StoneX’s Modest Q4 Profit Gains Might Change The Case For Investing In StoneX Group (SNEX)

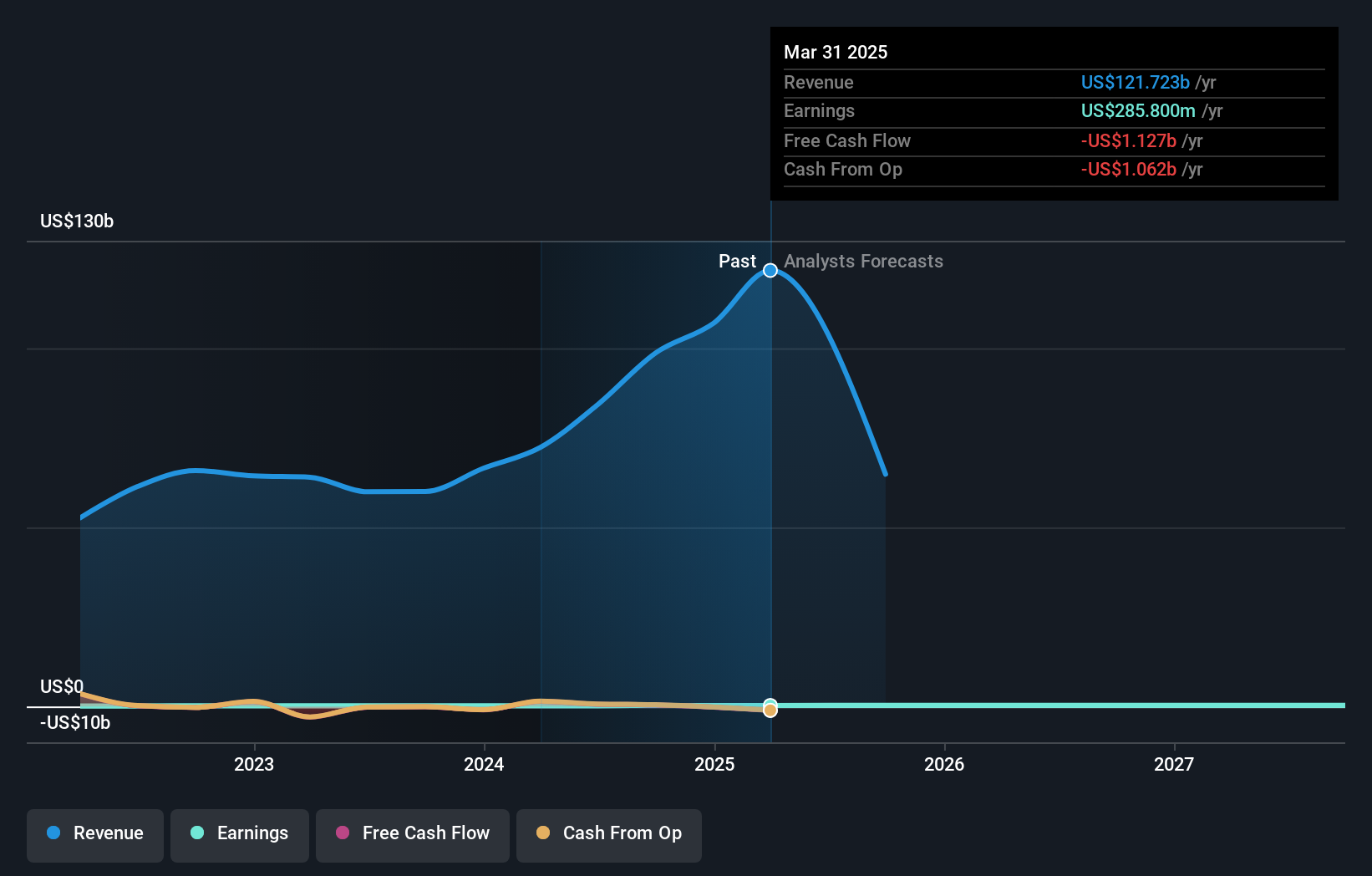

- StoneX Group Inc. reported past fourth-quarter 2025 results, with revenue rising to US$32.72 billion from US$31.14 billion and net income increasing to US$85.7 million from US$76.7 million a year earlier.

- Earnings per share from continuing operations inched higher on both a basic and diluted basis, pointing to efficiency gains alongside top-line growth.

- We will now examine how StoneX Group’s higher revenue and earnings per share shape the company’s broader investment narrative for investors.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is StoneX Group's Investment Narrative?

To own StoneX Group, you have to believe in its role as a scaled, low-margin capital markets and commodities platform that can steadily convert huge transaction volumes into consistent, if modest, earnings. The latest quarter’s uptick in revenue and EPS reinforces that story rather than changing it, and the market’s recent strong year-to-date gain suggests these solid, but unspectacular, numbers were broadly in line with expectations. In the near term, the main catalysts still sit around trading volumes, client activity and how aggressively management uses the recently expanded buyback authorization, which could support per-share earnings if executed. The biggest risks remain thin profit margins and execution missteps in capital allocation, and the new results do little to ease those structural pressures.

However, thin margins leave little room for error if trading activity or risk management stumbles. StoneX Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$48 to US$103 per share, underscoring how differently investors are modeling StoneX’s earnings power. Against that backdrop, the reliance on very slim net margins that emerged in our earlier discussion becomes a key factor shaping how each of these community views might play out.

Explore 5 other fair value estimates on StoneX Group - why the stock might be worth 48% less than the current price!

Build Your Own StoneX Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneX Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free StoneX Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneX Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com