Customizing your strike price when using a butterfly strategy

The butterfly strategy in options trading belongs to the "swing spread" family. By combining long and short options positions, investors can trade a strategy that limits both risks and potential gains.

What is the butterfly strategy?

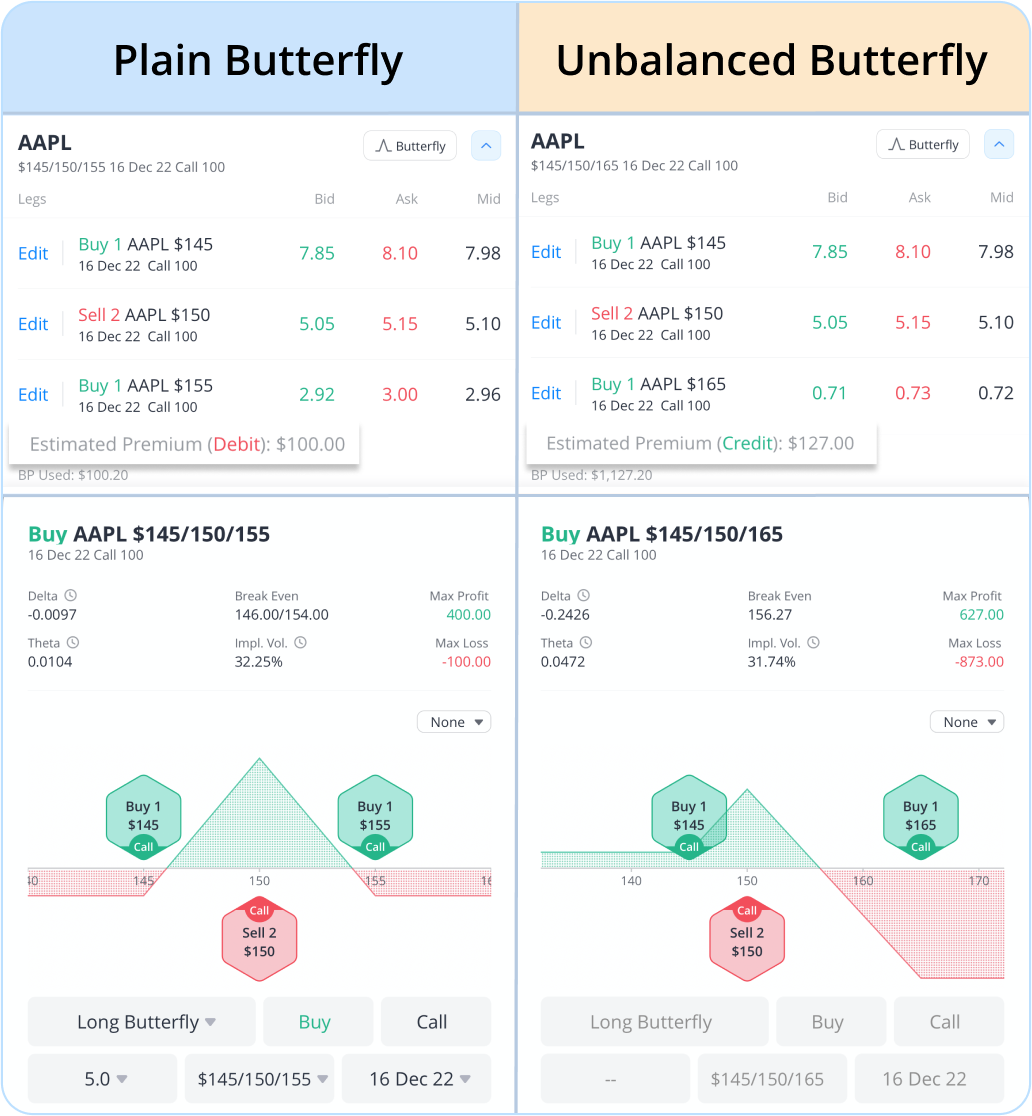

A butterfly is a three-part option strategy consisting of a long vertical spread and a short vertical spread with the same expiration date. The short option in the long spread, and the short option in the short spread, must have the same strike price. Both call options and put options can be used for a butterfly spread. A quick guide to butterfly strategies is shown below.

More Flexibility in an Unbalanced Butterfly Strategy

Compared to the plain butterfly option position, the unbalanced butterfly allows the selection of strike prices at unequal intervals between options, providing more flexibility. If the distance between the long option and short option is not the same, then the butterfly will have a “broken wing,” as the two spreads—the “wings” of the butterfly—are not balanced.

Take the long call butterfly as an example. Suppose AAPL is trading at $148. Instead of holding a 100 percent neutral attitude, the butterfly holder believes the probability of the stock price going up is relatively lower than moving downwards (more bearish), as the stock is nearing its resistant level. The broken-wing butterfly could be a better fit for this trader. If you opt for a higher-strike, lower-premium long option on the right wing of the spread, in some cases you can convert the position from a net debit to a net credit, but this carries its own risks. You may end up with a long stock position after expiration in some scenarios.

The case above is one scenario of adjusting the right-wing strike higher, with the stock price near the middle strike, for a holder with a bearish outlook.