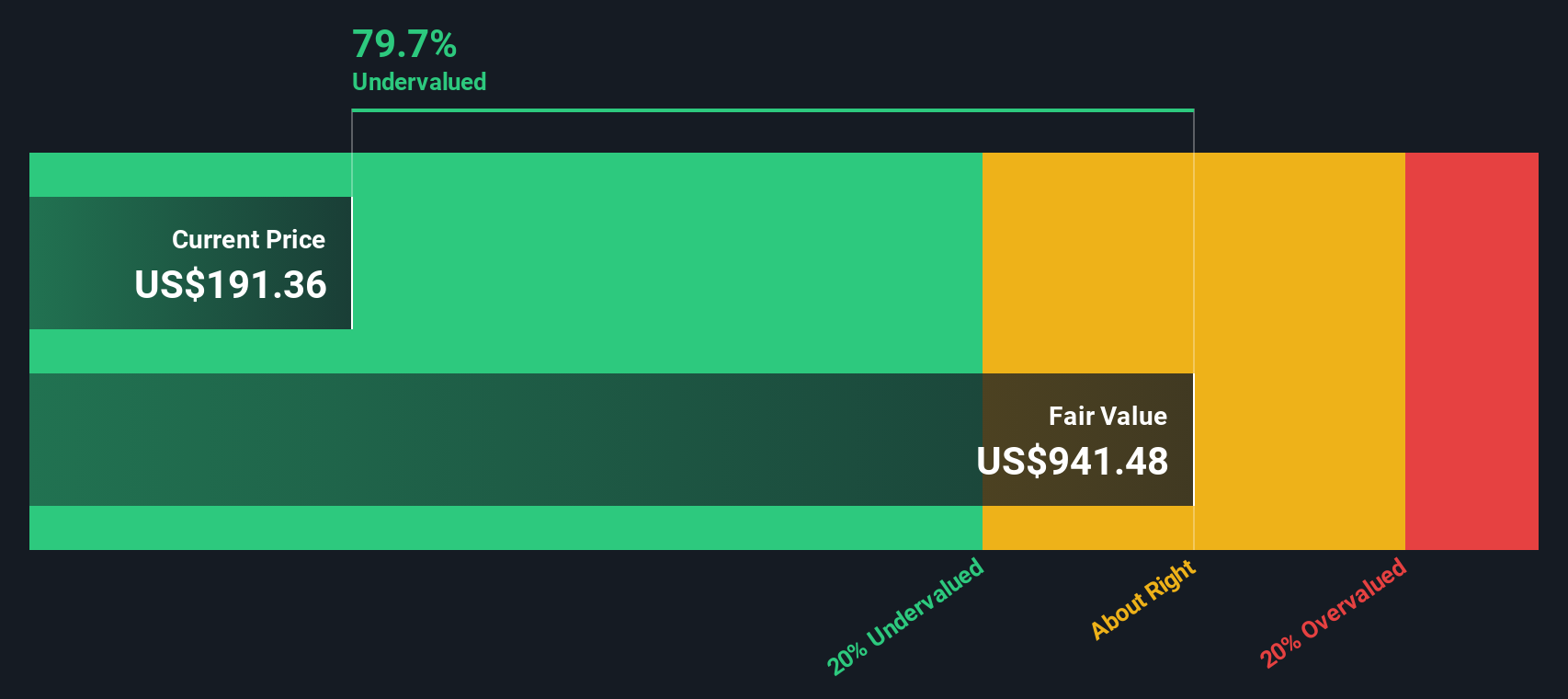

Compared with the current share price near $149, the DCF suggests Molina is roughly 77.0% undervalued. That gap implies the market is heavily discounting the company’s ability to sustain and grow these future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molina Healthcare is undervalued by 77.0%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Molina Healthcare Price vs Earnings

