Blue Origin Crypto Spaceflight Partnership Might Change The Case For Investing In Shift4 Payments (FOUR)

- On August 11, 2025, Blue Origin announced a collaboration with Shift4 Payments to enable customers to pay in cryptocurrency and stablecoins, including Bitcoin, Ethereum, Solana, USDT, and USDC, for commercial spaceflight bookings, with support for integrations such as Coinbase and MetaMask wallets.

- This partnership highlights how payment technology providers like Shift4 are expanding their reach into new, high-profile sectors by capitalizing on rising consumer demand for flexible digital payment options.

- We’ll now explore how enabling crypto payments for space tourism bookings could impact Shift4’s long-term growth outlook and competitive edge.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Shift4 Payments Investment Narrative Recap

To own Shift4 Payments stock, you need to believe that the company can sustain its rapid expansion in digital payments by capturing new markets and adopting next-generation payment technologies. While the Blue Origin collaboration showcases Shift4’s ability to integrate crypto payments for high-profile clients, it is unlikely to materially affect the company's biggest short-term catalyst, merging recent international acquisitions, nor does it reduce meaningful risks such as integration challenges and margin pressures in new sectors.

Among other recent announcements, Shift4’s share buyback program stands out, with over 3.4 million shares repurchased since May 2024. While not directly related to crypto innovation, this ongoing buyback demonstrates active capital management, which could offer some support to investor sentiment as the company continues to expand and integrate its growing suite of offerings.

But in contrast, investors should be aware of the significant integration risks tied to the company’s rapid global expansion if...

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments' narrative projects $7.1 billion revenue and $568.7 million earnings by 2028. This requires 25.4% yearly revenue growth and a $360.1 million earnings increase from $208.6 million currently.

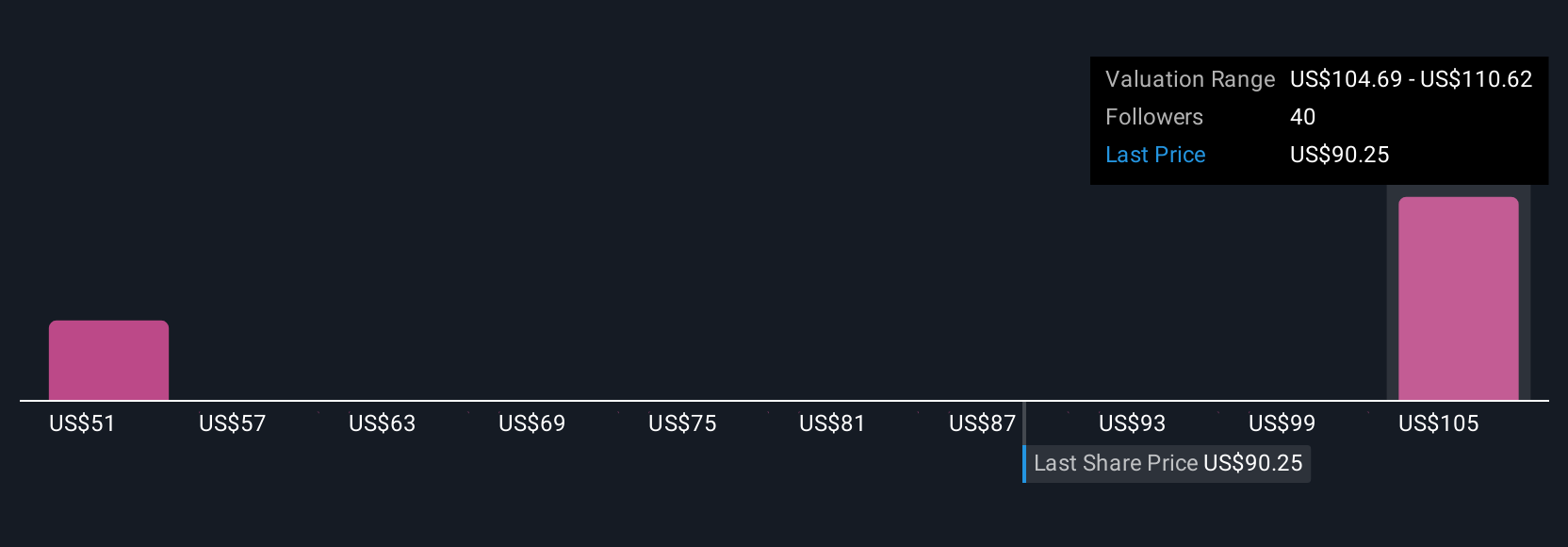

Uncover how Shift4 Payments' forecasts yield a $111.91 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Shift4 Payments range widely from US$50.59 to US$111.91 based on only 2 user submissions at Simply Wall St. With ongoing global expansion requiring careful integration, these diverging views highlight that your outlook on execution risk could dramatically shape your opinion on future performance.

Explore 2 other fair value estimates on Shift4 Payments - why the stock might be worth as much as 29% more than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com