Is Columbia’s New Star Wars Endor Collection Reframing Its Brand Strategy For Long-Term Relevance (COLM)?

- In early December 2025, Columbia Sportswear released The Endor™ Collection, a 20-piece Star Wars™-inspired lineup that combines its performance outerwear technologies with detailed designs based on the Rebel Alliance’s Endor mission from Return of the Jedi™.

- By blending fandom-driven storytelling elements, like Aurebesh “easter eggs,” Endor coordinates, and Rebel insignias, with a high-profile campaign fronted by Billie Lourd, Columbia is aiming to deepen engagement with both outdoor consumers and Star Wars enthusiasts.

- Next, we’ll explore how this Star Wars collaboration, especially the premium Han Solo trench and Endor poncho, could influence Columbia’s investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Columbia Sportswear Investment Narrative Recap

To own Columbia Sportswear, you need to believe the company can reinvigorate its core brand, improve underperforming U.S. direct-to-consumer channels, and defend margins despite cost pressures. The Endor Collection is brand-accretive, but unlikely to materially change the key near term swing factor, which is whether Columbia’s refreshed product and marketing efforts can translate into healthier sales and earnings after a period of weaker growth and compressed profitability.

Among recent developments, the appointment of Joseph P. Boyle as president of the Columbia brand and head of North America stands out in the context of this Star Wars launch. A clearer leadership structure over the core brand and U.S. business sits directly alongside capsule collaborations like Endor, which may serve as test beds for Columbia’s broader product innovation and storytelling efforts aimed at reigniting demand and supporting pricing power.

But while these collaborations are eye catching, investors should be aware that...

Read the full narrative on Columbia Sportswear (it's free!)

Columbia Sportswear's narrative projects $3.7 billion revenue and $184.1 million earnings by 2028. This requires 2.3% yearly revenue growth and a $40.7 million earnings decrease from $224.8 million today.

Uncover how Columbia Sportswear's forecasts yield a $57.57 fair value, a 6% upside to its current price.

Exploring Other Perspectives

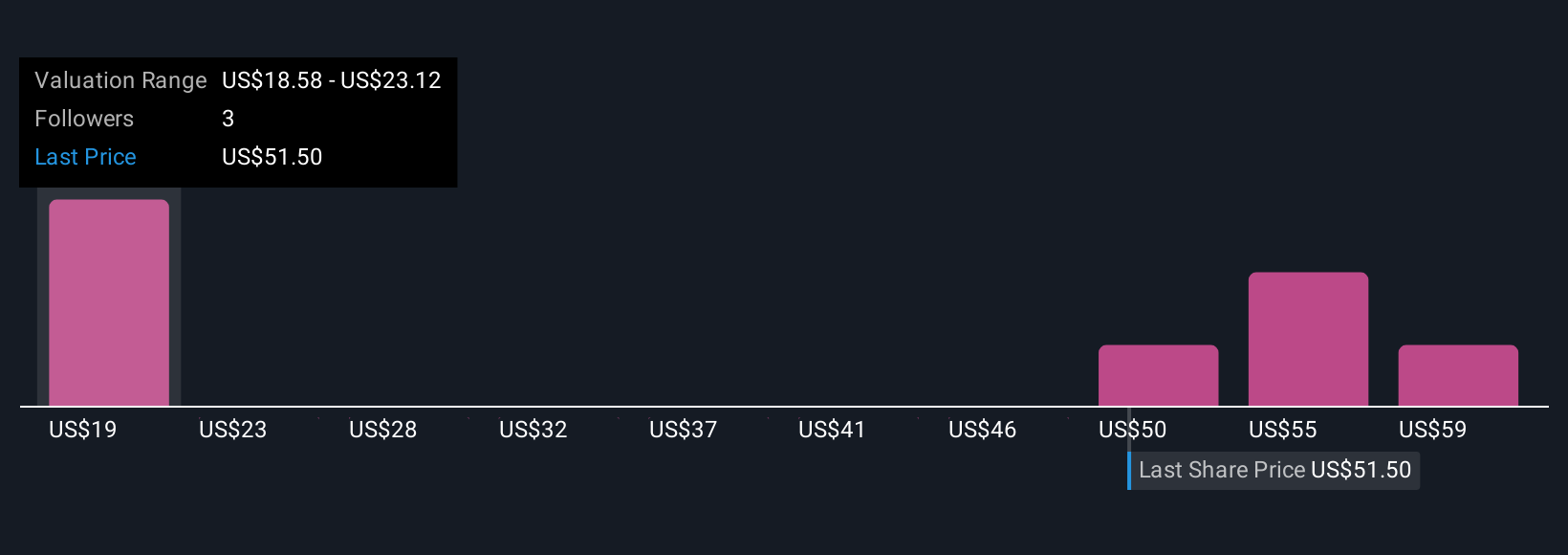

Four members of the Simply Wall St Community currently estimate Columbia’s fair value between US$17.99 and US$64, reflecting very different expectations for the brand. As you weigh those views, remember that softer recent earnings and pressure on margins remain central to how the company’s performance may evolve.

Explore 4 other fair value estimates on Columbia Sportswear - why the stock might be worth less than half the current price!

Build Your Own Columbia Sportswear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Columbia Sportswear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Sportswear's overall financial health at a glance.

No Opportunity In Columbia Sportswear?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com