Is Insider Selling and Elevated Valuation Shaping the Investment Case for Chefs' Warehouse (CHEF)?

- Over the past year, several insiders at The Chefs' Warehouse, Inc., including Founder Christopher Pappas, sold shares worth a combined US$9.8 million, with no insider purchases taking place during this period.

- This insider selling coincides with the company trading at a price-to-earnings ratio well above the industry average, raising questions about executive sentiment and stock valuation.

- We’ll explore how insider sales and valuation concerns could influence Chefs' Warehouse’s outlook within its existing investment narrative.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Chefs' Warehouse Investment Narrative Recap

To be a shareholder in Chefs' Warehouse, you need conviction in the company’s ability to expand premium foodservice distribution, capture share in urban markets, and drive profitability improvements amid highly competitive conditions. While recent insider selling, coinciding with a relatively high price-to-earnings ratio, has drawn attention, these actions do not appear to materially alter the company’s current catalysts or the key risk of prolonged cost inflation impacting margins in the near term.

Among recent announcements, the updated 2025 earnings guidance is most relevant, showing management’s expectation for sales between US$4 billion and US$4.06 billion and gross profit of up to US$979 million. This outlook reinforces the central investment case centered on margin expansion and market penetration, maintaining the importance of efficiency gains and cost management for future performance.

By contrast, investors should be aware that even as management projects continued growth, ongoing structural cost inflation could challenge...

Read the full narrative on Chefs' Warehouse (it's free!)

Chefs' Warehouse's narrative projects $4.9 billion in revenue and $121.9 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $52.3 million increase in earnings from the current $69.6 million.

Uncover how Chefs' Warehouse's forecasts yield a $76.62 fair value, a 17% upside to its current price.

Exploring Other Perspectives

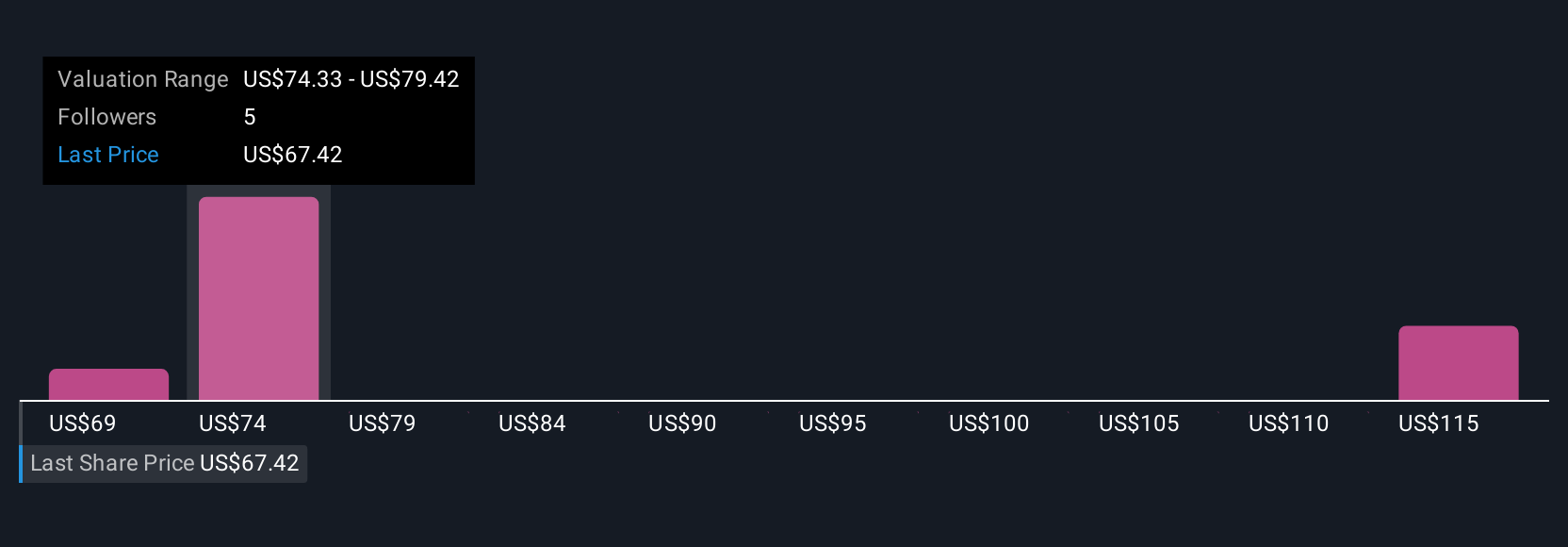

Simply Wall St Community members contributed five fair value estimates for Chefs' Warehouse, ranging widely from US$38.55 to US$112.02 per share. With executive share sales and high short-term earnings expectations in play, you can review how differing outlooks may shape sentiment on margin sustainability and valuation risk.

Explore 5 other fair value estimates on Chefs' Warehouse - why the stock might be worth as much as 71% more than the current price!

Build Your Own Chefs' Warehouse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chefs' Warehouse research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chefs' Warehouse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chefs' Warehouse's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com