Could Softer Barge Demand Quietly Redefine Kirby’s Capacity Advantage And Risk Profile (KEX)?

- Recently, investors highlighted that Kirby Corporation’s inland marine transportation business has come under pressure as softened barge utilization and weaker demand from energy, chemical, and industrial customers weigh on volumes and pricing.

- An interesting takeaway is that, despite these cyclical headwinds and lower earnings expectations, some institutional investors still view Kirby’s constrained industry capacity as a longer-term advantage.

- We’ll now examine how softer inland barge utilization and demand may reshape Kirby’s broader investment narrative and long-term risk-return profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kirby Investment Narrative Recap

To own Kirby today, you really have to believe that constrained barge capacity and the shift toward waterborne petrochemical transport will matter more than near term softness in volumes and pricing. The latest pullback in inland barge utilization directly affects Kirby’s key near term catalyst of tight industry supply supporting rates, and it also amplifies the most immediate risk that weaker demand from large chemical and energy customers could drag on earnings.

Against this backdrop, Kirby’s ongoing share repurchase program stands out, with US$753.05 million deployed since 2010 and roughly 15.9% of shares bought back by November 2025. While this capital return has not offset recent stock underperformance, it does interact with the same supply constraint story investors are focused on, as tighter vessel capacity and a smaller share count could both influence how much upside or downside the earnings cycle ultimately delivers.

However, investors also need to be aware that Kirby’s heavy reliance on the US inland petrochemical market leaves it particularly exposed if...

Read the full narrative on Kirby (it's free!)

Kirby's narrative projects $3.9 billion revenue and $445.6 million earnings by 2028. This requires 6.1% yearly revenue growth and about a $142.6 million earnings increase from $303.0 million today.

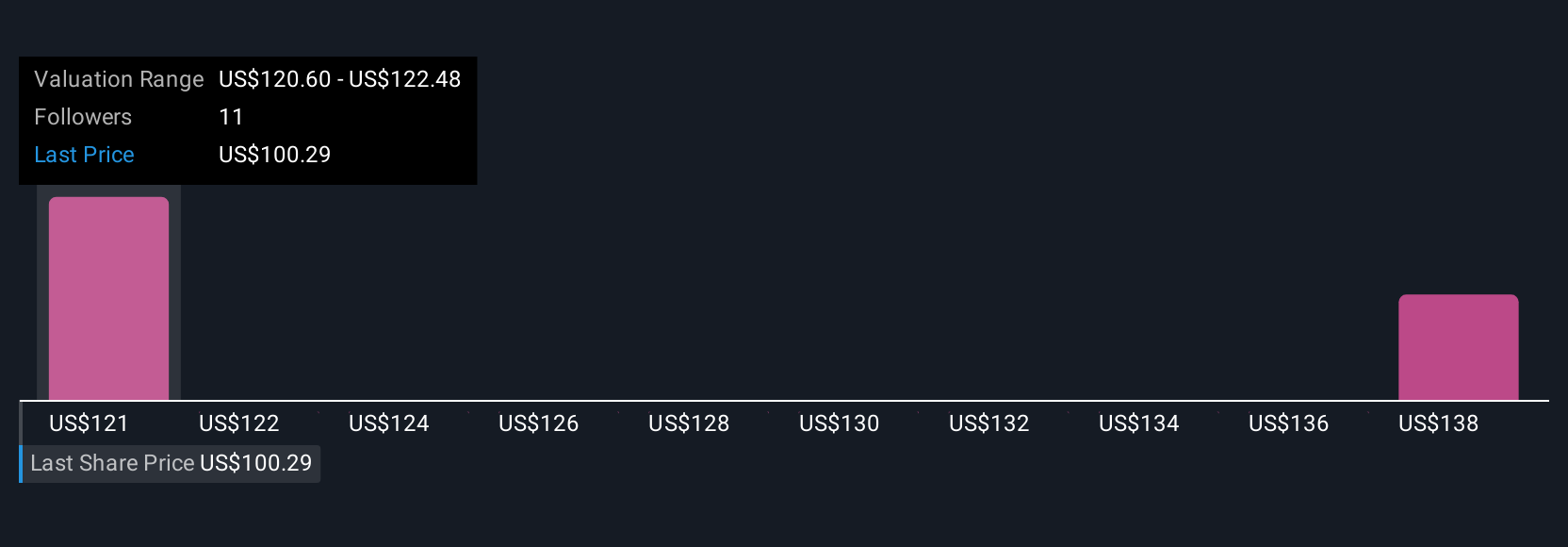

Uncover how Kirby's forecasts yield a $125.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Kirby span from US$36.91 to US$125.33 across 2 independent views, underscoring how far apart individual assessments can be. When you weigh this spread against the risk that softer chemical and energy demand could keep barge utilization and pricing under pressure, it becomes even more important to compare several perspectives before deciding how Kirby fits into your portfolio.

Explore 2 other fair value estimates on Kirby - why the stock might be worth less than half the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com