Does Linde’s 2025 Valuation Still Make Sense After Recent Clean Energy Expansion?

- Wondering if Linde at around $403 a share is still worth buying, holding, or finally trimming? This breakdown is for you if you care about paying a fair price for quality growth.

- The stock is down about 1% over the last week, 3.4% over the past month, and 2.5% year to date, but longer term it is still up 25.5% over 3 years and 72.4% over 5 years, a mix that can signal either a healthy pause or shifting risk perceptions.

- Recent headlines have focused on Linde expanding in high demand industrial gas segments and strengthening its footprint in clean energy and hydrogen projects, moves that can reshape how investors think about its growth runway. At the same time, market chatter around higher for longer interest rates and cyclical worries in industrials has weighed on sentiment, helping explain the more muted share performance over the last year.

- On our framework, Linde scores a 3/6 valuation score, meaning it looks undervalued on half of our checks. Next we will unpack what that actually means across different valuation methods, and then finish by looking at a more nuanced way to think about fair value than any single model alone.

Approach 1: Linde Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what Linde is worth by projecting its future cash flows and discounting them back to today, using a required rate of return. It is essentially asking how much you should pay now for the stream of cash the business is expected to generate in the future.

Linde currently generates around $5.7 Billion in free cash flow, and analyst based projections plus Simply Wall St extrapolations see this rising to roughly $8.0 Billion by 2029 and over $9.2 Billion by 2035. Those forecasts imply steady, mid single digit annual growth in free cash flow as the business scales and margins stay robust.

