Hong Kong Market 101

1.1 Hong Kong Exchanges Overview

The HKEX

Similar to Australia’s Australian Securities Exchange (‘ASX’), HKEX also offers a diverse range of products, including equities, derivatives, commodities, and fixed-income securities.

HKEX also operates the London Metal Exchange (‘LME’), providing exposure to global commodities.

For Australian investors, HKEX offers access to China’s market and liquidity advantage. The exchange’s robust infrastructure, English-language support, and alignment with global regulatory standards make it accessible to foreign participants.

The SEHK

The SEHK is the seventh-largest stock exchange globally by market capitalisation (USD5.2 trillion in 2025), hosting over 2,500 listed companies. Key segments include:

- Main Board: For large-cap companies (e.g., HSBC, Tencent). The listing eligibility criteria for the Main Board are much higher than for GEM. One example is the market cap needs to be at least HKD4 billion.

- Growth Enterprise Market (GEM): For small to mid-sized, high-growth firms

SSE/SZSE

Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) are mainland China's primary exchanges. International investors can trade eligible A-shares in these exchanges via China Connect (Details in lesson 8).

2. What do you need to know to trade?

Minimum Amount/Lots

The minimum trading size in HKEX is one lot, which can range from 10 shares to 100,000 shares depending on the stock, particularly:

Board lots standardise trading size. For example:

- Tencent (0700.HK): 100 shares per lot (~HKD 63,000 at 2026 Jan prices).

- HSBC (0005.HK): 400 shares per lot (~HKD 50,800 at 2026 Jan prices).

Odd lots (non-standard quantities) can be traded via HKEX’s “Odd Lot Market,” but liquidity is thin. Webull supports odd lots limit order.

Time in Force

· Day orders placed during the trading hour will expire if unfilled by end of trading day

· Good-till-cancelled (‘GTC’) orders are broker-dependent.

Trading rules

Stock bought (shorted) can be sold (buyback) on the same day. There is no limit on the number of transactions.

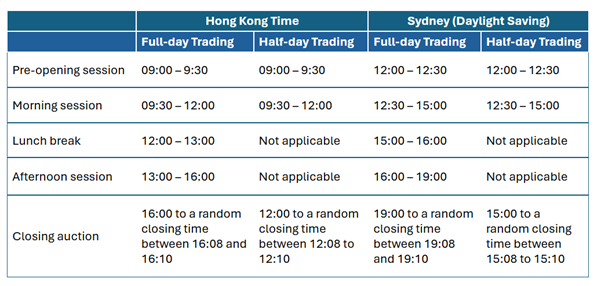

Trading Hours for all HK Exchanges and Australian Exchanges

Regular session (Continuous Trading Session):

9:30 AM – 4:00 PM HKT, split into morning (9:30 AM – 12:00 PM) and afternoon (1:00 PM – 4:00 PM) sessions.

- The trading system follows the principles of price priority and time priority. Orders are processed one by one based on the order in which they were entered into the system. Orders entered earlier must be executed before orders with the same price entered later.

- For half-day trading, there is no afternoon continuous trading session.

Auction sessions:

Opening auction:

- 9:00–9:15 AM (Order input)

- 9:15 AM to 9:20 AM (Pre-order matching)

- 9:20–9:28 AM (Order matching)

- 9:28 AM to 9.30 AM (Blocking period)

Closing auction: 4:00–4:10 PM, extended to 4:08–4:10 PM for order matching. Introduced in 2016, this session sets the closing price using a “single-price auction” to minimize manipulation.

Time Zone Considerations:

HKT (UTC+8) is 2–3 hours behind AEST. For example, HKEX’s 9:30 AM open is 12:30 PM AEST during Australian daylight saving.

Outside of market hours:

Any orders placed outside of market hours (including lunch break period) will be queued for the next “Continuous Trading Session”.

Settlement Period:

- T+2 settlement: Stocks traded today which is referred to as T0 will be settled on the second trading date (‘T+2’). For example, trades executed on Monday settle by COB Wednesday.

- Clearing: Managed by HKSCC, which holds securities and operates in central depository, Central Clearing and Settlement System (‘CCASS’).

3. Order types

Webull supports four types of orders:

Enhanced Limit Orders: An order similar to limit order except that it will only match up to 10 price queues.

At-Auction Orders: A market order without a specified price. It is used exclusively in the auction sessions. These orders contribute to the final Indicative Equilibrium Price (‘IEP’) which balances supply and demand. For instance, a large sell order in the auction could lower the closing price.

Auction Limit Orders: Specifies both a priced and quantity for buying or selling securities. This type of order is matched based on price and time priority during the closing auction at the final IEP. The order is executed when the specified price is at or better than IEP.

