Buyback and Upbeat Guidance Might Change The Case For Investing In Energizer Holdings (ENR)

- Earlier this month, Energizer Holdings announced the completion of a share buyback totaling 3,993,183 shares for US$89.67 million, alongside the release of third-quarter results showing significant year-over-year improvements in sales and profitability.

- The company also raised its earnings guidance for 2025, highlighting anticipated net sales growth supported by contributions from the recently acquired APS NV business.

- With robust earnings growth and an upward revision to guidance, we'll explore what these developments mean for Energizer's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Energizer Holdings' Investment Narrative?

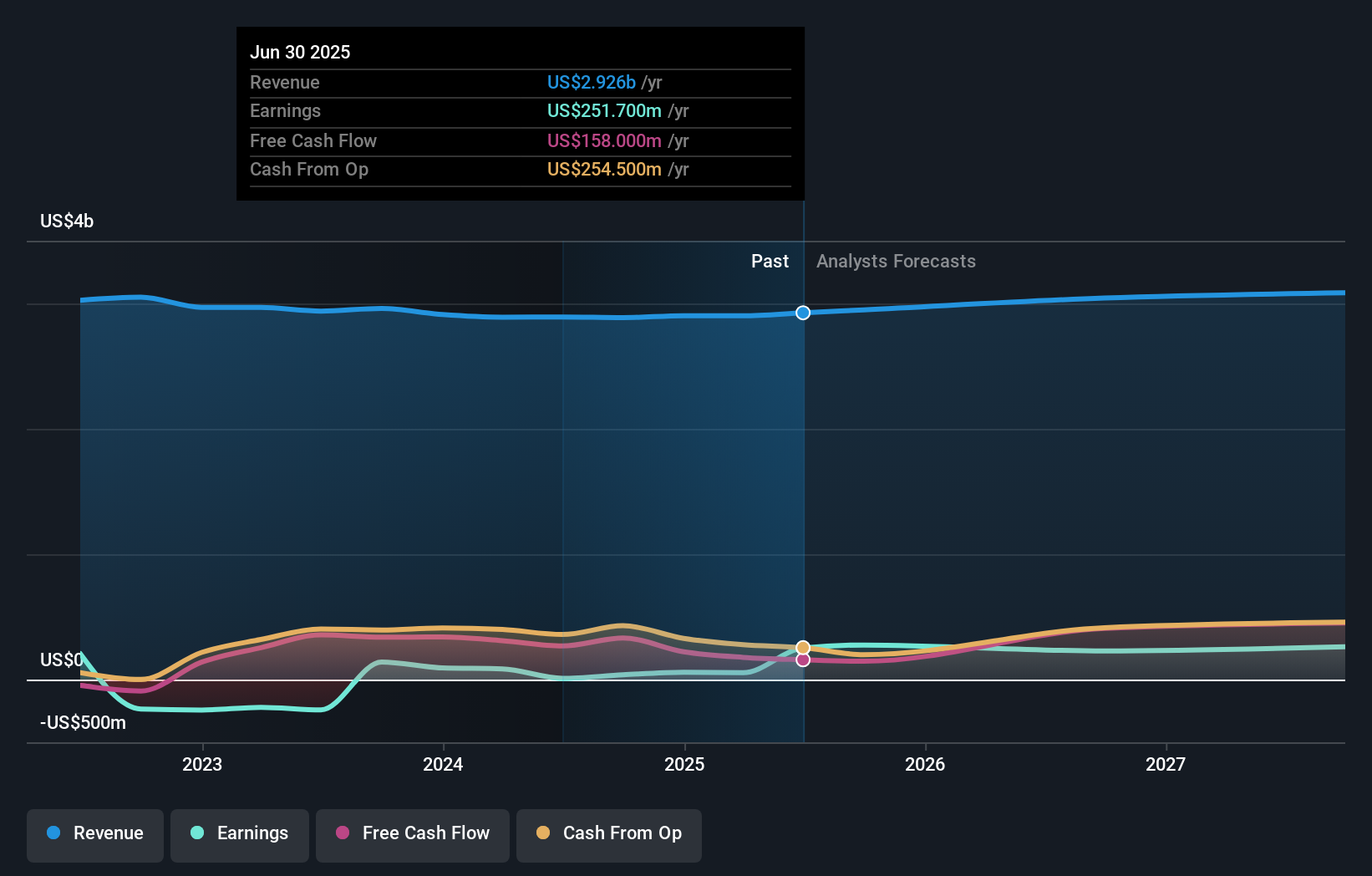

To be comfortable owning Energizer Holdings, you have to see value in a company delivering steady, though modest, growth amid a competitive household products market. Recent news has been a confidence boost: a nearly US$90 million share buyback, strong third-quarter results, and an earnings guidance upgrade for 2025 with extra revenue support from the APS NV acquisition. These moves may shift the short-term catalysts, since operational momentum and disciplined capital allocation can sway sentiment, especially after a difficult stretch. Yet, increased optimism should be balanced against enduring risks: annual revenue and earnings growth forecasts still lag the broader market, debt remains elevated, and cash flow debt coverage is tight. The latest results indicate improvement, but how much of the turnaround is sustainable, and how leveraged financial gains are, remains an open question.

But one risk may not be obvious without a closer look at the debt situation. Despite retreating, Energizer Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Energizer Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Energizer Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Energizer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energizer Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com