Has the 2025 Rally Left Citi Shares Too Pricey After Restructuring Momentum?

- If you are wondering whether Citigroup is still a value play after its massive run, or if you have already missed the boat, you are in the right place for a clear eyed look at what the current price really implies.

- The stock has climbed 5.2% over the last week, 6.7% over the past month, and is now up 54.1% year to date, with 53.4% gains over 1 year and triple digit returns over 3 and 5 years that have reshaped how the market sees its prospects and risk.

- Recent headlines have focused on Citigroup's ongoing restructuring efforts and strategic simplification, including divesting non core international consumer operations to sharpen its focus on higher return businesses. At the same time, investors have been watching regulatory developments and capital return plans, both of which help explain why sentiment has shifted in favor of the stock.

- Despite that optimism, Citigroup scores 2 out of 6 on our valuation checks, so we will unpack what different valuation approaches say about the stock today and introduce a more insightful way to think about its worth by the end of this article.

Citigroup scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Citigroup Excess Returns Analysis

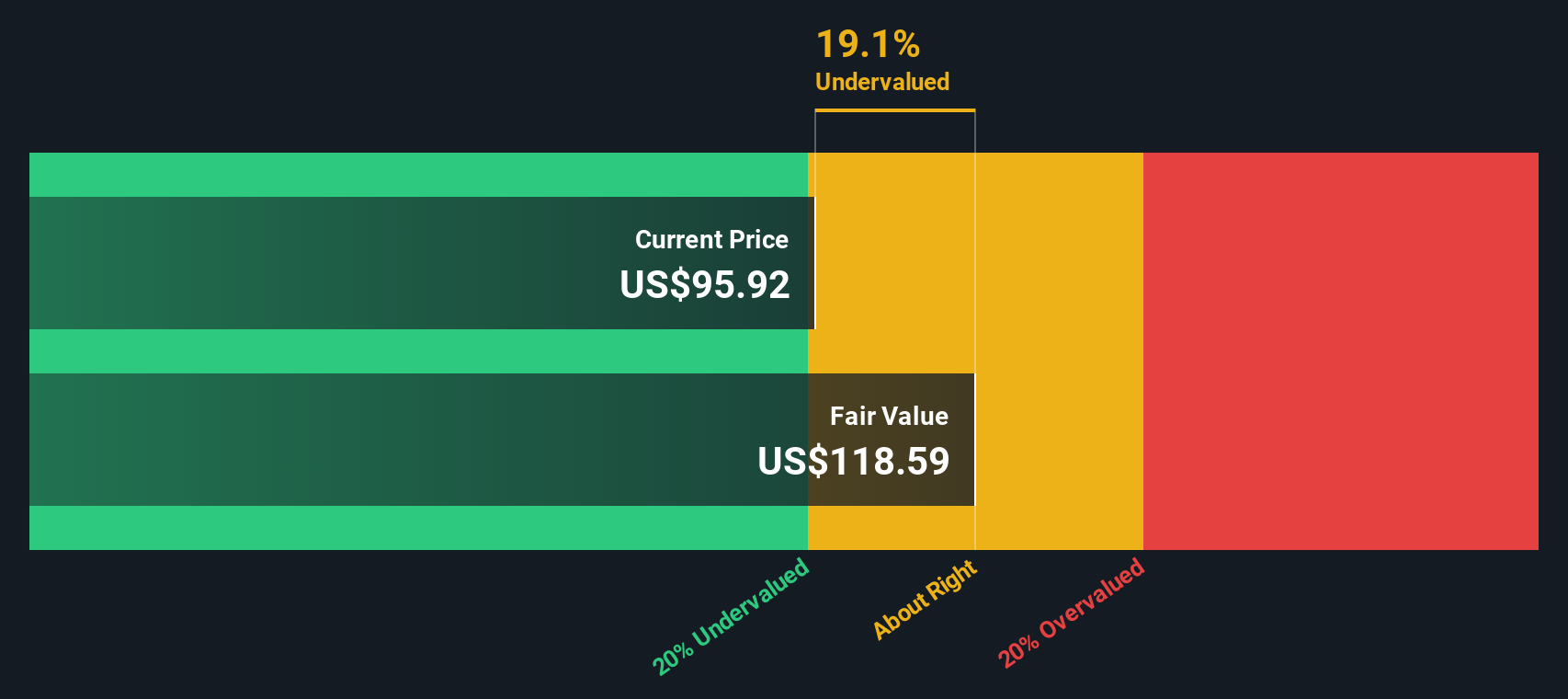

The Excess Returns model estimates what Citigroup can earn above its cost of equity over time and capitalizes those surplus profits into an intrinsic value per share.

For Citigroup, the starting point is its balance sheet strength and profitability. The stock is supported by a Book Value of $108.41 per share and a Stable EPS estimate of $10.27 per share, based on weighted future return on equity forecasts from 14 analysts. Against this, the Cost of Equity is estimated at $9.76 per share. This implies an Excess Return of $0.51 per share, or roughly the profit generated above what shareholders require for the risk they are taking.

