Dollar Cost Averaging: A Strategy for Long-Term Investment

What is Dollar Cost Averaging?

Dollar Cost Averaging (DCA) is an investment strategy that can be used domestically or internationally where you invest a fixed amount of money at regular intervals, regardless of market conditions which can help remove the uncertainty of market timing by adhering to a fixed investment schedule.

Instead of trying to time the market or making one large investment, you spread your purchases over time through recurring investments.

This approach is particularly effective when investing in volatile assets like stocks and ETFs, as it helps smooth out the impact of market fluctuations on your overall investment performance.

How Dollar Cost Averaging Works?

By investing the same amount regularly, you automatically buy more shares when prices are low and fewer shares when prices are high. This systematic approach can potentially reduce your average cost per share over time.

Real-World Example

Consider this scenario from 8 months ago:

Investor A (Lump Sum Strategy):

- Invested $800 all at once when Stock XYZ was trading at $10

- Purchased 80 shares at $10 each

- Total investment: $800

Investor B (Dollar Cost Averaging Strategy):

- Set up recurring investments of $100 monthly

- Invested consistently regardless of price fluctuations

- After 8 months: holds approximately 98 shares

- Average cost per share: $8.16

- Total investment: $800

The result? Investor B acquired more shares (98 vs 80) at a lower average cost ($8.16 vs $10.00) using the exact same amount of money.

Key Benefits of Dollar Cost Averaging

1. Risk Mitigation

By spreading investments across different market conditions, DCA helps manage the impacts of market volatility. This approach can potentially smooth out the ups and downs, reducing the risk of investing all your money at a market peak.

2. Disciplined Investing

DCA removes emotion from investment decisions. Your investment amount is predetermined and automatic, helping you stay focused on long-term accumulation regardless of market sentiment or news cycles.

3. Accessibility for All Investors

You don't need a large lump sum to start investing. DCA makes investing accessible by allowing you to start with smaller, manageable amounts that fit your budget.

Getting Started with Dollar Cost Averaging

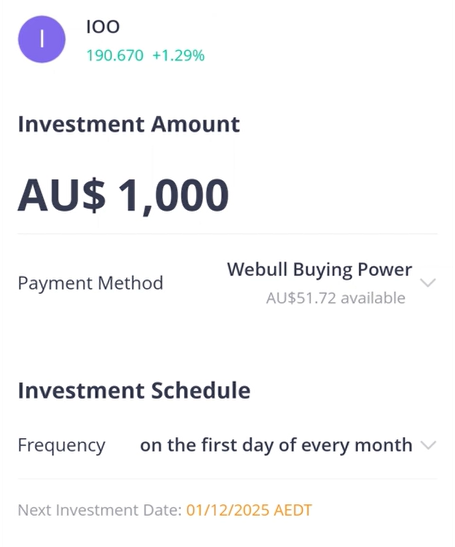

To implement a DCA strategy using Webull’s Auto Investing:

![]()

- Select your investments: Choose a stock, ETF, managed fund or construct your own portfolio through our DIY Portfolio feature that align with your goals.

- Choose your investment amount: Select a comfortable sum you can invest regularly.

- Set your frequency: Decide whether to invest daily, weekly, or monthly.

- Automate the process: Set up recurring investments to maintain consistency.

- Stay committed: Stick to your plan through market ups and downs.

For more details on Webull’s Auto Investing, please refer to the Terms and Conditions.