Will Leadership Exits Amid UK Strains and Profit Outperformance Change Domino's Pizza's (DPZ) Narrative?

- In November 2025, Domino’s Pizza announced the immediate resignation of board member C. Andrew Ballard and confirmed earlier news of the UK CEO’s departure amid a supply glut and tough conditions in the British pizza market, while reiterating that Ballard’s exit was not due to any disagreement with company practices.

- At the same time, management highlighted profit growth slightly ahead of expectations and confidence in taking market share despite macro and industry pressures, raising questions about how leadership changes could affect the company’s ability to sustain that performance.

- We’ll now examine how management’s emphasis on profit growth and market share gains amid a tough backdrop may reshape Domino’s existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Domino's Pizza Investment Narrative Recap

To own Domino’s today, you need to believe its global brand and franchise model can keep converting steady pizza demand into growing profits, even as category growth looks limited and competition remains intense. The recent UK leadership change and US board resignation do not appear to materially alter the near term catalyst, which is management’s focus on profit growth and market share gains, but they may sharpen attention on execution risk in weaker international markets.

The most relevant recent announcement here is management’s Q3 commentary that profit growth came in slightly ahead of expectations despite macro pressures. That message of resilient profitability sits alongside the leadership changes and keeps the spotlight on whether Domino’s can keep growing earnings once the benefit from newer initiatives like delivery partnerships and loyalty upgrades fades, particularly as the global pizza category shows signs of stagnation.

Yet behind that profit resilience, investors should be aware of the risk that a flat global pizza category and tougher comparisons could...

Read the full narrative on Domino's Pizza (it's free!)

Domino's Pizza's narrative projects $5.6 billion revenue and $720.0 million earnings by 2028. This requires 5.5% yearly revenue growth and about a $122.9 million earnings increase from $597.1 million today.

Uncover how Domino's Pizza's forecasts yield a $496.65 fair value, a 15% upside to its current price.

Exploring Other Perspectives

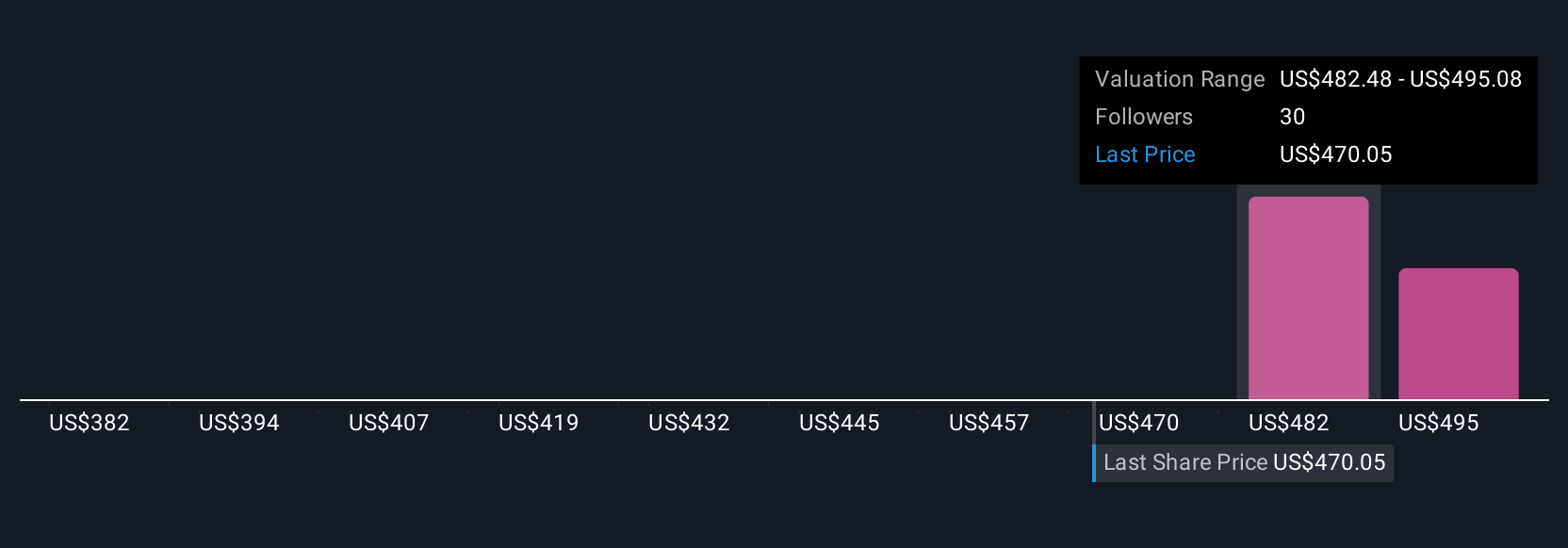

Three members of the Simply Wall St Community see Domino’s fair value between US$351 and US$497, underscoring how far opinions can stretch. Set against concerns about a flat global pizza category, this spread invites you to weigh several competing views on Domino’s ability to sustain growth and margins.

Explore 3 other fair value estimates on Domino's Pizza - why the stock might be worth 19% less than the current price!

Build Your Own Domino's Pizza Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Domino's Pizza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Domino's Pizza's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com