Pitney Bowes’ Long‑Dated Debt Tender Might Change The Case For Investing In Pitney Bowes (PBI)

- In November 2025, Pitney Bowes Inc. launched tender offers to repurchase up to US$75,000,000 of its 6.70% Notes due 2043 and 5.250% Medium-Term Notes due 2037, with the offers scheduled to expire on December 19, 2025.

- This move signals an effort to reshape the company’s long-dated debt profile, potentially reducing interest costs while giving management more control over its capital structure.

- We’ll now consider how Pitney Bowes’ move to repurchase up to US$75,000,000 of long-dated notes could influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Pitney Bowes Investment Narrative Recap

As a Pitney Bowes shareholder, you need to believe the company can use improving profitability and tighter capital management to offset structural mail and logistics pressures. The US$75,000,000 tender offer for long-dated notes points to incremental balance sheet repair, but does not materially change the near term catalyst of earnings execution or the key risk around high leverage and refinancing needs.

The most closely connected development is Pitney Bowes’ broader refinancing activity in 2025, including the January term loan and revolver refresh. Taken together with the new tender offers, these moves reinforce that the company’s immediate story still hinges on how effectively it can manage its debt stack while revenue is guided to decline modestly.

Yet investors should also weigh how this reshaping of long term obligations interacts with the ongoing risk that interest payments are not well covered by earnings...

Read the full narrative on Pitney Bowes (it's free!)

Pitney Bowes' narrative projects $1.9 billion revenue and $348.2 million earnings by 2028. This implies a 2.1% yearly revenue decline and about a $202.3 million earnings increase from $145.9 million today.

Uncover how Pitney Bowes' forecasts yield a $14.00 fair value, a 41% upside to its current price.

Exploring Other Perspectives

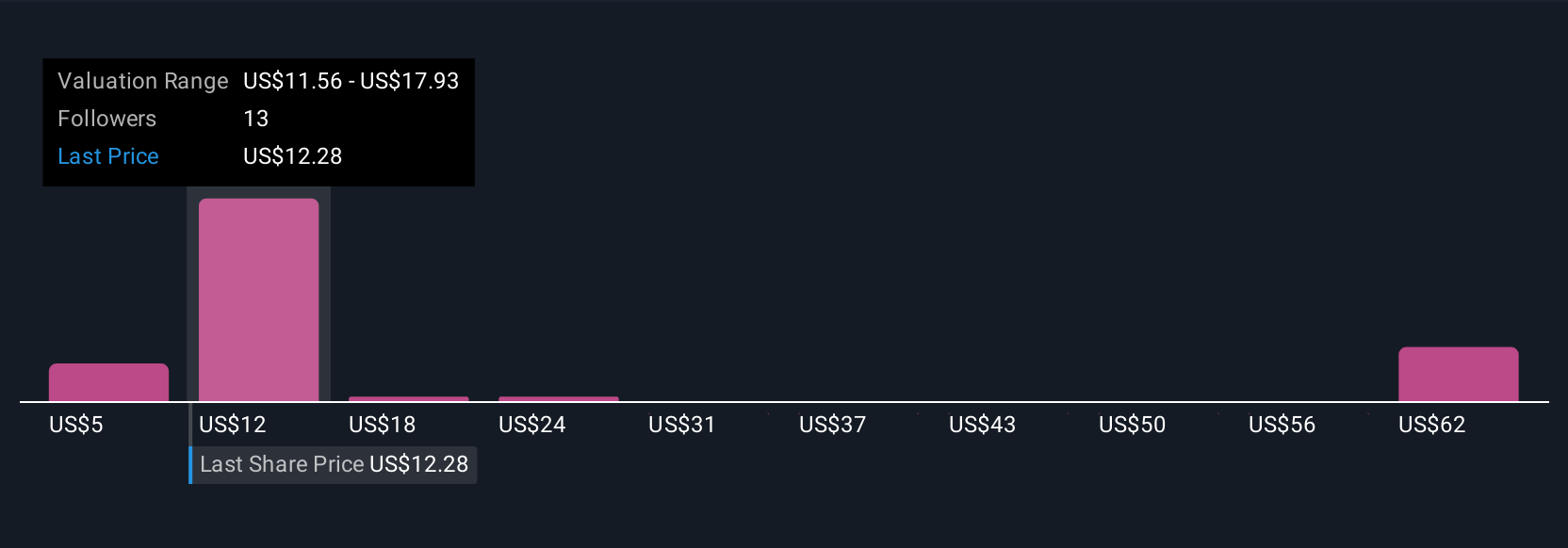

Eleven Simply Wall St Community fair value estimates span roughly US$5.20 to US$38.78 per share, showing very different views of Pitney Bowes’ potential. When you set that against concerns about high leverage and uneven interest coverage, it underlines why considering several independent perspectives can be so important.

Explore 11 other fair value estimates on Pitney Bowes - why the stock might be worth 47% less than the current price!

Build Your Own Pitney Bowes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pitney Bowes research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pitney Bowes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pitney Bowes' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com