Walgreens Boots Alliance (WBA): Assessing Valuation Following Voluntary SEC Deregistration Announcement

Walgreens Boots Alliance (WBA) has taken a bold step by announcing the voluntary deregistration of its common stock through a Form 15 filing with the SEC. This move signals a significant transition in the company’s public market presence and sets the stage for shifting investor perceptions. Decisions like these rarely go unnoticed, and if you are holding or following WBA, it is natural to wonder how this will affect the stock’s story from this point forward.

The market has been in flux around Walgreens Boots Alliance this year. While shares have added an impressive 32% year to date, long-term investors know the climb has been challenging, with declines in the past three and five years. Momentum has recently picked up, supported by positive annual net income growth and a modest increase in revenue. However, this abrupt regulatory change shifts attention away from operational progress and toward uncertainty about future access, liquidity, and valuation benchmarks.

Is this regulatory reset a chance to buy WBA at a significant discount, or is the market already reflecting lower expectations for future growth and public market participation?

Most Popular Narrative: Fairly Valued

The prevailing analyst narrative judges Walgreens Boots Alliance as fairly valued, with the consensus price target sitting almost exactly at the current share price and a discount rate grounded in sector expectations.

Walgreens Boots Alliance is optimizing its store footprint by closing underperforming locations. This is expected to lead to a healthier and more profitable store network, positively impacting net margins and reducing costs over time.

Can store closures and leaner operations really transform Walgreens Boots Alliance’s future profitability? The narrative examines which operational optimizations and quantitative ambitions are believed to support fair value. There is one key variable that could make all the difference for earnings and margins. What is it?

Result: Fair Value of $11.93 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent retail headwinds and litigation costs could undermine Walgreens Boots Alliance’s turnaround. These factors may continue to put pressure on margins and challenge the fair value thesis.

Find out about the key risks to this Walgreens Boots Alliance narrative.Another View: What Does Our DCF Model Say?

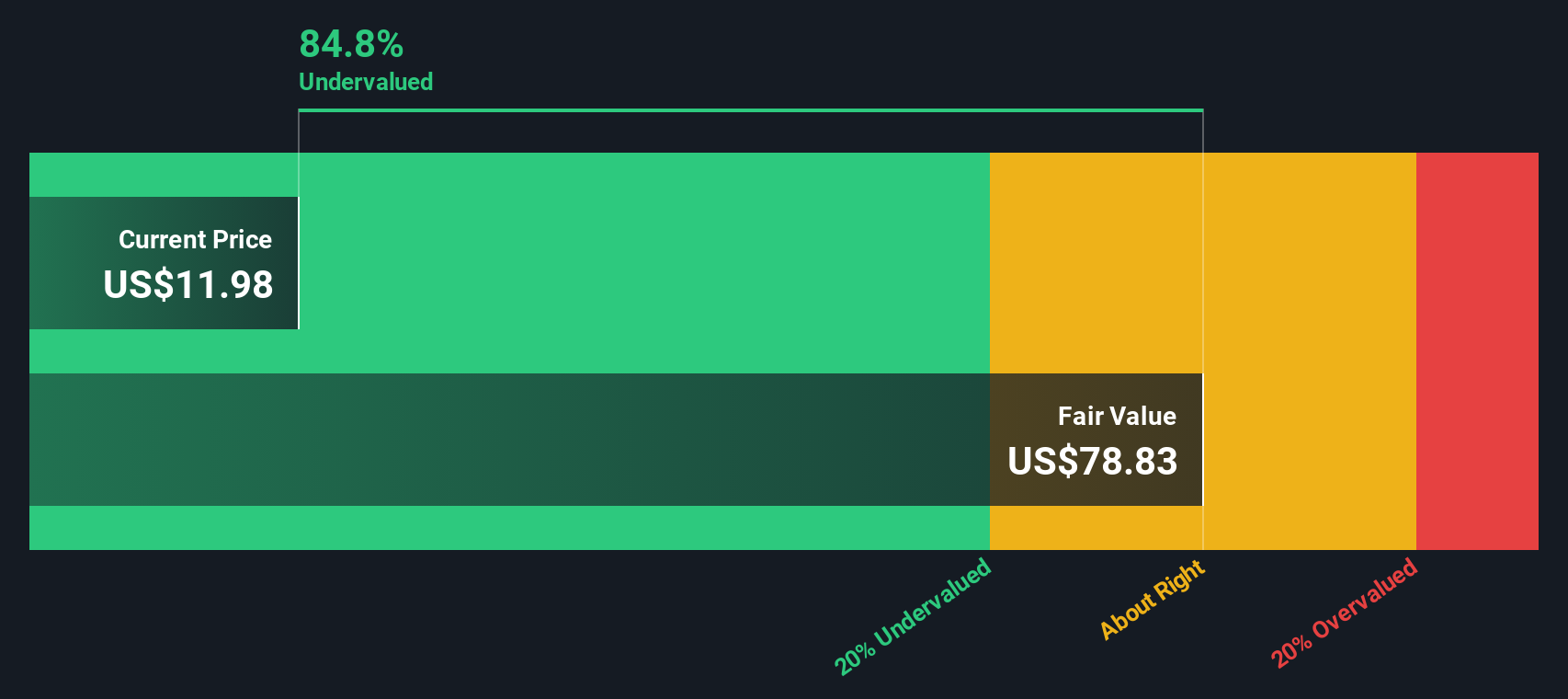

While analysts see the share price as about fair based on earnings projections, our DCF model takes a long-term view of cash flows and arrives at a very different result, signaling undervaluation. Which approach better reflects reality for Walgreens Boots Alliance?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Walgreens Boots Alliance Narrative

If you see things differently or want to dig into the numbers yourself, you can easily put together your own analysis in just a few minutes. Do it your way

A great starting point for your Walgreens Boots Alliance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

If you want your portfolio to stay ahead in today's dynamic market, now is the time to look beyond the obvious and seize compelling stocks using our top screeners. Don’t risk missing out on sector leaders and undervalued gems. Start exploring smarter options today.

- Uncover powerful value plays by targeting companies trading well below their intrinsic worth using our undervalued stocks based on cash flows for fresh opportunities others might overlook.

- Spot the next AI disruptor and shape your future returns by tapping into the potential of AI penny stocks leading the digital intelligence revolution.

- Supercharge your passive income stream by locking in robust yields from companies featured in our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com