Commvault (CVLT): Assessing Valuation After $785 Million Convertible Note Offering Expands Capital Base

If you have been watching Commvault Systems (CVLT) lately, the company has made a bold move that could catch the attention of anyone looking for their next stock play. The recent completion of a $785 million zero-coupon senior unsecured convertible note offering stands out not just for its size, but for its structure. The notes are callable, convertible, and do not carry the burden of coupon interest. The involvement of several co-lead underwriters also amplifies the importance of this capital raise, as it potentially sets the stage for strategic moves ahead or signals confidence in Commvault’s future path.

Following this headline event, Commvault’s shares have slid 3.9% over the past month. This pullback comes after a strong run in the past year, with the stock up 19%. Looking even further out, long-term performance is eye-catching, with three- and five-year returns of 239% and 330% respectively. While short-term trading sentiment may appear shaky, some investors could see the recent capital move as positioning for more growth or possibly as a shift in risk perception given changing market dynamics.

After all these developments, it’s only natural to wonder: is this a buying opportunity with more upside ahead, or is the current stock price already factoring in Commvault’s future ambitions?

Most Popular Narrative: 15% Undervalued

Commvault Systems is currently presented as undervalued by the prevailing analyst narrative. This view highlights significant upside potential based on projected earnings and industry trends.

Rapid expansion and successful cross-sell and upsell momentum within the SaaS (Metallic) platform, evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, all point to continued improvement in the quality and predictability of future revenues. These factors directly support margin expansion and higher earnings visibility.

Interested in what is driving this optimistic outlook? The consensus narrative describes a dramatic transformation in Commvault’s revenue mix and profitability and points to bold, optimistic financial forecasts that are unusual for a traditional data protection provider. What are the numbers behind that price? If you want to examine the key assumptions supporting this $208 valuation, keep reading for the details that could shape your next move.

Result: Fair Value of $208.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there remain real risks, including Commvault’s reliance on existing customers for growth and the possibility of margin pressure from recent acquisitions.

Find out about the key risks to this Commvault Systems narrative.Another View: The Market’s Multiple Tells a Different Story

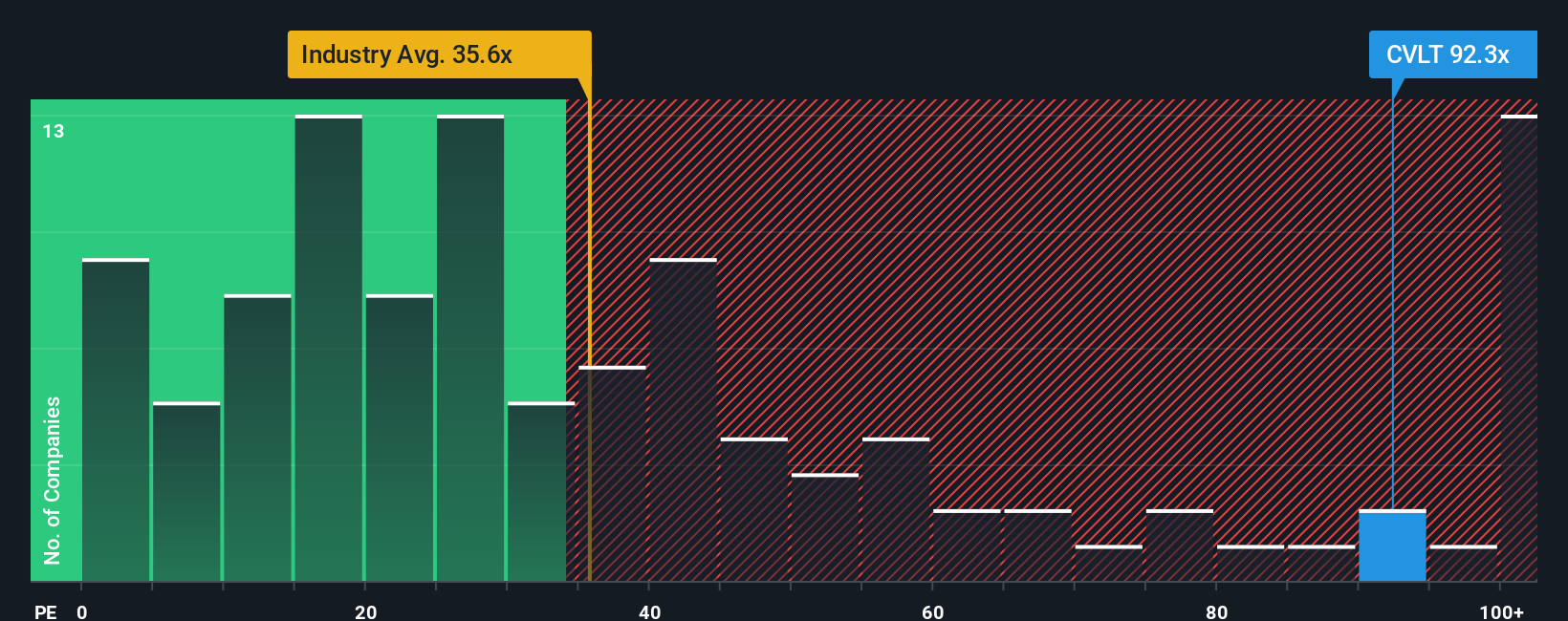

While analysts see upside potential based on future growth and SaaS momentum, the company looks expensive using its current earnings ratio compared to the software sector. Could the market be overestimating future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you see things differently or want to dig into the data yourself, you can put together your own perspective in just a few minutes. Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take control of your investment journey with tailored ideas you won’t want to miss. Find the next opportunity before everyone else does by using these handpicked screeners.

- Uncover under-the-radar companies with solid financial health and growth potential when you scan for penny stocks with strong financials that check all the right boxes.

- Supercharge your portfolio by exploring the fast moving landscape of AI penny stocks powering tomorrow’s breakthroughs in artificial intelligence.

- Capture value ahead of the crowd by targeting undervalued stocks based on cash flows and spotting stocks that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com