How to implement factor ETFs as part of your portfolios

Common use cases for factor ETFs are to enhance return outcomes and to manage risk. Some examples of these use cases can be summarized as:

- Generating returns: Strategically allocating across rewarded factors and harvesting their risk premiums over time e.g., size, value etc.

- Managing risk: Investors can diversify a portfolio’s risk drivers by allocating to factors with low correlations of excess returns i.e., with diversified outcomes. Investors can use factors to increase their risk (for the potential of higher returns) by blending value and size factors or they can decrease their risk (to reduce risk of drawdowns) by blending low volatility and quality factors.

- Tactically capture market trends: Factors perform differently across various market environments or cycles. Investors can allocate across different factors tactically based on current market cycle e.g., during a recovery stage, investors might like size and value factors. During an expansion, they might like to allocate across size, value and momentum. There are ETFs out there that can do this actively for investors.

Equal weighting exposures

There are scenarios where equal weighting the constituents of a common index, like the S&P 500, will deliver differentiated risk and return outcomes. By equally weighting each of the constituents of the S&P 500 index, investors will achieve an overweight to the value factor and an overweight to the size factor whereas ordinarily through the original index they would be achieving a growth factor exposure. Thinking about the way you gain exposure to certain markets can deliver enhanced return outcomes and mitigate risks.

Building a better core portfolio by managing risk

Where investors expect high volatility and potential drawdowns in broad markets, they can consider allocating to low volatility factor ETFs. These ETFs can deliver similar broad market returns but protect on the downside by only allocating to low volatility securities within that market and applying heavier weights to the lowest volatility securities.

Not all factor ETFs are the same

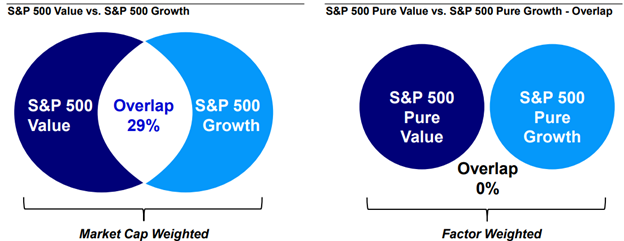

When implementing factor ETF strategies, ensure you understand how that ETF has been constructed. For example, value and growth are inversely correlated factors, which means when value increases in price then growth will fall and vice versa. Certain ETFs might be value ETFs but will give significant overlaps (in some cases, up to a 29% overlap) in securities with growth ETFs. Certain ETF issuers will take a “pure” approach to construct their ETFs to ensure their value ETF does not have any overlap with their growth ETF and deliver a more pure single factor exposure.

For Illustrative Purposes Only

Source: Bloomberg as of 12/31/2022. The S&P 500 Value & Growth Indexes were launched on May 30,1992. The S&P 500 Pure Value & Pure Growth Indexes were launched on December 16, 2005.

What are the risks and awards?

Investors may want to buy factor ETFs for the following reasons.

- To invest in multiple companies exhibiting the same factor characteristics. Compared with holding stocks of one or several companies, factor ETFs enable investors to spread risks over dozens or hundreds of stocks.

- To manage for risk. A factor ETF combines similar stocks in the same factor in one security, and some factors are known for providing resiliency, for example, the Low Volatility factor.

- To capture performance opportunities. Some factors are known for capturing market opportunities, for example, Size and Value factors can capture outperformance relative to the broad market.

While the rewards are enticing, investors should be aware of the risks as well.

Concentrated risks. Buying ETFs in a specific factor does not mean building a diversified portfolio. When a particular factor does not perform well, the factor ETF is at risk. Investors could diversify by investing in ETFs across different, complementary factors.