Olin (OLN): Reassessing Valuation After a Steep Year-to-Date Share Price Slide

Why Olin Is Back on Value Investors Radar

Olin (OLN) has slid nearly 40% this year, yet revenue and net income are still growing. This is forcing investors to rethink whether the recent share price drop has gone too far.

See our latest analysis for Olin.

The latest slide leaves Olin trading around $20.44, capping a roughly 39% year to date share price decline and an even steeper one year total shareholder return loss near 48%. This suggests sentiment has weakened despite improving earnings.

If this kind of reset has you wondering where else value and momentum might be lining up, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still climbing and shares trading at a steep discount to some valuation estimates, investors face a familiar dilemma: is Olin genuinely undervalued here, or is the market already pricing in modest future growth?

Most Popular Narrative Narrative: 17.4% Undervalued

With the most followed narrative placing Olin’s fair value meaningfully above the recent 20.44 close, the gap hinges on a specific earnings transformation story.

Structural cost reduction initiatives (Beyond250 and Epoxy cost optimization) are expected to deliver significant operational savings, yielding an estimated $70-90 million run rate benefit by the end of 2025 and additional structural cost reductions from the Stade, Germany facility in 2026, this should improve net margins and boost earnings quality.

Curious how modest revenue growth, sharply rising margins and a lower than typical earnings multiple combine into that upside case, the full narrative unpacks the math behind this valuation shift.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global overcapacity in key chemicals or prolonged weakness in Winchester ammunition margins could quickly undermine today’s upbeat valuation story.

Find out about the key risks to this Olin narrative.

Another Angle on Valuation

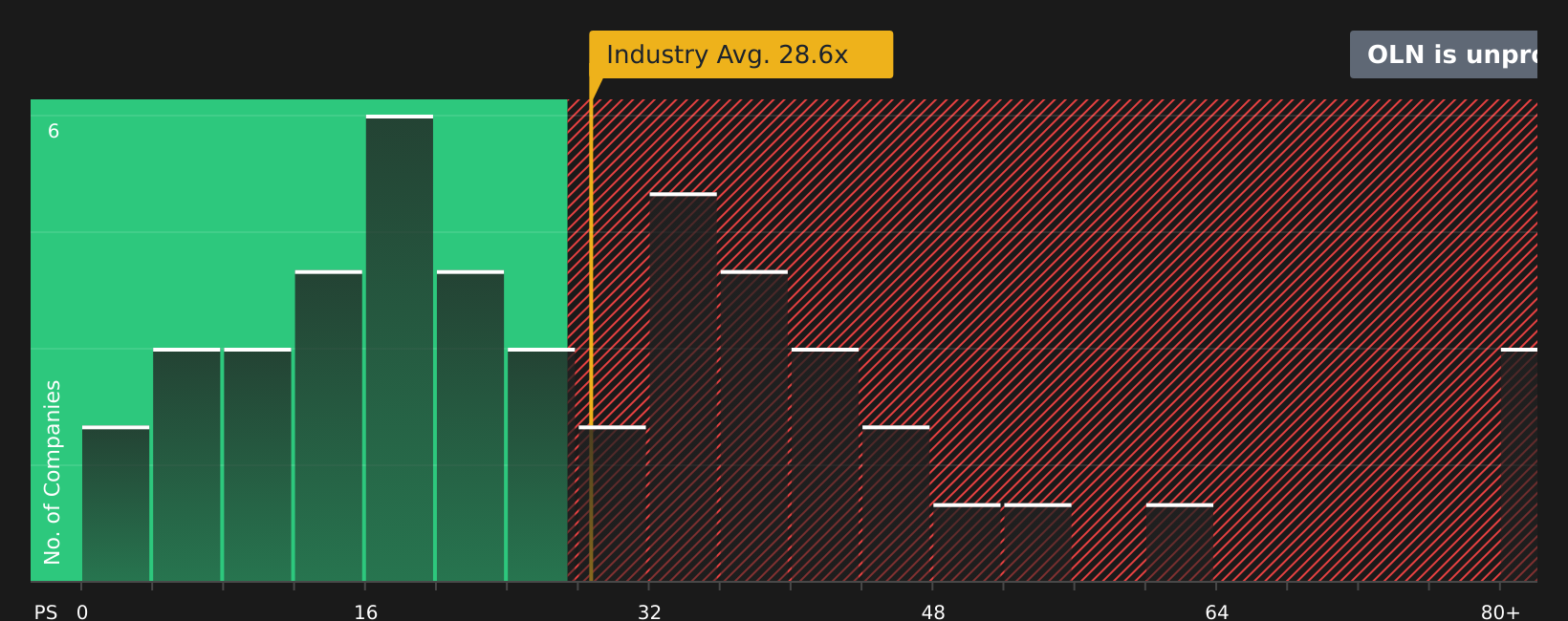

Step away from narratives and Olin suddenly looks pricey on earnings. Its price to earnings ratio around 43.5 times sits well above both the US Chemicals industry near 23 times and a fair ratio closer to 35.9 times, raising the risk that any earnings wobble hits the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Olin Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Olin research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall Street Screener to spot fresh opportunities that match your strategy and keep your portfolio ahead of the curve.

- Capture potential bargain opportunities by targeting companies trading below intrinsic value with these 908 undervalued stocks based on cash flows tailored to cash flow strength.

- Capitalize on the AI revolution by filtering innovative businesses at the frontier of machine learning through these 26 AI penny stocks.

- Build a steadier income stream by focusing on companies offering attractive yields using these 15 dividend stocks with yields > 3% as your starting point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com