Royal Gold (RGLD) Valuation After Dividend Hike, Record Q3 Revenue and Portfolio-Expanding Acquisitions

Royal Gold (RGLD) just gave income focused investors something to chew on, boosting its annual dividend by 6% alongside record third quarter revenue, even as earnings per share came in a bit light.

See our latest analysis for Royal Gold.

The latest dividend hike and portfolio expansion moves, including the Kansanshi Stream and Mount Milligan life extension, come as Royal Gold’s 30 day share price return of 16.35 percent and nearly 50 percent year to date share price gain signal building momentum. This is backed by a 41.31 percent one year total shareholder return and a striking 96.03 percent five year total shareholder return from its royalty focused model.

If this mix of income and growth appeals to you, it could be a good moment to explore fast growing stocks with high insider ownership for other under the radar opportunities with strong potential.

With Royal Gold now trading near record highs yet still at a discount to analyst targets and some estimates of intrinsic value, investors face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 18.9% Undervalued

Royal Gold’s most followed narrative sees its fair value comfortably above the last close of $201.66, framing today’s price as a discounted entry point.

The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reducing single-asset risk and increasing exposure to long-term growth projects, which should support more stable revenue streams and improved net margins. Recent investments in projects like the Kansanshi gold stream (with a multi-decade production profile) and the Warintza copper-gold-moly project (which has large-scale development potential in the early 2030s) position Royal Gold to be exposed to demand for gold (as a hedge against inflation and geopolitical risk) and copper (driven by electrification and renewable energy adoption), supporting expectations for higher long-term revenue and earnings.

Curious how a diversified royalty portfolio, rising margins, and ambitious growth forecasts combine into this upside case? The projections behind that fair value might surprise you.

Result: Fair Value of $248.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could unravel if gold prices weaken or key mines underperform, which would put pressure on projected revenue growth and margins.

Find out about the key risks to this Royal Gold narrative.

Another Lens on Valuation

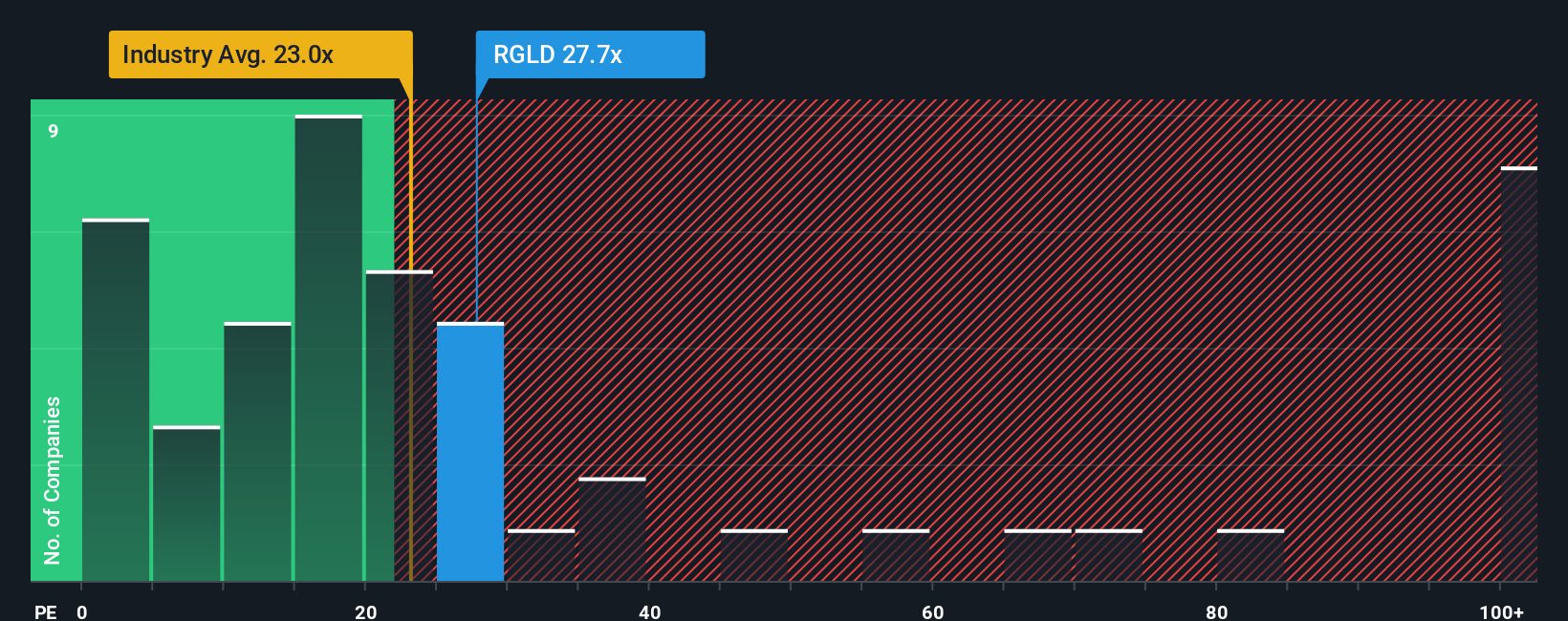

While the narrative points to an 18.9% upside, our take on today’s price using a single earnings based yardstick is more cautious. Royal Gold trades on 35.5 times earnings, well above the US Metals and Mining average of 22.6 times and peers at 20.7 times.

Even against our fair ratio of 25.2 times, the current multiple looks stretched. This suggests investors are already paying up for much of the expected growth. Is this a quality premium that will hold, or a margin of safety that has quietly disappeared?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Gold Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can quickly scan fresh themes on Simply Wall Street’s screener and line up your next smart move.

- Capture potential income and stability by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Tap into innovation at the frontier of technology with these 26 AI penny stocks shaping how data, automation, and intelligent systems transform entire industries.

- Hunt for mispriced quality by assessing these 906 undervalued stocks based on cash flows where current market pessimism may have opened up attractive long term entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com