Does Rising Short Interest Quietly Reframe NNN REIT’s (NNN) Necessity-Retail Resilience Story?

- Recently, NNN REIT Inc reported that short interest rose by 8.54% since the prior update, with 5.44 million shares sold short, equal to 3.94% of its freely tradable shares.

- Even after this increase, NNN REIT’s short interest remains lower than that of many retail REIT peers, highlighting a relatively more constructive positioning by bearish investors.

- We’ll now explore how the recent rise in short interest could influence NNN REIT’s investment narrative built on resilient, necessity-based retail assets.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

NNN REIT Investment Narrative Recap

To own NNN REIT, you need to believe in the durability of necessity-based, single-tenant retail and the REIT’s ability to keep properties leased while managing funding costs. The recent uptick in short interest looks modest relative to peers and does not materially alter the near term focus on acquisition pacing as a key catalyst or tenant health and retail bankruptcies as the primary risk.

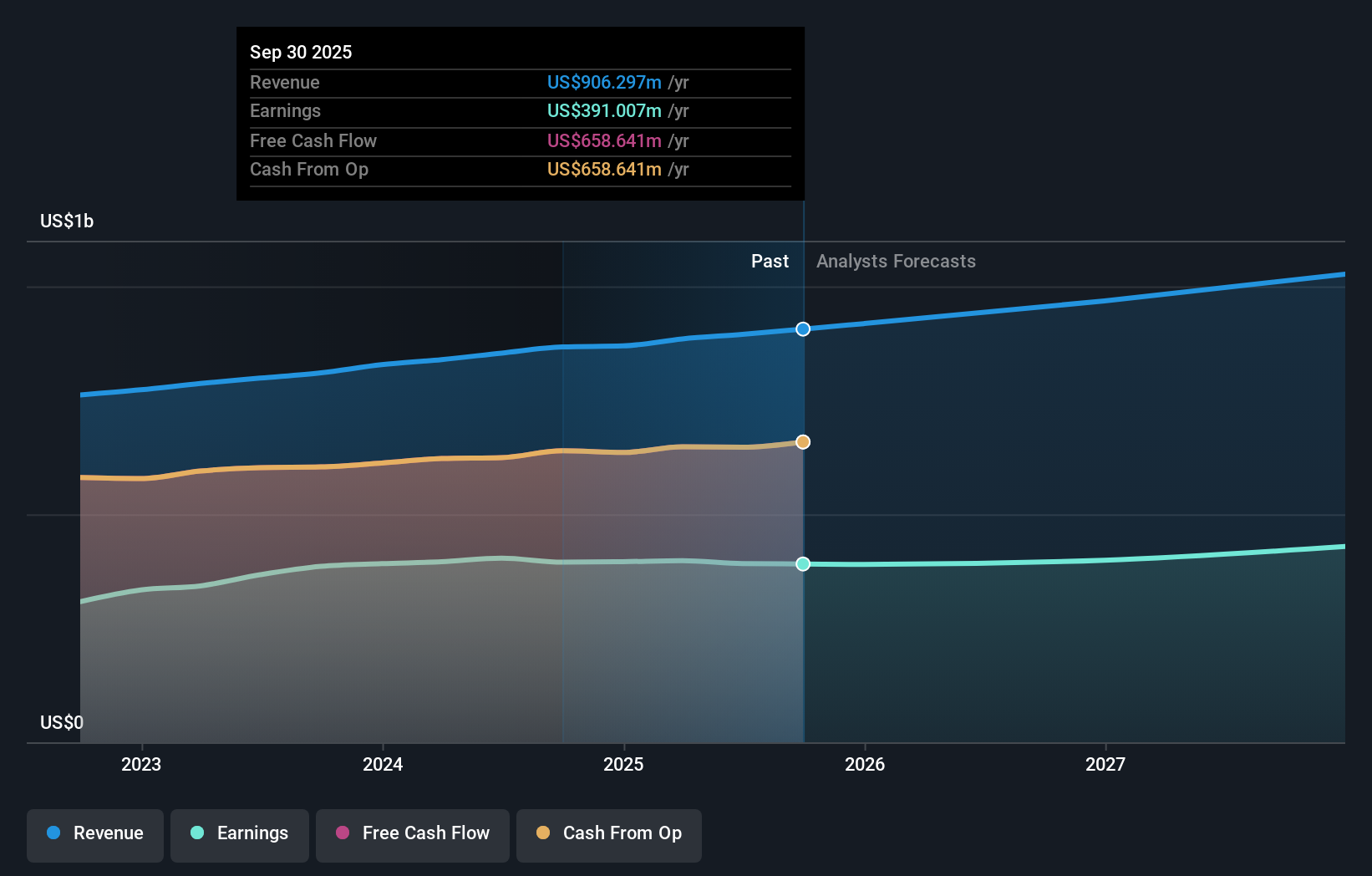

Against this backdrop, the latest quarterly results on 5 November 2025 are especially relevant, with Q3 2025 revenue rising to US$230.16 million while net income softened to US$96.84 million. This mix of higher top line and slightly lower earnings underlines how operating costs, interest expense, and tenant issues could interact with changing sentiment in the short term, even as NNN REIT continues to emphasize high occupancy and long leases as its core drivers.

Yet despite the resilient, necessity-focused tenant base, investors should be aware that tenant bankruptcies and consolidation risk could still...

Read the full narrative on NNN REIT (it's free!)

NNN REIT's narrative projects $1.0 billion revenue and $425.2 million earnings by 2028. This requires 4.6% yearly revenue growth and about a $33 million earnings increase from $392.1 million today.

Uncover how NNN REIT's forecasts yield a $44.54 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see NNN REIT’s fair value between US$41 and about US$79, reflecting a wide spread of expectations. When you weigh those views against concerns about tenant bankruptcies and retail consolidation risk, it becomes clear that you are choosing among several very different scenarios for NNN’s future performance.

Explore 4 other fair value estimates on NNN REIT - why the stock might be worth as much as 95% more than the current price!

Build Your Own NNN REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NNN REIT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NNN REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NNN REIT's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com