Why Extreme Networks (EXTR) Is Up 5.9% After Surging Demand for Cloud and AI Networking Solutions

- In recent days, the networking sector has seen increased attention amid expectations for heightened demand driven by cloud computing, AI applications, 5G expansion, and the upcoming Wi-Fi 7 upgrade cycle, with key providers such as Cisco Systems, Extreme Networks, and RADCOM ramping up new product initiatives and global expansion strategies.

- An important takeaway is that industry-wide optimism is being influenced by the accelerated adoption of advanced networking technologies, even as macroeconomic headwinds and supply-chain complexities remain ongoing concerns for suppliers.

- We'll examine how enthusiasm for cloud and AI-driven networking is shaping Extreme Networks' future outlook and investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Extreme Networks Investment Narrative Recap

To be a shareholder in Extreme Networks, you need confidence in the sustained adoption of cloud, AI-driven networking, Wi-Fi 7, and 5G, which are believed to drive industry growth. The recent news reinforces these secular trends, but it does not appear to change the company’s most important short-term catalyst: demand for AI-powered, cloud-managed solutions; nor does it materially shift the biggest near-term risk, which remains customer concentration in public sector contracts where revenue may be lumpy.

The launch of Extreme Platform ONE™, which integrates AI directly into the networking experience, stands out as a company effort that aligns closely with rising demand highlighted by industry news. This AI-enabled suite could help Extreme capture infrastructure refresh cycles linked to Wi-Fi 7 and cloud adoption, supporting growth in subscription revenues and recurring business.

However, investors should keep in mind that despite the sector’s momentum, customer concentration in large government, education, and public sector contracts means that...

Read the full narrative on Extreme Networks (it's free!)

Extreme Networks is projected to achieve $1.3 billion in revenue and $18.1 million in earnings by 2028. This would require a 5.8% annual revenue growth rate and represents a $25.6 million increase in earnings from the current level of -$7.5 million.

Uncover how Extreme Networks' forecasts yield a $23.83 fair value, a 13% upside to its current price.

Exploring Other Perspectives

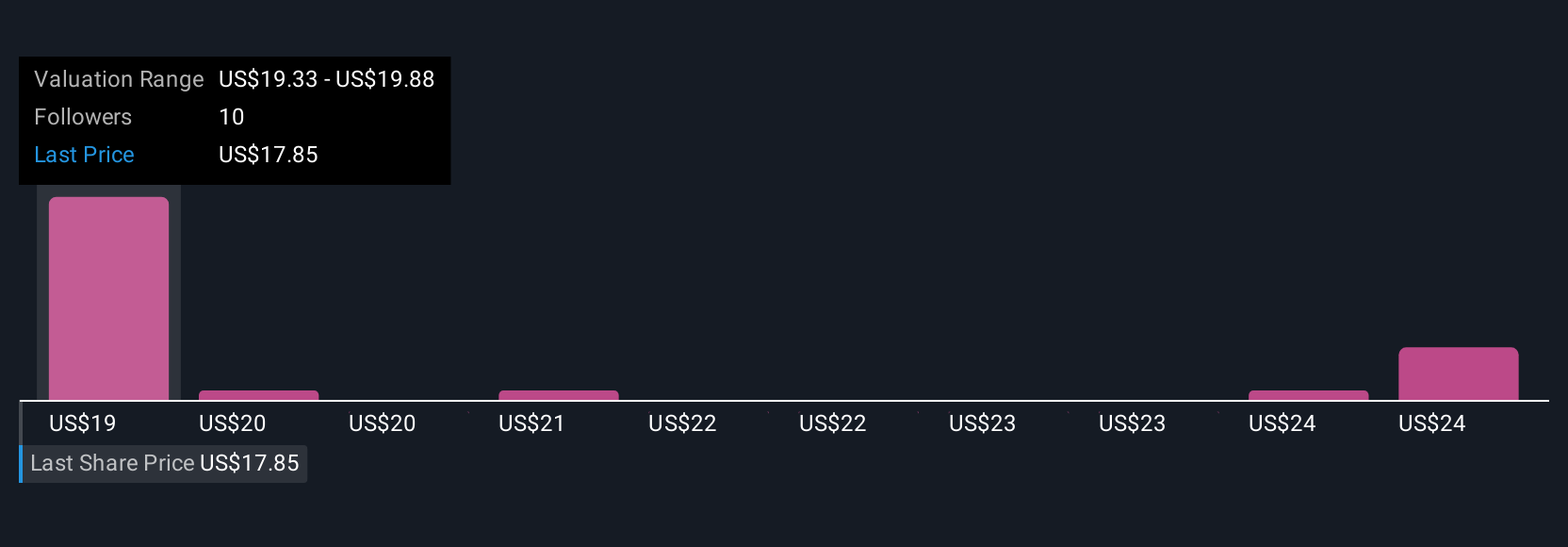

Six members of the Simply Wall St Community estimate fair values spanning US$17.17 to US$28.01. Opinions are mixed, mirroring industry optimism for cloud and AI networking but also reflecting risk if Extreme Networks’ contract wins prove difficult to repeat.

Explore 6 other fair value estimates on Extreme Networks - why the stock might be worth 19% less than the current price!

Build Your Own Extreme Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Extreme Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Extreme Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Extreme Networks' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com