Heidrick & Struggles (HSII): Assessing Valuation After Strong Multi‑Year Share Price Gains

Heidrick & Struggles International (HSII) has quietly delivered strong multi year gains, with the stock up about 34% over the past year and more than doubling in the past 3 years.

See our latest analysis for Heidrick & Struggles International.

With the latest share price at $58.97 and a standout 90 day share price return of 17.07 percent, the recent move looks like a continuation of the strong multi year total shareholder return rather than a short lived bounce. This suggests momentum is still building as investors warm to its steady revenue and earnings growth.

If Heidrick and Struggles success has you thinking more broadly about where leadership and execution really matter, it could be a good moment to explore fast growing stocks with high insider ownership.

Yet with shares now hovering around analyst targets despite solid revenue and profit growth, the key question is whether Heidrick and Struggles is still undervalued or if the market has already priced in its future gains.

Most Popular Narrative: 10% Undervalued

Compared with the latest close at $58.97, the most followed narrative points to a higher fair value, leaning on robust long term growth assumptions.

The company's expansion into consulting, interim/on-demand talent, and leadership development services is diversifying its revenue base beyond traditional executive search, which should reduce cyclicality in earnings and support durable long-term EBITDA growth.

Curious how modest top line growth, rising margins, and a leaner share count potentially combine into that richer valuation story? The full narrative reveals the exact earnings trajectory and future multiple behind the $59 fair value call.

Result: Fair Value of $59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and intensifying tech driven competition could delay hiring decisions and compress margins, which would challenge the upbeat valuation narrative.

Find out about the key risks to this Heidrick & Struggles International narrative.

Another View: Rich on Earnings

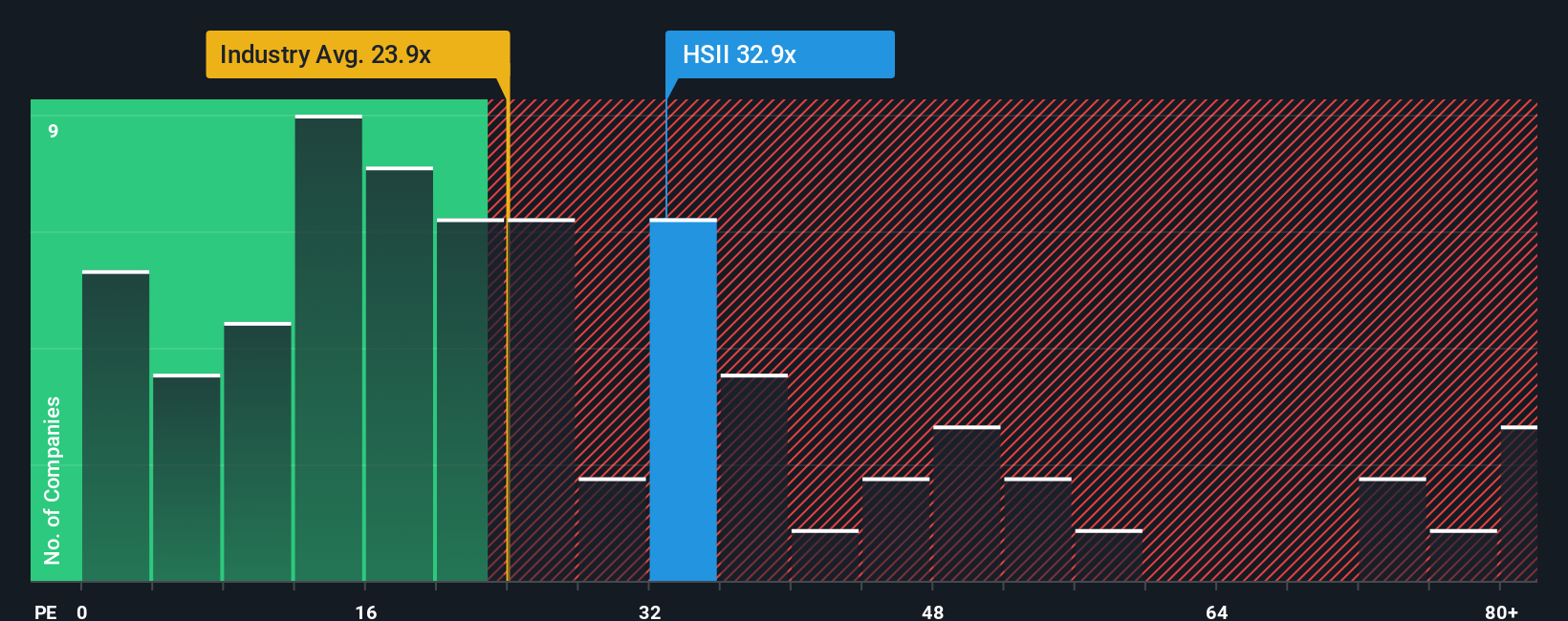

Our SWS DCF model sees clear upside, but a simple price to earnings check tells a cooler story. At 33.1 times earnings versus a 25.3 times fair ratio and 24.9 times for the industry, investors appear to be paying up, so how much safety margin is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heidrick & Struggles International Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next smart move?

Instead of stopping at Heidrick and Struggles, you can use your research momentum with the Simply Wall St Screener to uncover your next high conviction opportunity.

- Explore potential multi baggers early by targeting these 3573 penny stocks with strong financials with solid fundamentals before they become widely recognized.

- Focus on structural trends in automation and data by looking at these 26 AI penny stocks that use AI to help transform industries.

- Search for quality at more attractive prices by considering these 911 undervalued stocks based on cash flows where cash flow strength may not yet be fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com