Zeta Global Holdings (ZETA) Is Up 30.0% After Strong Earnings, Raised Guidance and $200M Buyback - Has The Bull Case Changed?

- Zeta Global Holdings Corp. recently announced strong second quarter earnings, raised its revenue guidance for both Q3 and full year 2025, and unveiled a US$200 million share repurchase program extending through 2027.

- An important development is the addition of a new President of Zeta Data & AI Lab, Nate Yohannes, who brings significant AI leadership from Meta and Microsoft.

- We'll explore how Zeta's increased revenue guidance and buyback program could influence the company's investment narrative going forward.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zeta Global Holdings Investment Narrative Recap

To be a shareholder in Zeta Global Holdings, you need to believe in the company’s ability to sustain rapid revenue growth through AI-driven marketing and continuous platform innovation. The recent uptick in Q2 earnings and raised revenue guidance reinforce the current investment story, yet the company’s unprofitability and reliance on maintaining 20%+ organic growth mean any slowdown in AI adoption or customer demand remains the major short-term risk. At this stage, the latest results highlight momentum but do not erase ongoing execution and market adoption uncertainties.

Zeta’s US$200 million share repurchase program, running through 2027, stands out in the current context. While buybacks can signal confidence and potentially support the share price, they do not materially address the key catalyst: translating strong AI and data investments into sustained customer and revenue gains.

Yet, against all the optimism, investors should also be mindful of ongoing class action litigation that could …

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings' outlook anticipates $1.8 billion in revenue and $241.1 million in earnings by 2028. This scenario is based on 19.2% annual revenue growth and a $292.9 million improvement in earnings from the current level of -$51.8 million.

Uncover how Zeta Global Holdings' forecasts yield a $25.33 fair value, a 25% upside to its current price.

Exploring Other Perspectives

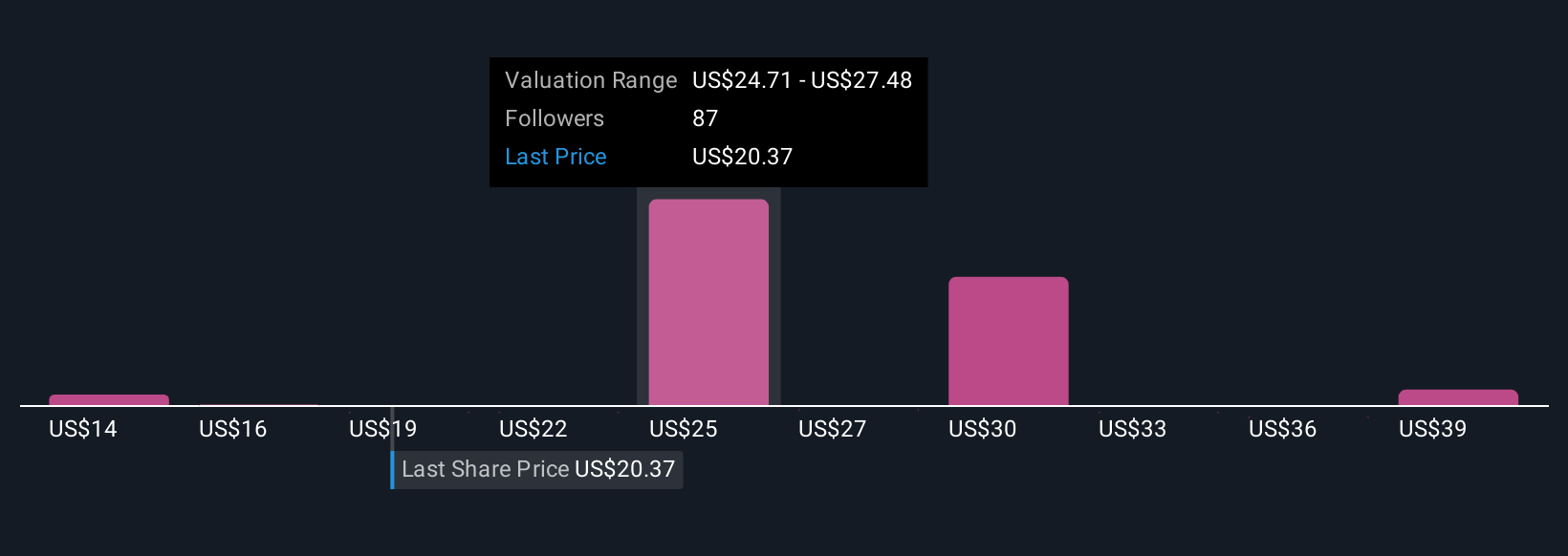

Simply Wall St Community members have shared 23 fair value estimates for Zeta Global, ranging from US$11.32 to US$34.01 per share. While expectations for AI-fueled growth are high, views differ widely and the risk of failing to achieve projected margins remains central to the company’s story.

Explore 23 other fair value estimates on Zeta Global Holdings - why the stock might be worth as much as 68% more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com