How Record Q3 Results, Dividend Move, and CEO Conference Spotlight Will Impact PJT Partners (PJT) Investors

- PJT Partners announced that Chairman and CEO Paul J. Taubman will present at the Goldman Sachs 2025 Financial Services Conference on December 9, 2025, with the session webcast via the firm’s investor relations website.

- Investor attention is also being shaped by PJT’s recently reported record third-quarter results and a fresh quarterly dividend following its ex-dividend date on December 3, 2025.

- With these developments and the upcoming CEO presentation spotlighting corporate strategy, we’ll explore how this shapes PJT Partners’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is PJT Partners' Investment Narrative?

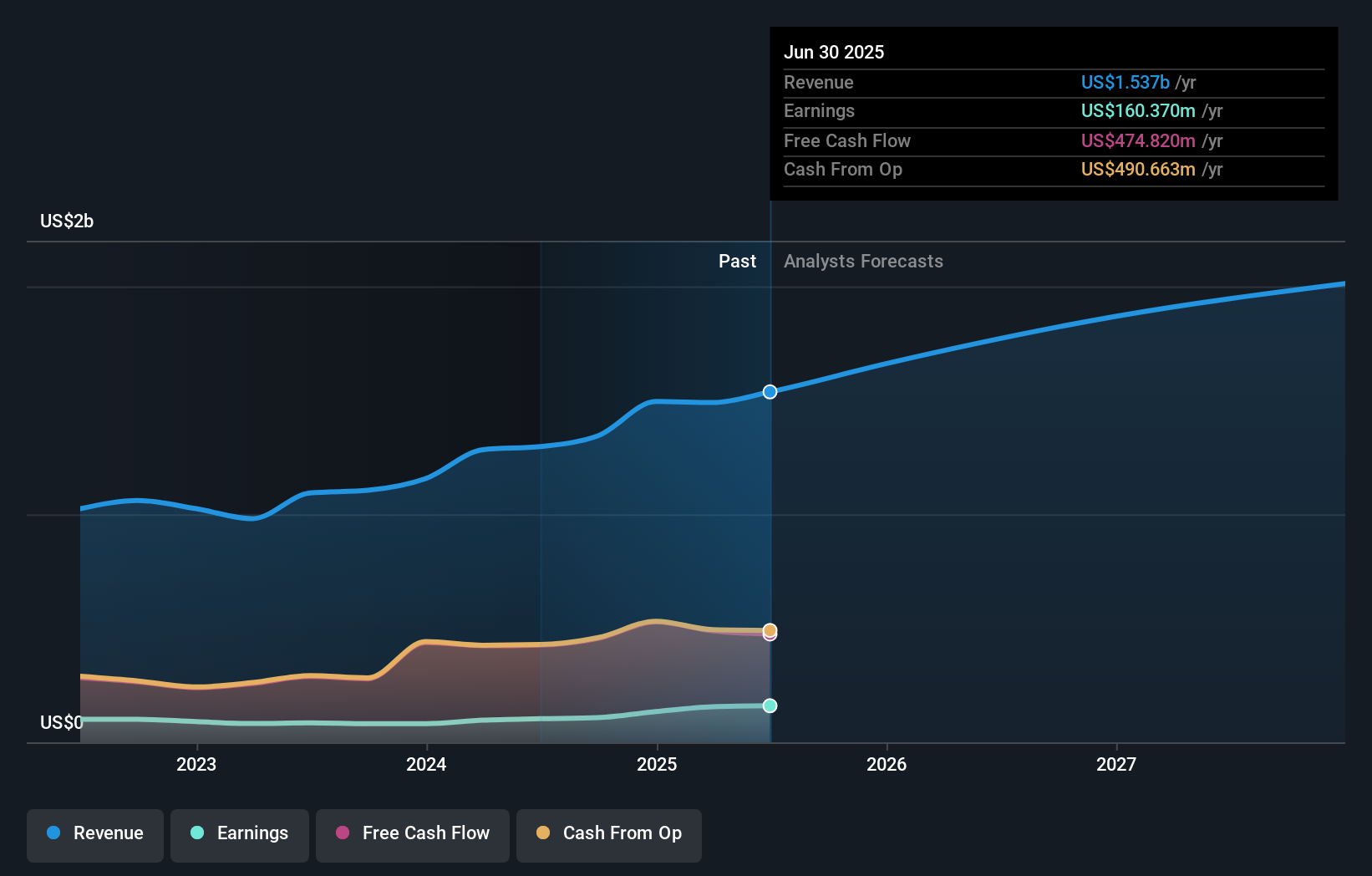

To own PJT Partners, you have to believe in the durability of its advisory franchise and its ability to convert deal flow into high‑margin fees over time, even if activity is cyclical. Record Q3 revenue of US$447.09 million and EPS growth, layered on top of a long‑running US$0.25 quarterly dividend and sizeable buybacks, reinforce that story but also raise the bar for what “good” looks like from here. The upcoming Goldman Sachs conference appearance by CEO Paul Taubman is unlikely to change fundamentals on its own, yet it could influence near term sentiment if management’s tone on the deal pipeline or capital returns differs from what the recent results implied. With the share price now close to consensus targets and trading on a premium multiple, the key short term catalysts remain transaction volumes, fee mix, and how disciplined PJT stays on costs and shareholder payouts.

However, one particular risk tied to that premium valuation is easy to overlook. PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com