Please refer to HKEX website for more details on the trading mechanism:

4. How to place a trade in HK and Stock Connect in Webull?

4.1 Opting into HK Market and Stock Connect?

Looking to trade in the HK markets? We can help you! Below explains simple steps to achieve this:

1. Navigate to Menu > Settings > Manage Brokerage Account > Stocks and ETFs

2. Select HK Market (Stock Connect is included)

3. Review and accept the relevant terms and conditions

4. Submit your application and wait for approval

To trade in the HK markets you first need to:

- Have funds upfront in your account; and

- Have ensured you have read our relevant terms and disclosures regarding HK markets.

4.2 Transferring AUD currency to HKD/CNH

1. Tap the Webull logo at the bottom of the screen

2. Select 'Transfers' from top navigation bar and then 'Currency Exchange'

3. Enter the amount you would like to exchange

4. Tap ‘Exchange Now’

5. Tab ‘Confirm’.

4.3 Placing a trade in the HK market:

1. Select Market – Hong Kong -> Select preferred stock (eg. 01211 BYD)

2. Select “Trade”

3. Select “Buy” or “Sell”

4. Select “Order Type” (Please see Lesson 3 on details of order types)

5. Input “Limit Price”, quantity (number of shares depends on lot size) and Time-In-force

6. Select “Buy” or “Sell”

4.4 Placing a trade in the China market:

1. Select Market – Chinese Mainland-> Select preferred stock

2. Select “Trade”

3. Select “Buy” or “Sell” (Only Limit order can be selected)

4. Input “Limit Price”, quantity (number of shares depends on lot size)

5. Select “Buy” or “Sell”

5. Corporate Actions

Corporate actions in Hong Kong require careful attention to timelines and tax implications:

Dividends:

Most HK-listed companies pay semi-annual dividends.

Timeline:

- Declaration Date: Company announces dividend.

- Ex-dividend Date: Set two trading days before the record date. Buying on/after this date forfeits the dividend.

- Payment Date: Typically, 2–4 weeks post-record date.

Tax: Hong Kong does not withhold dividends tax, but Australia taxes this income as part of your marginal rate.

Other Corporate actions:

- Stock Splits: Stock splits adjust share quantities without altering market cap and improve liquidity.

- Mergers: For example, the 2021 Link REIT acquisition, require HKEX disclosures and shareholder votes. Post-merger, shares may be suspended. Adjustments are automatic in broker accounts, but delay can occur for cross-listed entities.

- Rights Issues: Companies offer new shares at a discount to existing shareholders. This is less common but critical to monitor. For example, AIA’s 2020 rights issue allowed shareholders to buy new shares at a discount, diluting existing holdings if not participated in.

- Proxy voting: A mechanism that allows shareholders to vote on corporate matters without attending meetings in person. Webull currently do not offer proxy voting for Hong Kong stocks.

HKEX mandates 5 business days’ notice for most corporate actions, published via the HKEX newsplatform. Australian investors should align notifications with their time zone to avoid missing deadlines.

6. Announcements

Timely access to HKEX disclosures is critical, as delays can lead to missed opportunities or unexpected losses.

Earnings Releases

Frequency: Main Board companies report semi-annually; Growth Enterprise Market (GEM) firms report quarterly.

Deadlines:

- Interim report: Released by 31 August annually; and.

- Annual report: Published by 31 March annually.

Note: These deadlines apply to companies with December 31 financial year-ends. Companies with different year-ends have proportionally adjusted deadlines.

Content: Includes balance sheets, cash flow statements, and management commentary.

Regulatory Filings

- Substantial Shareholder Disclosures: Required when holdings cross 5% thresholds. In 2023, BlackRock’s filing on reduced Alibaba stakes impacted sentiment.

- Profit Warnings: Mandatory if earnings are expected to swing >50% YoY.

Sources

1.HKEX news: Central repository for all filings. Use its “Company Search” tool with stock codes.

2. Company Websites: IR sections often provide investor-friendly summaries.

3. Third-Party Platforms: Morningstar and Bloomberg aggregate filings but may lag by minutes.

Language Considerations

All filings are published in English and Chinese, but smaller firms may use machine-translated English. Critical documents (e.g., merger terms) should be verified with bilingual advisors.

7. Share Categories, Indices, and key concepts

Ticker Codes

4-digit codes for Main Board (e.g., 0005.HK for HSBC) and 5-digit for GEM (e.g., 08083.HK for China Automation). Unlike ASX’s mnemonic codes (e.g., CBA for Commonwealth Bank), HK uses numbers for easier localisation.

Share Categories

- Blue Chips: In Hong Kong, the constituents of the Hang Seng Index (HSI) are generally recognised as blue chips. Blue-chip stocks are normally leaders in their industries. They are characterised by high liquidity, strong financial conditions, stable earnings, and fixed dividend distribution. Due to the high profitability of these stocks, most of the blue chips are preferred by funds.

