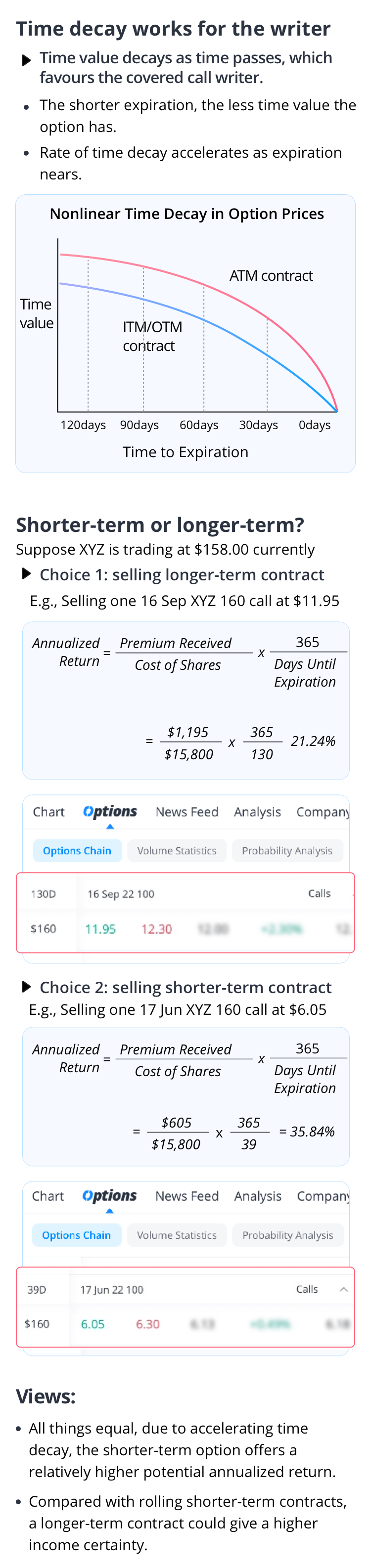

Selecting Expiration for a Covered Call Strategy

Here is an infographic about selecting expiration when writing covered calls.

0

0

0

Options trading entails significant risk and is not appropriate for all investors. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Losses can potentially exceed the initial required deposit. Before trading options please read the Options Disclosure Document "Characteristics and Risks of Standardized Options" which can be obtained at www.webull.com.au Regulatory and Exchange Fees may apply.

Lesson List

1

Options Trading

2

Getting Started with Calls and Puts

3

Buy Calls vs Buy Puts

4

Buying a Call vs Buying a Stock

5

Buying a Put vs Short Stock

6

Option Learning Begins at Calls

7

Call Buyer Profit & Loss Chart

8

Option Learning Begins at Puts

9

Put Buyer Profit & Loss Chart

10

Time: friend or foe to call buyers

11

Which strike for call buyers?

12

How leverage works for call options?

13

How Do I Get Started with Call Options?

14

Things to Consider When Choosing an Underlying Security of Puts

15

Time: friend or foe to put buyers

16

Which strike for put buyers?

17

How leverage works for put options?

18

Selling an OTM or ITM Cash Secured Put?

19

Selecting a Strike Price of Cash Secured Put

20

Selecting Expiration for a Cash Secured Put Strategy

21

Enhance Your Income with Buy Writes

22

Selecting a Strike Price of Covered Call

Selecting Expiration for a Covered Call Strategy

24

Feeling the Market Downturns? Put Options Might Help

25

Three Common Mistakes in Single Options Trading

26

How Do You Pick the Right Expiration Date and Strike Price as an Option Seller?

27

How to Select the Best Expirations and Strikes for Options

28

Select a Contract When Buying an Option: Consider Key Elements