Citigroup's Average Return on Equity of 8.63% and a projected Stable Book Value of $118.91 per share, sourced from 11 analysts, underpin the Excess Returns valuation. Putting these together, the model arrives at an intrinsic value of about $129.16 per share, which suggests the stock is roughly 16.5% undervalued relative to its current trading price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citigroup is undervalued by 16.5%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

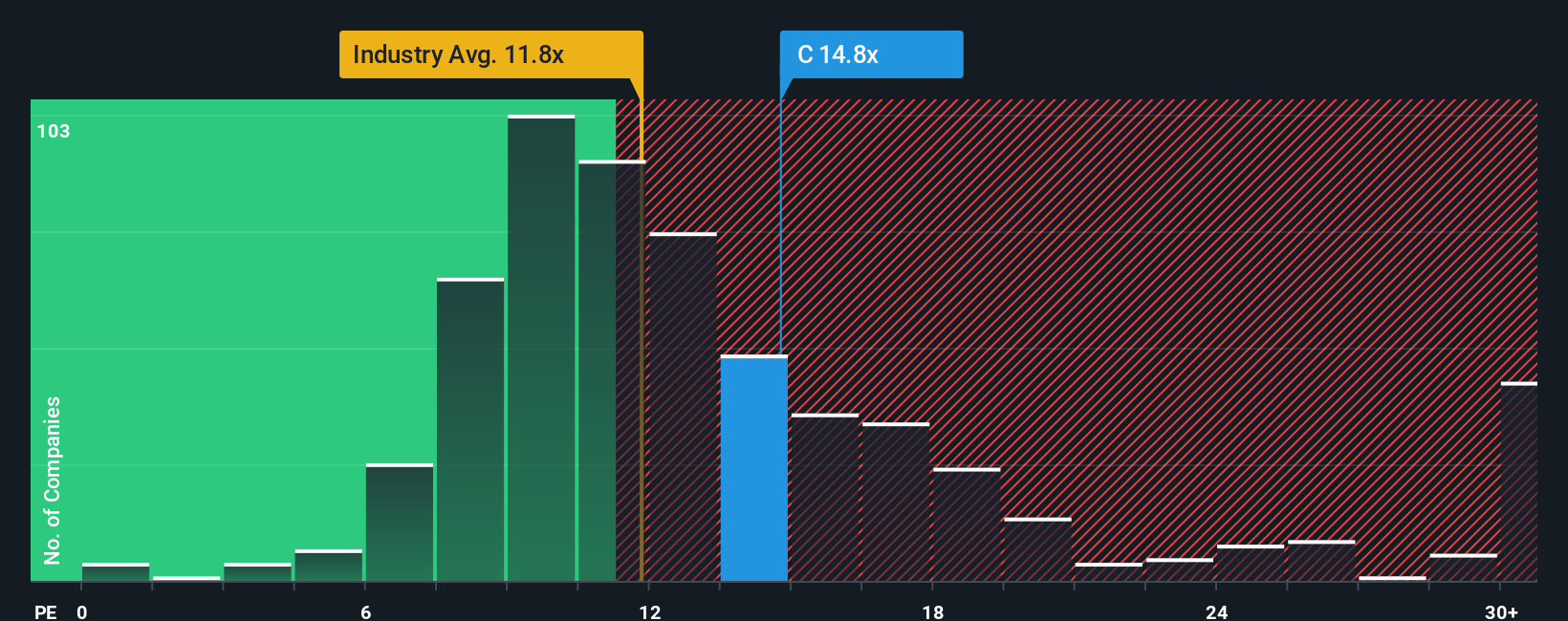

Approach 2: Citigroup Price vs Earnings

For a profitable bank like Citigroup, the price to earnings ratio is a straightforward way to gauge how much investors are paying for each dollar of current earnings. It ties directly to profitability, so it is more informative here than sales based metrics, which can be distorted by balance sheet size for banks.

What counts as a fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower risk usually justify a higher multiple. Citigroup currently trades on a PE of about 14.35x, above the broader banks industry average of roughly 11.65x and also above its peer group average of around 13.13x, implying the market is already assigning it a relative premium.

