MACOM Technology Solutions (MTSI) Valuation After Earnings Beat, New COO Appointment and Insider Share Sales

MACOM Technology Solutions Holdings (MTSI) has been back in the spotlight after beating quarterly earnings expectations, promoting long time operations leader Robert Dennehy to Chief Operating Officer, and seeing a cluster of insider share sales.

See our latest analysis for MACOM Technology Solutions Holdings.

The stock has been riding a clear upswing, with a roughly 41 percent 3 month share price return and a 3 year total shareholder return near 168 percent, suggesting momentum is still very much on investors’ side despite the latest pullback to about $184.

If MACOM’s run has you rethinking your semiconductor exposure, it could be a good moment to scan other high growth tech and chip names via high growth tech and AI stocks.

With shares hovering just below analyst targets after a powerful multi year run, investors now face a tougher question: is MACOM still trading at a discount to its growth prospects, or has the market already priced in its next chapter?

Most Popular Narrative Narrative: 1% Overvalued

With MACOM closing at about $184 against a narrative fair value of $183, the story hinges on whether its future profit ramp justifies today’s premium.

Full operational control of the RTP fab enables increased capacity (up to 30% boost within 12-15 months), improved yields, and cost efficiencies; this is expected to shift the fab from a short-term gross margin headwind to a meaningful margin tailwind by late 2026, leading to expansion of company-wide gross and operating margins.

Want to see how projected double digit revenue growth, massive margin expansion, and a future earnings multiple combine to support that fair value? Tension filled and detailed.

Result: Fair Value of $183 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat story could unravel if data center and telecom demand proves choppier than expected, or if RTP fab efficiency improvements slip.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

Another Lens on Valuation

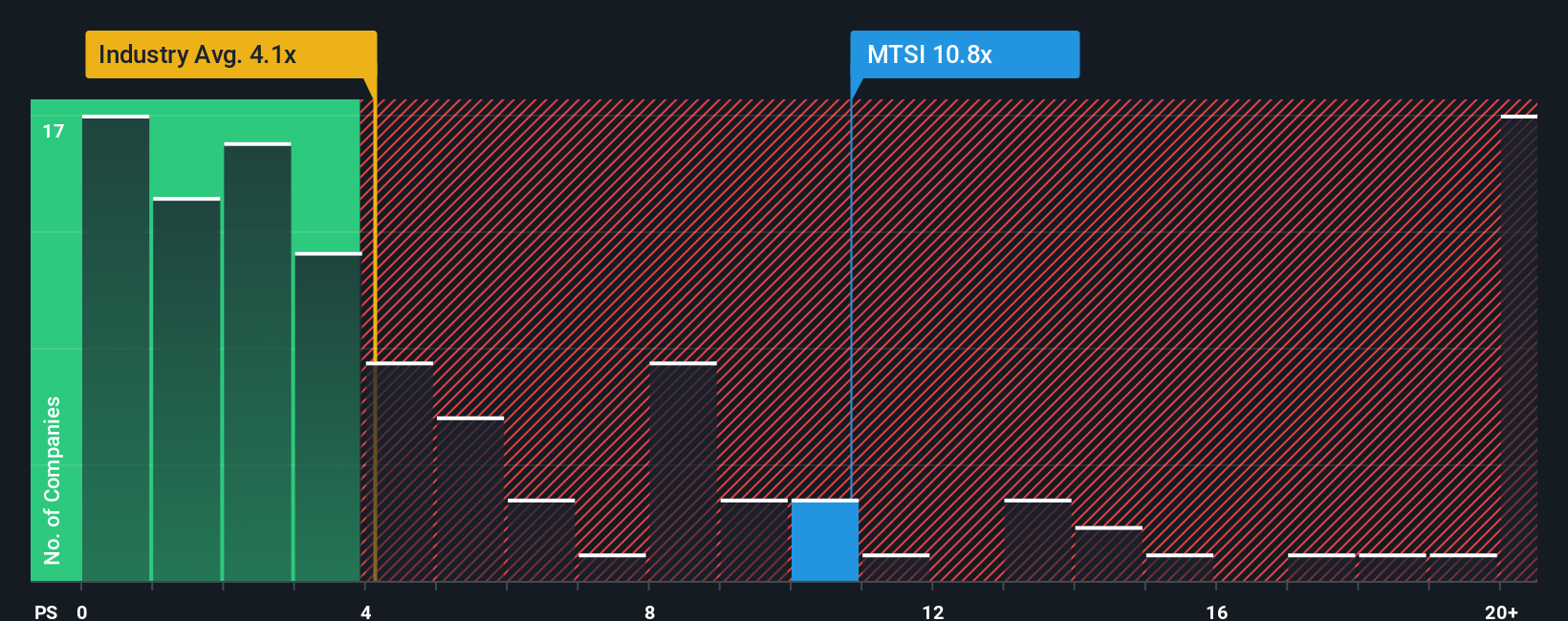

Looked at through its sales multiple, MACOM is far from cheap. The stock trades on a 14.3 times price to sales ratio versus about 5.5 times for the broader US semiconductor space and a fair ratio of 5.8 times, leaving little room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you would rather challenge this view and dig through the numbers yourself, you can build a personalized MACOM narrative in minutes: Do it your way.

A great starting point for your MACOM Technology Solutions Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story. Use the Simply Wall St Screener to uncover fresh opportunities before other investors move first and narrow your edge.

- Capitalize on market mispricing by targeting companies trading below their estimated cash flow value through these 907 undervalued stocks based on cash flows and position yourself for potential re rating upside.

- Accelerate your growth hunt by zeroing in on next wave innovators using these 26 AI penny stocks and stay ahead of the technologies reshaping entire industries.

- Strengthen your income stream by focusing on reliable payers via these 15 dividend stocks with yields > 3% and avoid missing out on compounding returns from consistent cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com