Should US Foods’ US$1 Billion Buyback Plan Require Action From US Foods Holding (USFD) Investors?

- In November 2025, US Foods Holding Corp. (NYSE: USFD) announced that its Board had approved a share repurchase program of up to US$1,000 million, signaling a major capital return initiative to investors.

- This sizable buyback authorization highlights management’s willingness to deploy balance sheet capacity toward reducing share count, which can enhance per-share metrics and underline confidence in the company’s longer-term outlook.

- We’ll now explore how this sizeable repurchase plan could influence US Foods Holding’s existing investment narrative built around efficiency, margins, and growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

US Foods Holding Investment Narrative Recap

To own US Foods, you need to believe in steady gains from efficiency, modest case growth and disciplined capital allocation in a mature, competitive foodservice market. The new US$1,000 million buyback supports that capital return story, but it does not materially change the near term demand-driven catalyst or the key risk that softer “food away from home” spending could cap volume and earnings growth.

The November 2025 authorization builds on an already active repurchase pace, including the May 2025 program and the completion of earlier tranches that retired more than 10 percent of shares. This steady reduction in share count sits alongside ongoing productivity and automation efforts, which many investors view as central to supporting margins if case volume remains under pressure.

However, investors should also be aware that if secular demand for dining out weakens over time, then...

Read the full narrative on US Foods Holding (it's free!)

US Foods Holding's narrative projects $45.1 billion revenue and $1.1 billion earnings by 2028. This requires 5.3% yearly revenue growth and an earnings increase of about $547 million from $553.0 million today.

Uncover how US Foods Holding's forecasts yield a $92.40 fair value, a 23% upside to its current price.

Exploring Other Perspectives

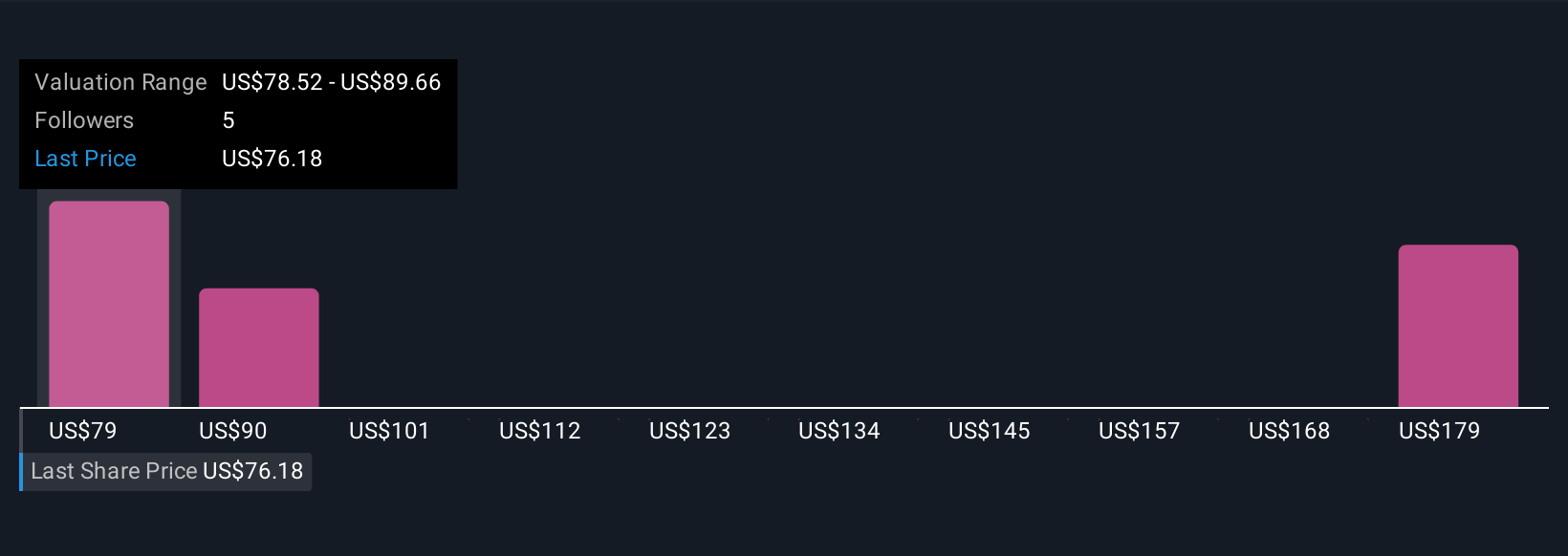

Seven fair value estimates from the Simply Wall St Community span roughly US$78 to US$208 per share, showing how far apart individual views can be. You can compare those opinions with the current focus on efficiency, margins and buybacks to judge how resilient US Foods might be if food away from home spending stays soft.

Explore 7 other fair value estimates on US Foods Holding - why the stock might be worth over 2x more than the current price!

Build Your Own US Foods Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your US Foods Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free US Foods Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate US Foods Holding's overall financial health at a glance.

No Opportunity In US Foods Holding?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com