Check Point (CHKP): Assessing Valuation After Upsized Convertible Notes Deal and Quantum Firewall R82.10 Launch

Check Point Software Technologies (CHKP) just paired an upsized $1.75 billion convertible notes deal with the launch of its Quantum Firewall R82.10, a one two move that sharpened investor focus on its AI centric security strategy.

See our latest analysis for Check Point Software Technologies.

Those moves have come against a backdrop of steady but not explosive gains, with the share price at $195.83 after a 1 day share price return of 2.48% and a 1 year total shareholder return of 4.14%. The 3 year total shareholder return of 49.18% hints that longer term momentum has been quietly building as investors reassess Check Point’s AI centric pivot and capital allocation strategy.

If this kind of AI driven security story has your attention, it is also worth exploring high growth tech and AI stocks for other tech names riding similar themes.

With Check Point now trading at a modest discount to analyst targets despite multiyear outperformance, the real question is whether investors are underestimating its AI driven security runway or whether the market is already pricing in the next leg of growth.

Most Popular Narrative: 14.3% Undervalued

With the narrative fair value set around $228.40 versus the recent $195.83 close, the stage is set around durable growth on steady margins.

The Infinity platform continues to gain traction, with strong double digit revenue growth and increased customer adoption, now accounting for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross selling opportunities.

Curious how modest revenue growth, firm margins, and a richer future earnings multiple can still add up to upside from here? See the full narrative math.

Result: Fair Value of $228.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case assumes firewall refresh and AI demand persist, while supply chain exposure and intensifying SASE competition do not undercut margins or growth.

Find out about the key risks to this Check Point Software Technologies narrative.

Another Angle on Value

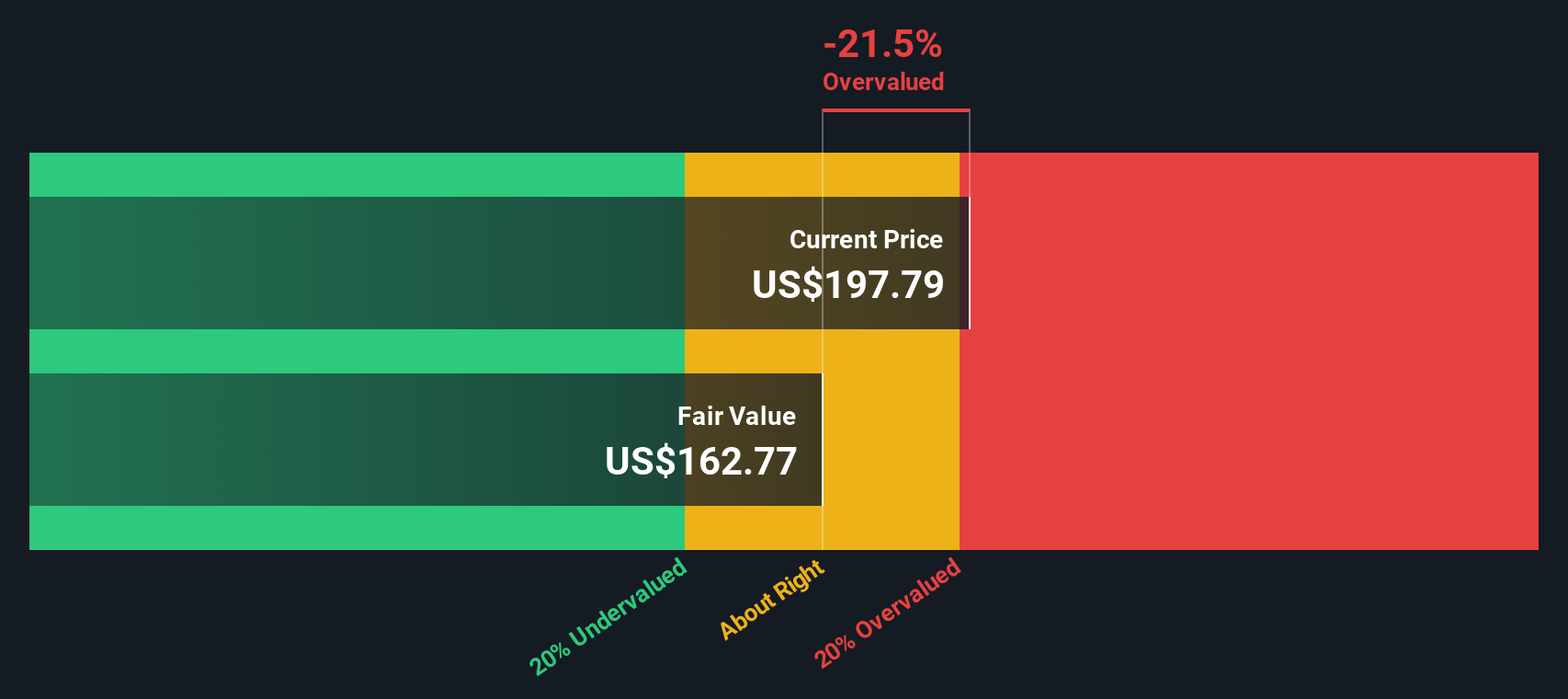

Our SWS DCF model paints a cooler picture, putting fair value at about $166.82 versus today’s $195.83 share price, which implies that Check Point might be overvalued. If cash flows disappoint or multiples compress, recent momentum could leave late buyers more exposed.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you would rather challenge these assumptions and follow your own research path, you can build a personalized Check Point thesis in just a few minutes, Do it your way.

A great starting point for your Check Point Software Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now on what you have learned here and explore additional opportunities with tailored stock ideas that match your strategy before the market moves without you.

- Capture potential mispricings by using these 908 undervalued stocks based on cash flows to pinpoint companies where strong cash flows are not yet fully reflected in the share price.

- Explore technology-related opportunities by checking out these 26 AI penny stocks that may be positioned to benefit as artificial intelligence influences a wide range of industries.

- Strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that combine attractive yields with the potential for long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com