- Red Chips: Stocks issued by companies listed on the SEHK, where their main sources of income stem from businesses in Mainland China. Generally, red-chip companies are incorporated outside Mainland China. Their main feature is the concept of capitalisation and restructuring, as most of their parent companies are well-capitalised and have strong assets in the mainland.

- H-Shares: Issued by companies incorporated in Mainland China and listed on the HKEX with the approval of the China Securities Regulatory Commission.

- A-Shares: Shares of incorporated companies based in mainland China that are listed on either the Shanghai or Shenzhen stock exchanges. These shares are issued in China under Chinese law and are quoted in Chinese yuan or renminbi.

Indices

- Hang Seng Index (HSI): Since its introduction in 1969, the Hang Seng Index (HSI) has been the benchmark of the SEHK. The HSI holds 88 (as at Jan 2026) of the stocks listed on SEHK. The aggregate market capitalisation of these stocks accounts for about 70 percent of the total market capitalisation of the SEHK. HSI stocks are all known to be blue chips.

- Hang Seng China Enterprises Index (‘HSCEI’) : The HSCEI serves as a benchmark that reflects the overall performance of Mainland securities listed in Hong Kong.

- Hang Seng TECH (‘HSTECH’): It tracks the performance of the 30 largest technology companies listed on the HKEX that are focused on high-tech or innovative industries. Composition includes major Chinese tech giants such as Alibaba, Tencent, Meituan, JD.com, Xiaomi.

8. China Connect

China Connect links Hong Kong and mainland China stock markets via the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs.

8.1 Northbound Trading:

This enables international investors trade eligible A-shares in Shanghai and Shenzhen through Hong Kong brokers.

- Australians buy A-shares via HK brokers (e.g., HSBC HK, Webull).

- Eligible Stocks: Stock Connect allows trading of 1,500+ A-shares listed in Shanghai (‘SSE’) and Shenzhen (‘SZSE’), including giants like Kweichow Moutai or BYD.

- Quotas: Daily buying quotas is RMB52 billion for Northbound trade. This is rarely hit but position limits may apply to individual stocks.

8.2 Trading Hours:

8.3 Settlement date and process:

Settlement Date (T+1):

The transaction completes one business day later. Delays occur if Hong Kong or mainland China holidays fall within this window.

- Note: Day-trading is not allowed for A-shares. Clients can only sell A-shares positions after settlement.

Currency Handling:

Trades are placed in HKD/USD (via your broker), but shares settle in Chinese yuan (‘CNY’). Brokers automatically convert currencies, so no mainland bank account is needed.

Clearing Mechanism:

Hong Kong’s CCASS and China’s ChinaClearcoordinate cross-border settlement. Investors don’t interact directly with mainland systems.

8.4 Risks to note:

- Holiday Risks: Trading halts during mainland China or HK holidays. For example, A-shares are inaccessible during Golden Week (October).

- Chinese citizen: Chinese citizen (without permanent residence status outside Mainland China) is restricted from Northbound Trading of China Connect Securities.

8.5 BCAN:

To trade with China Stock Connect, a Broker-Client Assigned Number (‘BCAN’) will be assigned to your account. The BCAN is a unique identification number used to track and identify your account, transactions, and other relevant information. It functions similarly to a Holder Identification Number (HIN) used on the ASX.

8.6 Tax Considerations

Dividends:

- China imposes a 10% withholding tax on dividends paid by mainland Chinese companies. This is deducted at source.

- Australia taxes dividends as income, but you may claim a foreign income tax offset for the 10% withheld, under the Australia-China Double Taxation Agreement (DTA).

Capital Gains Tax (CGT):

- Profits from selling shares are subject to Australian CGT if held for less than 12 months (full tax on gains). If held longer, a 50% CGT discount applies.

- China does not levy capital gains tax on foreign investors for Stock Connect trades.

9. Key regulators and operators of HKEX

Securities and Futures Commission (SFC)

- Primary Role: Independent statutory regulator overseeing Hong Kong’s securities, derivatives, and leveraged forex markets.

- Key Responsibilities: Licenses and supervises brokers, fund managers, and listed entities, enforces market integrity rules and coordinates cross-border regulation with Mainland China’s CSRC for initiatives like Stock Connect.

Hong Kong Securities Clearing Company (HKSCC)

- Primary Role: A subsidiary of HKEX, operating as the central clearinghouse for securities transactions.

- Key Responsibilities: Safely settles and clears stock trades, acting as a middleman to reduce risks, and supports programs like Stock Connect.

Inland Revenue Department (IRD)

- Primary Role: Hong Kong’s tax authority.

- Key Responsibilities: Collects taxes on stock transactions, while the FRC checks financial reports and audits to ensure companies are truthful.

Financial Reporting Council (FRC)

- Primary Role: Ensures audit and financial reporting quality.

- Key Responsibilities: Investigates misconduct by auditors of HKEX-listed companies and reviews financial statements for compliance with standards.