On Holding (ONON): Reassessing Valuation After Strong Earnings Beat and Upgraded Growth Forecasts

On Holding (ONON) has been on a tear after its latest earnings, with the stock jumping about 25% over the past month as investors respond to revenue and profit figures that beat expectations.

See our latest analysis for On Holding.

That surge has shifted the tone after a tougher stretch, with a 30 day share price return of 37.5% contrasting sharply with a negative year to date move and yet a powerful three year total shareholder return of 176%. This suggests momentum is rebuilding as investors refocus on growth.

If On Holding’s rebound has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

Yet even after a sharp post earnings rally, analysts still see upside and earnings forecasts keep climbing. Is On Holding’s growth run underappreciated here, or is the market already baking in years of expansion?

Most Popular Narrative Narrative: 21.6% Undervalued

With On Holding last closing at $48.14 against a narrative fair value near $61, the story centers on whether rapid growth can sustain that valuation gap.

The acceleration in DTC (Direct-to-Consumer) and e-commerce channels, with DTC reaching new highs (41.1% of sales in Q2 and up 54% YoY), gives On more control over brand, pricing, and customer data while increasing gross and EBITDA margins, an operational catalyst likely to further expand profitability as DTC continues its mix shift.

Want to see how a premium athletic brand earns a tech like valuation? The core narrative focuses on aggressive growth, expanding margins and a bold future earnings multiple. Curious which assumptions need to land perfectly for that price to make sense? Explore the full roadmap behind this fair value estimate.

Result: Fair Value of $61.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if premium pricing power fades or APAC expansion stumbles, which could squeeze margins and expose how much growth is already priced in.

Find out about the key risks to this On Holding narrative.

Another Lens on Valuation

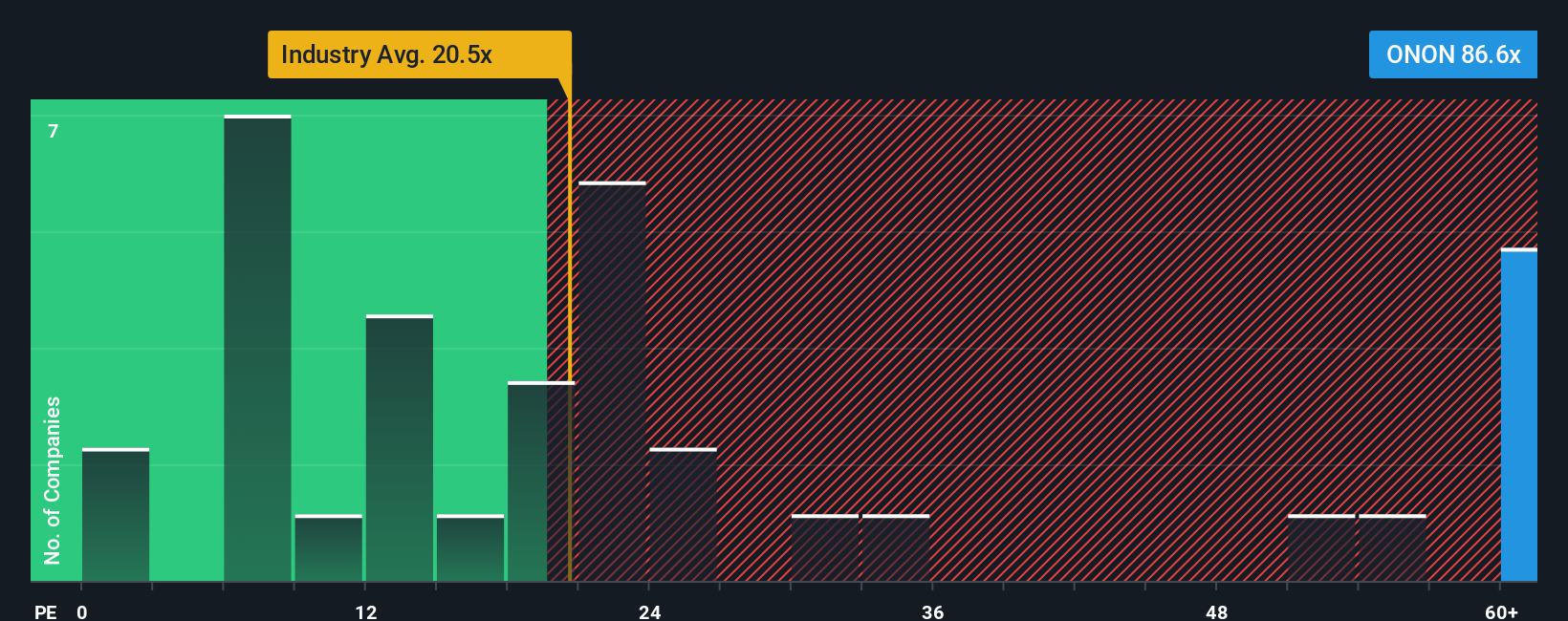

Zooming out from the narrative fair value, the market is asking a steep price for that growth. On Holding trades on a price to earnings ratio of 57.6 times, almost double its peer average of 29.8 times and well above a fair ratio of 28.8 times. This raises clear downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see the outlook differently or want to test your own assumptions against the numbers, you can build a full narrative yourself in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Ready for more investment ideas?

Before you move on, lock in your next moves by scanning fresh opportunities on the Simply Wall St Screener so your watchlist never falls behind.

- Capitalize on mispriced potential by targeting companies that look attractive on future cash flows using these 908 undervalued stocks based on cash flows.

- Ride powerful technological shifts by focusing on innovators reshaping automation, analytics, and digital infrastructure through these 26 AI penny stocks.

- Boost your income strategy by uncovering steady payers with solid yields and resilient track records via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com