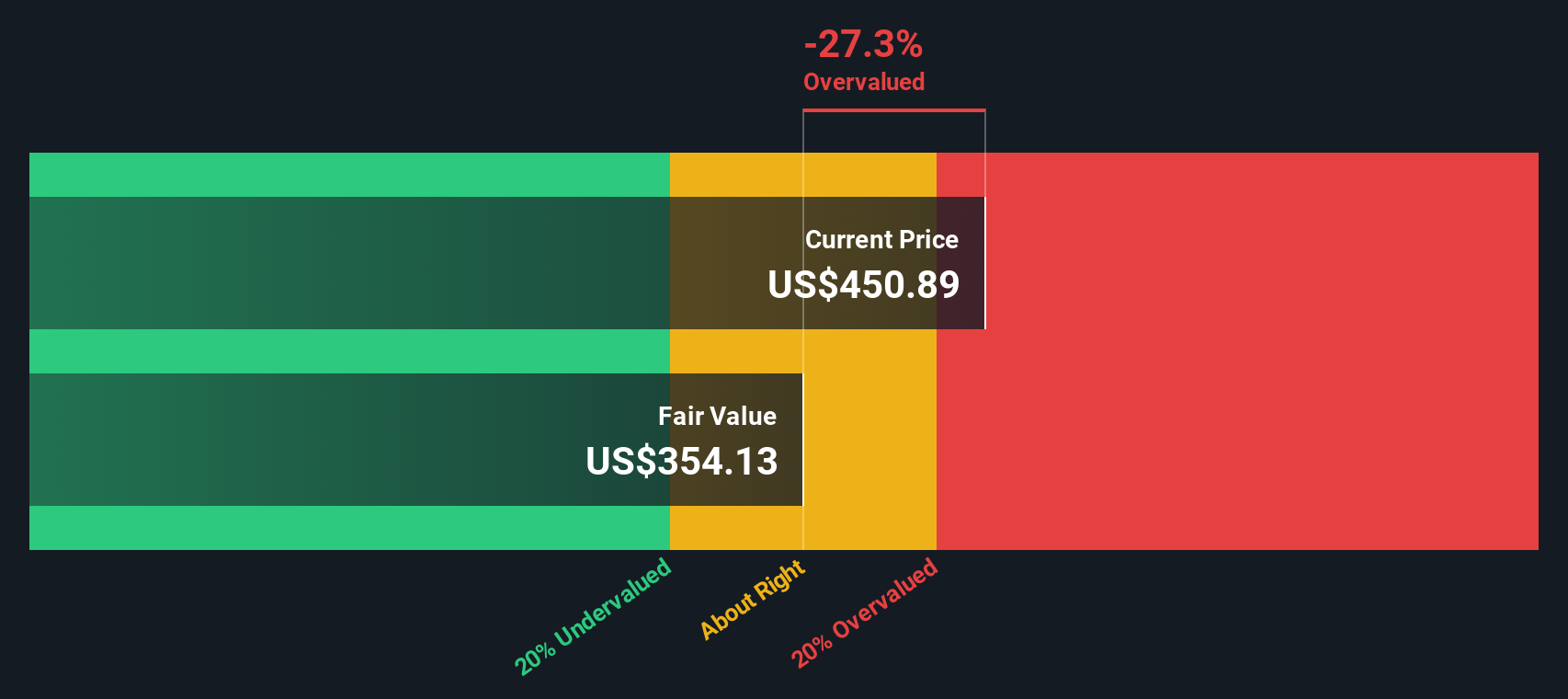

When all those future cash flows are discounted back under a 2 Stage Free Cash Flow to Equity model, the intrinsic value for Linde comes out at about $310.64 per share. Compared with a current share price of roughly $403, the DCF suggests the stock is about 30.0% above fair value, indicating a quality company trading at a full, even stretched, valuation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Linde may be overvalued by 30.0%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Linde Price vs Earnings

For a mature, consistently profitable business like Linde, the price to earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of earnings. In general, companies with faster, more reliable earnings growth and lower perceived risk can justify a higher PE multiple, while slower or more cyclical businesses tend to trade on lower PE levels.

