Did Surging Q2 Results and a Share Buyback Just Shift Coeur Mining's (CDE) Investment Narrative?

- Coeur Mining announced its second quarter 2025 results, highlighting sales of US$480.65 million and net income of US$70.73 million, with strong increases in both gold and silver production figures compared to the same period last year.

- Alongside these results, the company reaffirmed its annual production guidance for both metals and completed a share buyback, signaling a focus on operational discipline and capital allocation.

- With Coeur delivering a sharp rise in production and profits, we'll assess how this operational momentum could impact its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Coeur Mining Investment Narrative Recap

Owning Coeur Mining stock means believing in management's ability to efficiently ramp up its expanding gold and silver production against a backdrop of evolving sector risks. While the latest quarterly results show significant jumps in both metals output and earnings, these operating gains do not fundamentally change the most immediate catalyst, continued operational execution at key projects, nor do they remove the biggest risk around permitting and exploration-driven reserve replacement.

Among recent announcements, the reaffirmed 2025 gold and silver production guidance stands out as most related to the recent news, showing that strong results have not led to higher targets. For investors, this reinforces that management sees current momentum as supporting rather than revising its production path, highlighting the importance of consistent delivery against stated operational goals.

Yet, beneath these strong figures lurks a different concern that investors should keep in mind: even with record production, challenges tied to ongoing exploration and regulatory approvals...

Read the full narrative on Coeur Mining (it's free!)

Coeur Mining's outlook anticipates $2.1 billion in revenue and $672.8 million in earnings by 2028. This scenario relies on a 12.4% annual revenue growth rate and a $482.1 million increase in earnings from the current $190.7 million.

Uncover how Coeur Mining's forecasts yield a $12.69 fair value, a 9% upside to its current price.

Exploring Other Perspectives

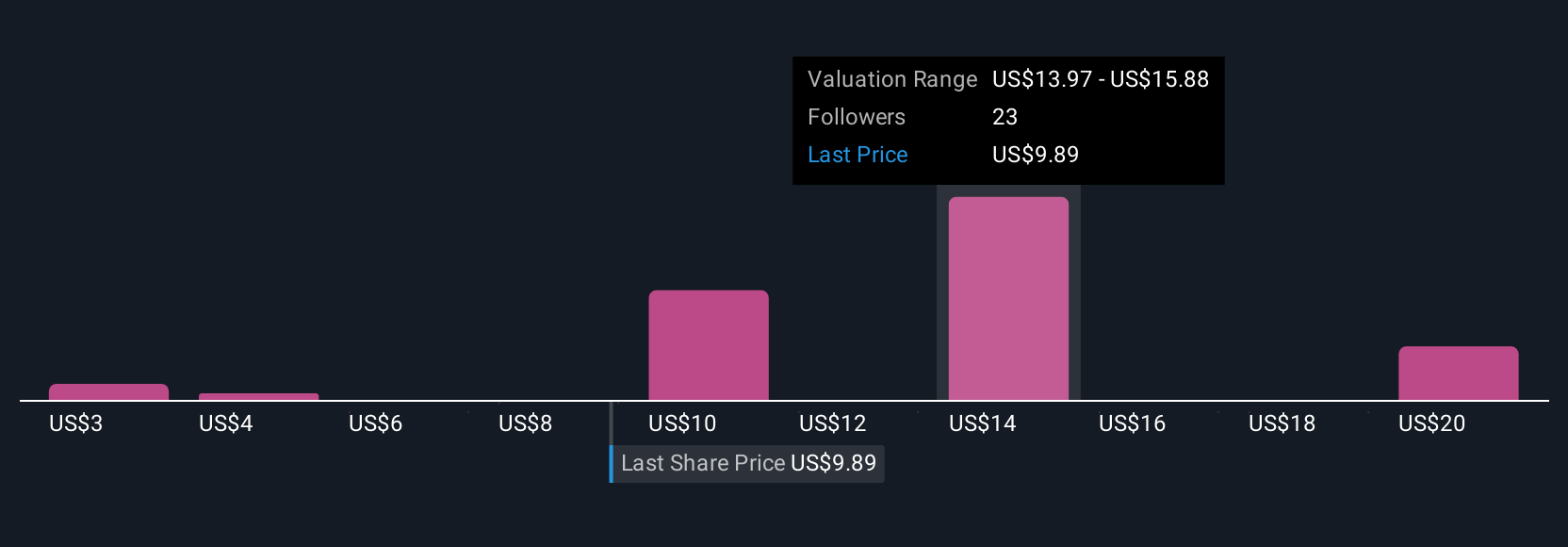

Simply Wall St Community members have published 9 fair value estimates for Coeur Mining that stretch from US$2.52 up to US$22.54 per share. These viewpoints capture a broad mix of optimism and caution, echoing the importance of continued reserve expansion as a critical driver of future results.

Explore 9 other fair value estimates on Coeur Mining - why the stock might be worth as much as 93% more than the current price!

Build Your Own Coeur Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coeur Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coeur Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coeur Mining's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com