Globe Life (GL): Assessing Valuation After Q2 Earnings Beat and Major Share Buybacks

Globe Life (GL) just posted second-quarter results that surprised to the upside, mainly thanks to a jump in Life and Health insurance premiums and a lift in underwriting income. Even though investment income came in a bit light and expenses ran higher, the positive impacts more than offset the negatives this time around. Also catching investors’ attention, Globe Life bought back nearly $226 million worth of stock over the quarter, a move that often signals confidence from management and can give shares a push.

This latest earnings beat fits into a year that has already been strong for Globe Life. The stock has gained 39% over the past year, with momentum especially increasing in the past three months. There has been growing speculation that the company’s steady revenue and net income growth, along with these significant share repurchases, may reflect strength in the business that is now appearing in its price chart.

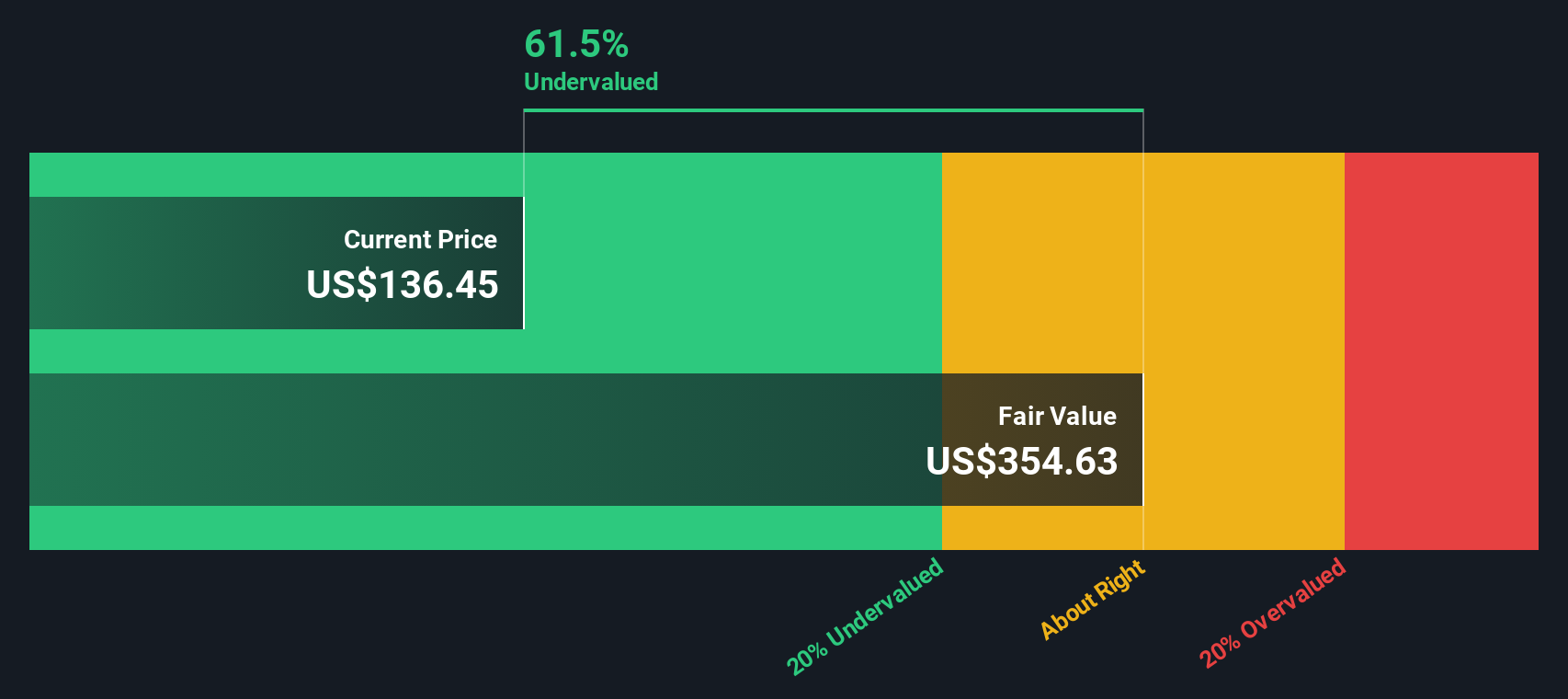

With the share price surging and management clearly signaling optimism, some investors may be asking whether Globe Life is still trading at an attractive value or if the market has already reflected the company’s next stage of growth in the current price.

Most Popular Narrative: 11.8% Undervalued

According to community narrative, Globe Life is currently seen as significantly undervalued, with its fair value estimate sitting well above the present trading price. Analysts believe the market is not fully appreciating the company’s future earnings potential and strategic shifts.

Recent investments in digital underwriting automation and higher conversion rates in the Direct to Consumer channel are expected to reverse declining trends. These initiatives could enable Globe Life to boost policy sales, increase marketing efficiency, and drive revenue growth across both direct and agency channels.

Ready for a deeper dive? The narrative behind this fair value reveals a bold vision involving growing profits, margin upgrades, and a valuation multiple that challenges the current market view. Want to know what ambitious assumptions are fueling analyst optimism? Their forecasts may surprise you. Learn how these projections could reshape Globe Life’s investment case.

Result: Fair Value of $160.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Globe Life’s growth story could be threatened by increased regulatory scrutiny or by continued reliance on traditional agent sales in a changing market landscape.

Find out about the key risks to this Globe Life narrative.Another View: SWS DCF Model

Taking a step back, our DCF model offers a different lens. By focusing on underlying cash flows instead of earnings multiples, this approach also suggests Globe Life is trading below its intrinsic value. Could both signals be pointing to something important, or is the market missing a crucial risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Globe Life Narrative

If you have a different perspective or want to see how your analysis compares, you can put together your own version in just a few minutes, or simply do it your way.

A great starting point for your Globe Life research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Ways to Grow Your Wealth?

The market is always changing, and it's important to keep adapting. Stay ahead by exploring unique strategies that go beyond the most obvious choices. If you want to capture tomorrow’s biggest opportunities, consider these powerful approaches. Missing out now could mean overlooking potential gains.

- Unlock reliable income streams by scanning for dividend stocks with yields > 3%. This introduces companies offering robust yields that can help strengthen your portfolio’s cash flow.

- Dive into innovation by tracking AI penny stocks and identifying AI-driven businesses poised to transform entire industries before they become widely recognized.

- Tap into niche technology trends by exploring quantum computing stocks. This reveals stocks at the forefront of quantum breakthroughs with the potential for significant growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com