Options Trading Strategies Commonly Used During Earnings Season

Almost nothing has as big an impact on stock prices as an earnings report. Heading into earnings season, there’ll be many such reports coming out. So it’s a good time to review options strategies that can be especially useful to managing a portfolio in that environment.

Options Strategies based on the Directional Expectation

When trading earnings with options, some traders select their strategies based on what direction they think the stock could go. Options traders can narrow down which strategies correspond to their bullish, bearish, or neutral outlook.

If an investor expects the earnings to be stronger than estimates, he or she could buy call options to build a speculative position. Alternatively, when expecting that there will be a negative price move after an earnings report, an investor could buy put options. One notable factor in single-leg buying strategies is the rising implied volatility before the announcement, usually followed by IV crush, which can harm a long option position.

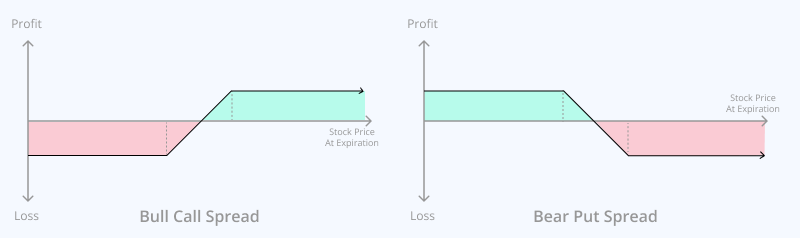

Some traders may apply multileg strategies, such as vertical spreads, to reduce the volatility risk. A vertical spread involves simultaneously buying one call (or put) and selling another call (or put) on the same underlying asset and expiration, but at different strike prices. The strategy allows investors to trade directionally with lower theta and vega risk, but with capped potential profits.

There are four types of vertical spreads. You can read more about them by following the links below.

- Bull call spread (bullish)

- Bear call spread (bearish to neutral)

- Bear put spread (bearish)

- Bull put spread (bullish to neutral)

Anticipating a Big Move in Stock Price, But are Unsure of the Direction

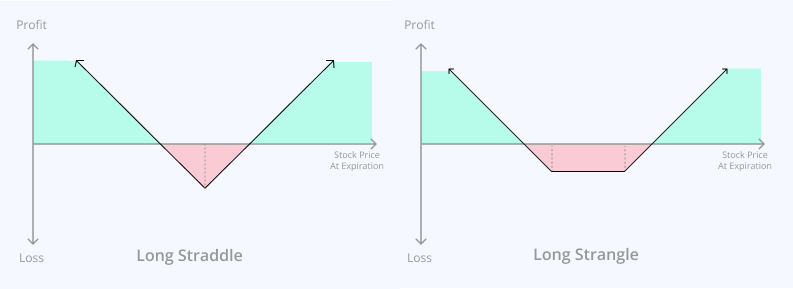

An investor expecting a big move in the price of a particular, but who is unsure which direction that movement will be in, can use the long straddle/strangle strategy to benefit from the tendency toward higher volatility around earnings announcements.

A long straddle involves buying a call option and a put option on the same underlying security with the same expiration date and strike price. A long strangle strategy is similar to a straddle, but uses different strike prices between the put and call (higher strike call, lower strike put). For example, a trader might buy a call option with a strike price of $50 and a put option with a strike price of $45. This trade will profit if the stock price moves significantly outside of this price range before the options expire.

Both long straddles and strangles are considered to be neutral strategies. However, they can be risky because they require the underlying stock to make a significant move in order to be profitable. They can also be expensive to implement due to the cost of buying or selling multiple options.

Summary

These are just a few examples of options strategies that investors might consider using during earnings season, and there are many more potential strategies that may be suitable depending on an individual's investment objectives and risk tolerance. As with any investment strategy, it's important to thoroughly research and understand the potential risks and rewards before implementing an options strategy.