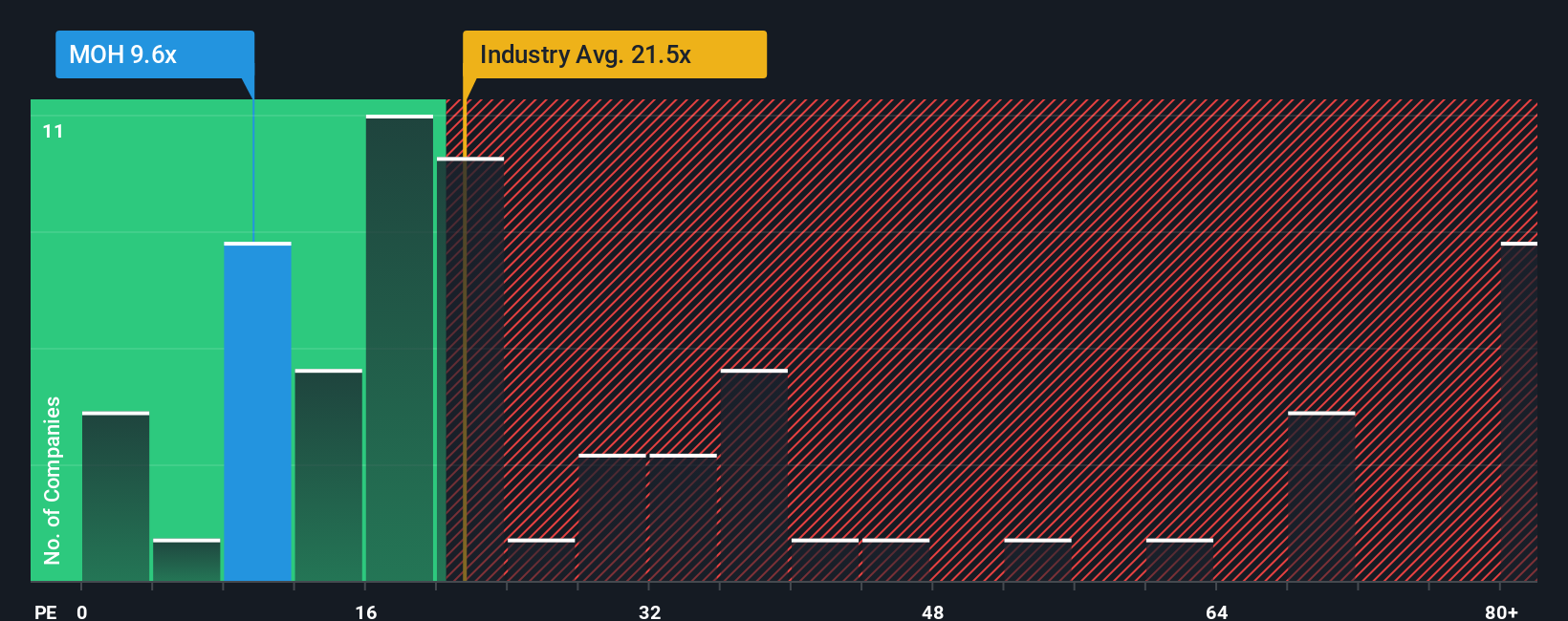

For a profitable company like Molina Healthcare, the price to earnings, or PE, ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing and lower risk companies tend to justify a higher PE multiple, while slower growth or higher uncertainty usually warrants a lower one.

Molina currently trades on a PE of about 8.7x, which is well below both the healthcare industry average of roughly 22.3x and a broader peer average near 33.2x. On the surface, that discount suggests investors are pricing in weaker growth or higher risk than for comparable managed care names.

Simply Wall St also calculates a Fair Ratio of about 20.7x for Molina, which is the PE level you might expect given its earnings growth outlook, profit margins, market cap, industry positioning and risk profile. This Fair Ratio is more tailored than a simple comparison with peers or industry averages, because it adjusts for the company’s own fundamentals rather than assuming it should trade exactly in line with the group. With the actual PE at 8.7x versus a Fair Ratio of 20.7x, the multiple based view also points to meaningful undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

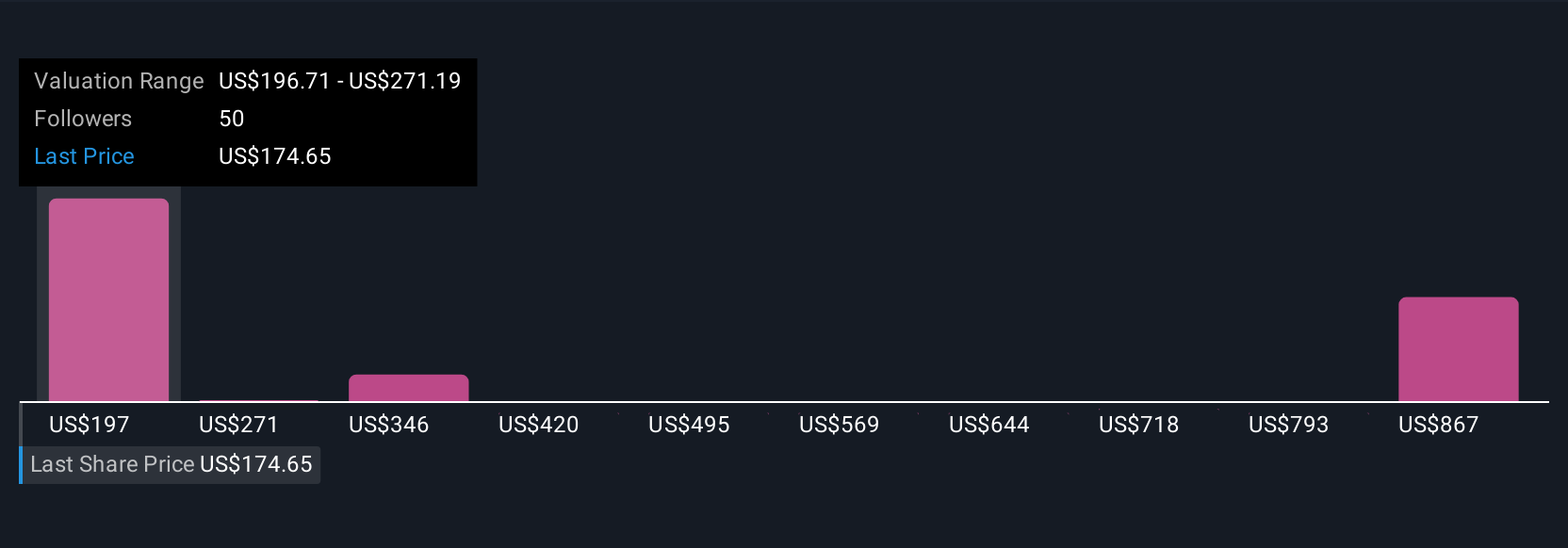

Upgrade Your Decision Making: Choose your Molina Healthcare Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where millions of investors connect a company’s story to a financial forecast and then to a fair value. They do this by writing their own perspective on future revenue, earnings and margins, comparing that Fair Value to today’s Price to decide whether to buy or sell, and watching it update dynamically as new news or earnings land. For Molina Healthcare, one investor might build a bullish Narrative around successful Medicaid contract wins, 6.8% annual revenue growth and a fair value closer to the most optimistic $330 target. Another might focus on Medicaid funding risk, margin pressure and a more cautious fair value near the $153 bearish target, with both storylines clearly quantified and tracked over time.

Do you think there's more to the story for Molina Healthcare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com