Simply Wall St’s Fair Ratio estimate for Citigroup is 16.79x, which reflects what investors might reasonably pay given its specific mix of growth prospects, profitability, size, industry position and risk profile. Because this Fair Ratio incorporates those company level fundamentals, it provides a more tailored view than simple comparisons with peers or the sector. With the current 14.35x multiple sitting below the 16.79x Fair Ratio, the PE based view suggests that Citigroup may still be undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

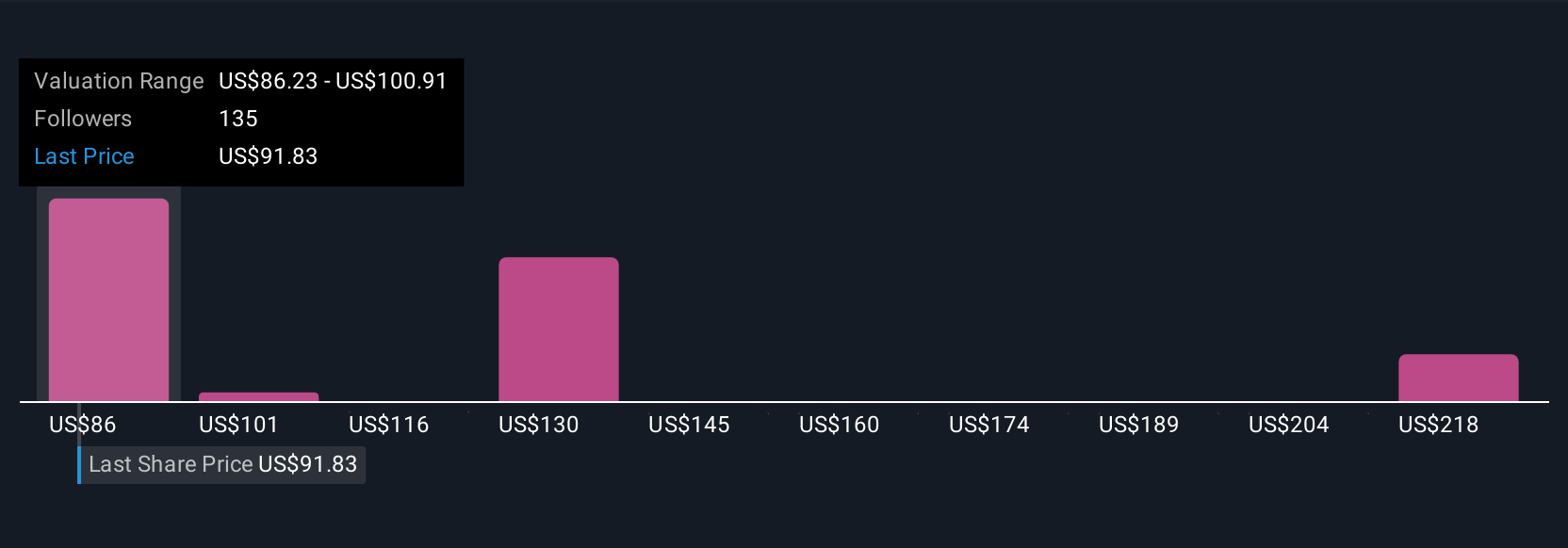

Upgrade Your Decision Making: Choose your Citigroup Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about Citigroup to the numbers behind its fair value. A Narrative is your own reasoned perspective on the company, where you spell out how you expect its revenue, earnings and margins to evolve and then translate that story into a financial forecast and fair value estimate. On Simply Wall St, Narratives live inside the Community page, where millions of investors already use them as an easy, accessible tool to turn their views about digital assets, restructuring or capital returns into concrete forecasts. Because each Narrative calculates a Fair Value that can be compared to today’s Price, it gives you a clear, rules based way to decide if Citigroup looks like a buy, hold or sell. Narratives also update dynamically as new news, earnings or guidance comes in, so your valuation stays in sync with reality rather than a stale spreadsheet. For example, some investors currently see a fair value for Citigroup closer to $77 while others are closer to $230, depending on how confident they are about its growth, margins and PE multiple.

For Citigroup however we will make it really easy for you with previews of two leading Citigroup Narratives:

Fair value: $233.04

Implied undervaluation vs last close of $107.79: approximately 53.8%

Forecast revenue growth: 6%

- Sees the GENIUS Act and Citi Token Services as catalysts for Citi to become a leading, capital efficient player in regulated digital assets and cross border payments.

- Highlights broad based strength across Services, Markets, Banking, Wealth and U.S. Personal Banking, with rising RoTCE and disciplined cost and capital management.

- Argues that sustained mid to high single digit revenue growth, higher margins and ongoing buybacks could justify a long term fair value near $230 and a total shareholder yield close to 6%.

Fair value: $102.80

Implied overvaluation vs last close of $107.79: approximately 4.6%

Forecast revenue growth: 8.31%

- Builds on optimistic analyst assumptions for revenue, margin expansion and buybacks, but concludes that a fair value a little above consensus is still below the current share price.

- Emphasizes macroeconomic, regulatory, geopolitical and credit risks that could derail growth, pressure margins and limit the benefits of Citi’s AI and infrastructure investments.

- Suggests investors should only side with the bullish analyst cohort if they are confident Citi can hit higher earnings and justify a richer PE multiple than the wider U.S. banks industry.

Do you think there's more to the story for Citigroup? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com