Can Viasat’s (VSAT) New HaloNet Portfolio Reshape Its Competitive Edge in Satellite Connectivity?

- Viasat recently unveiled its HaloNet portfolio, a modular communications architecture designed to unify space and terrestrial connectivity for government and commercial missions, supporting multi-orbit operations up to 1,100 km altitude with solutions for telemetry, data relay, and secure communications.

- This launch signals Viasat's expanded focus on flexible, high-capacity communications infrastructure meeting rising demand for secure and resilient connectivity across satellite and ground networks, particularly for defense and emerging commercial space sectors.

- We'll explore how the introduction of HaloNet enhances Viasat’s positioning within growing government and commercial satellite communications markets.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Viasat Investment Narrative Recap

To be a Viasat shareholder, you ultimately need to believe in the company's ability to capitalize on rising demand for secure, multifaceted connectivity for both government and commercial customers. The recent HaloNet launch expands Viasat's solution set, but does not materially alter the most significant short-term catalyst, the company’s execution on rolling out ViaSat-3 and realizing revenue from new service offerings, nor does it offset the ongoing risk from high capital expenditures pressuring free cash flow and earnings in the near term. Another recent development closely tied to HaloNet is Viasat's U.S. government contract to build the next-generation Ethernet Data Encryptor, reinforcing the company’s strength in secure communications. This complements the HaloNet portfolio and addresses critical growth sectors, supporting Viasat's ambitions within government and defense as it seeks to drive adoption of its hybrid network technologies. However, against these positive signals, investors should closely monitor the strain from ongoing capital outlays and their impact on leverage and profitability...

Read the full narrative on Viasat (it's free!)

Viasat's outlook anticipates $5.0 billion in revenue and $534.2 million in earnings by 2028. This projection assumes annual revenue growth of 2.9%, and marks a $1,132.7 million increase in earnings from the current -$598.5 million level.

Uncover how Viasat's forecasts yield a $24.29 fair value, a 6% downside to its current price.

Exploring Other Perspectives

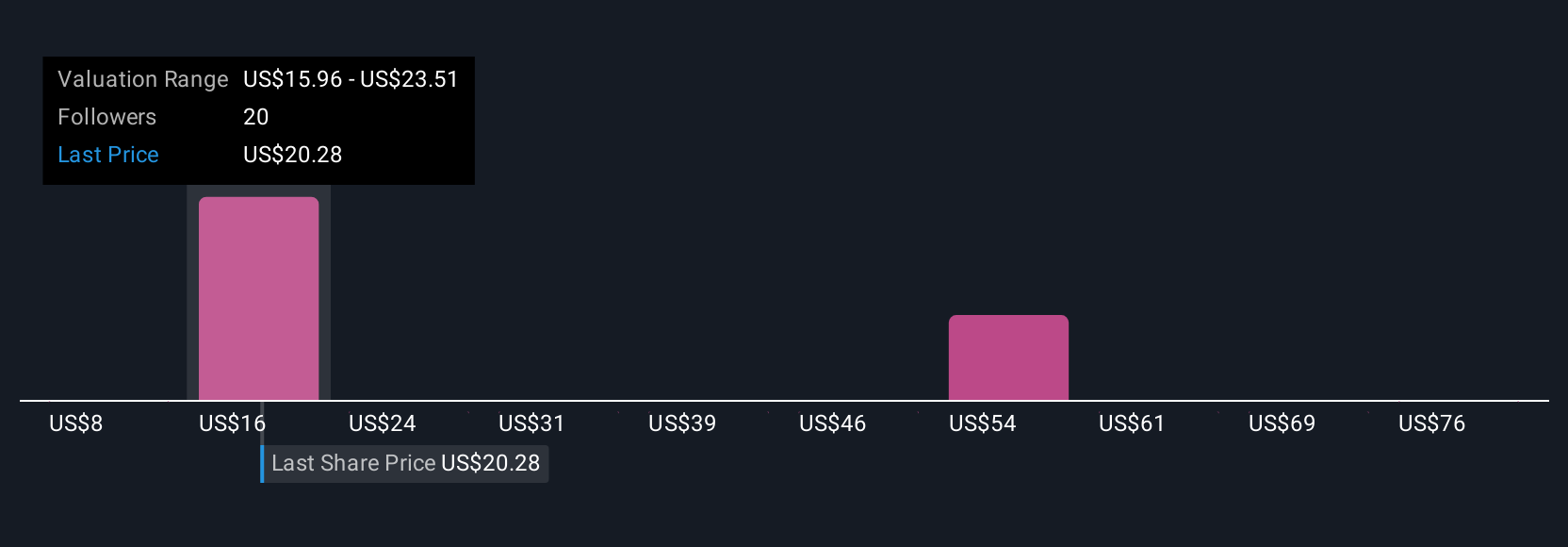

Six individual fair value estimates from the Simply Wall St Community currently range from US$8.40 to US$112.88 per share. While many see secure and resilient connectivity as a key catalyst, your outlook could look different depending on which of these perspectives you identify with, compare alternative opinions for a fuller picture.

Explore 6 other fair value estimates on Viasat - why the stock might be worth less than half the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com