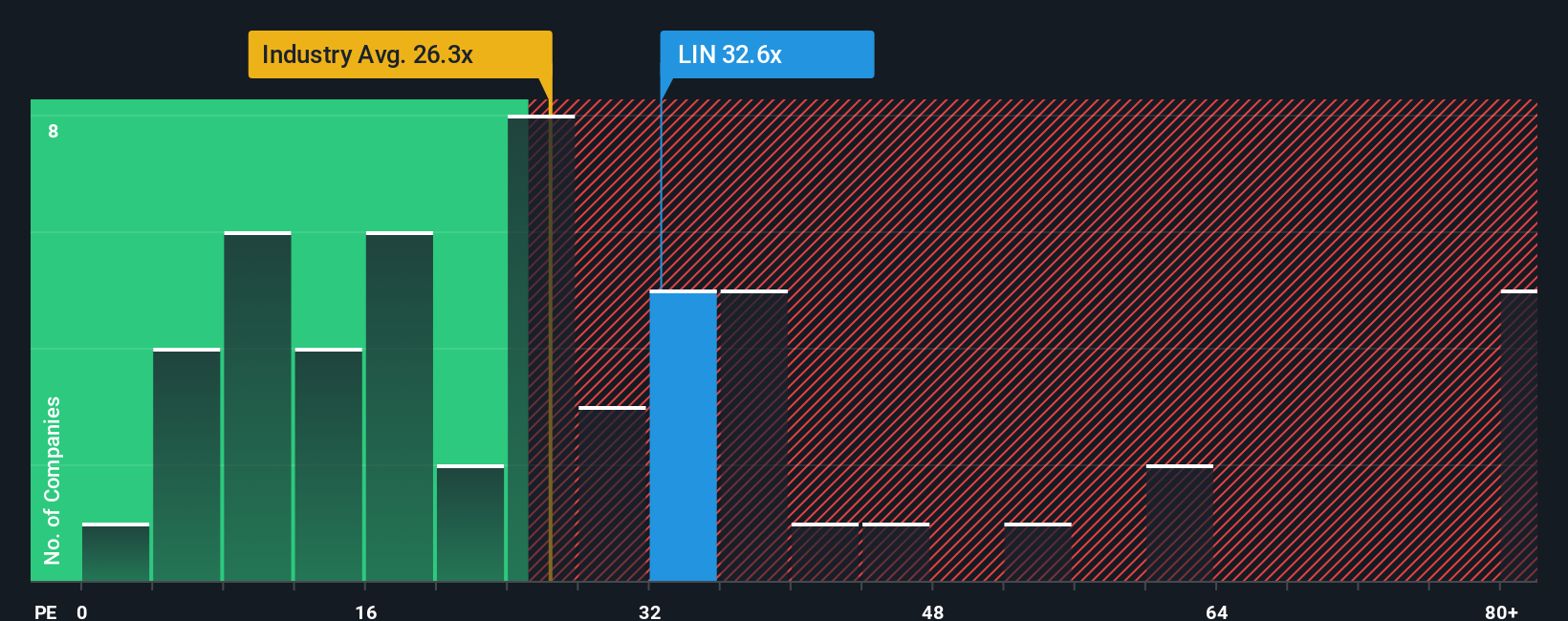

Linde currently trades on a PE of about 26.6x, which is above the broader Chemicals industry average of roughly 23.0x but below the peer group average of around 31.6x. To refine that comparison, Simply Wall St calculates a proprietary Fair Ratio of 26.6x, which reflects what Linde’s PE should be given its specific mix of earnings growth, margins, industry, market cap and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison, because it adjusts for the fact that not all chemical companies share the same growth runway or resilience across cycles. With Linde’s actual PE almost exactly in line with its Fair Ratio, the stock appears to be trading close to a reasonable, fundamentals based multiple rather than at a clear bargain or bubble level.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Linde Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about a company with the numbers behind its future.

A Narrative is your own, clearly stated perspective on where a business is heading, tied directly to assumptions for its future revenue, earnings and margins, and then to what you think its fair value should be.

On Simply Wall St, Narratives live in the Community page and are easy to use. They let you pick or adjust forecasts, see the resulting fair value, and compare that with today’s share price so you can decide whether Linde looks worth buying, holding, or trimming.

Because Narratives are updated dynamically when new information comes in, like earnings results, major contracts or macro news, they stay relevant and help you quickly see whether the story, the forecast and the valuation still line up.

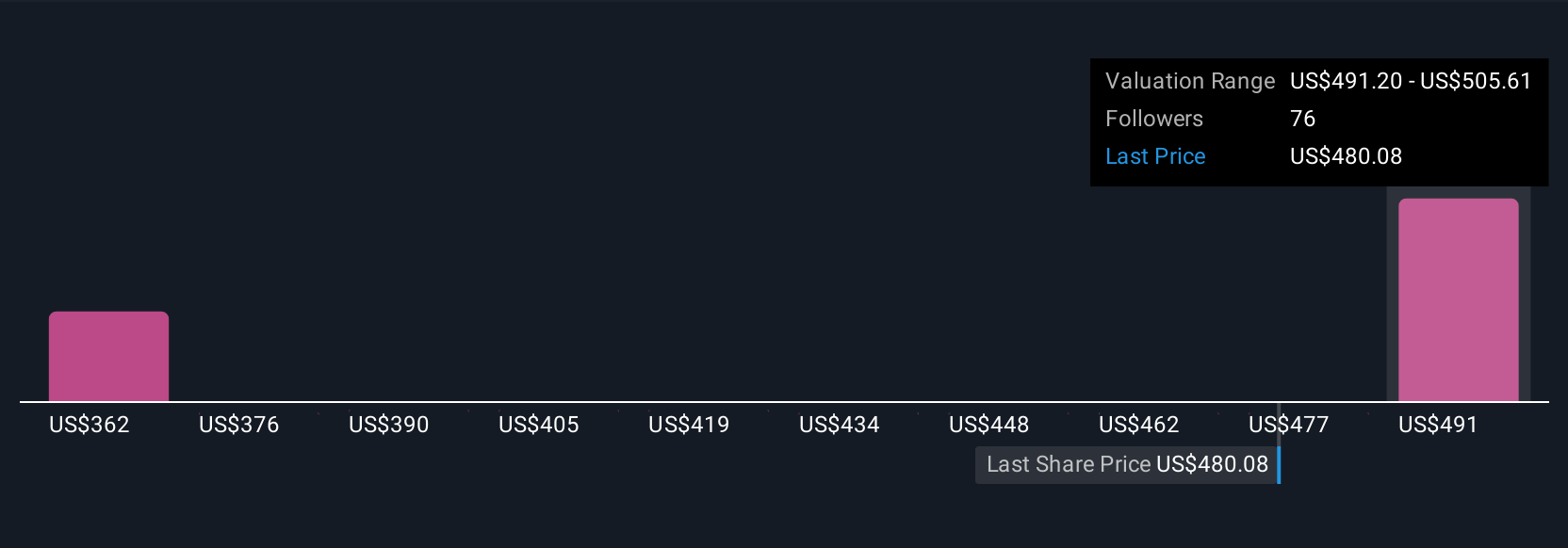

For Linde, for example, one bullish Narrative might lean toward the higher end of analyst fair values near $576 on the view that clean energy and electronics growth will drive faster margin expansion. A more cautious Narrative could anchor closer to $381, assuming slower demand and more pressure on project returns.

Do you think there's more to the story for Linde? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com