Will CNA Financial’s (CNA) New Leadership Deepen Segment Expertise or Complicate Its Strategic Focus?

- In August 2025, CNA Financial Corporation announced a series of leadership appointments, placing David Haas as President Global Specialty, Michael Nardiello as President Global Property & Casualty, and Song Kim as President Global Commercial Industry Segments, expanding their responsibilities across financial lines, property, casualty, healthcare, and construction.

- This shift underscores CNA Financial’s commitment to enhancing underwriting capabilities and supporting business segment specialization through experienced internal talent.

- We’ll examine how CNA's leadership appointments to bolster underwriting strength may influence the company’s future operational and growth outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CNA Financial Investment Narrative Recap

To be a shareholder in CNA Financial, you need to believe in the company’s ability to deliver disciplined underwriting and specialty insurance growth while adapting to shifting risks. The latest executive appointments, expanding internal leaders’ roles across core business lines, support CNA’s push to reinforce underwriting capabilities; however, these personnel changes do not materially affect the key short-term catalyst, the continuation of premium growth and rate momentum, or the biggest risk, volatility from catastrophe losses and rising loss ratios.

Of all recent company developments, the launch of Cardinal E&S in June stands out as directly complementing the new leadership structure. This business expansion aims to solidify CNA’s specialty presence at a time when operational and segment specialization, now overseen by newly appointed executives, is an important catalyst for supporting revenue and margin growth potential.

However, it’s important to consider that even experienced leadership is not immune to the risks of elevated catastrophe losses and the impact they could have on underwriting...

Read the full narrative on CNA Financial (it's free!)

CNA Financial's narrative projects $17.1 billion revenue and $1.7 billion earnings by 2028. This requires 6.2% yearly revenue growth and a $741 million earnings increase from $959 million today.

Uncover how CNA Financial's forecasts yield a $48.37 fair value, in line with its current price.

Exploring Other Perspectives

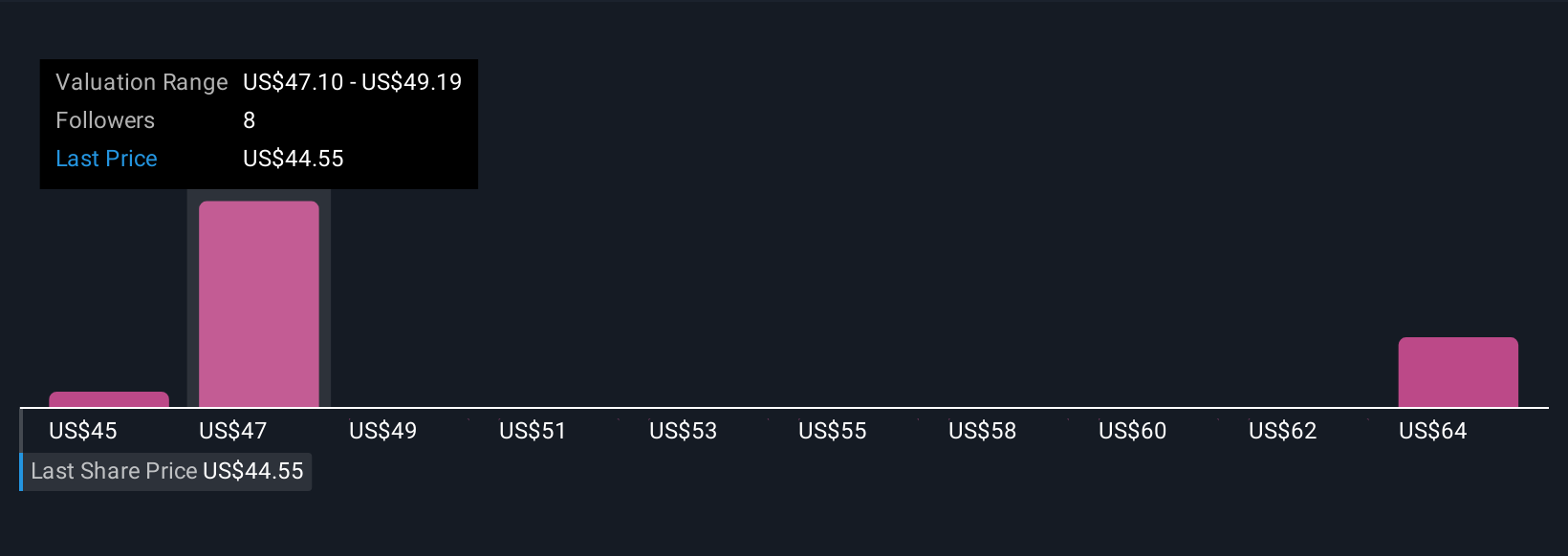

Simply Wall St Community members share three fair value estimates ranging from US$45.00 to US$65.97, revealing wide uncertainty around CNA’s worth. Many focus on the impact of underwriting performance on results, highlighting the importance of assessing both upside and downside for the stock.

Explore 3 other fair value estimates on CNA Financial - why the stock might be worth as much as 35% more than the current price!

Build Your Own CNA Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CNA Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNA Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com