A Look at GitLab's (GTLB) Valuation Following Strong Revenue Growth and CFO Departure

GitLab (GTLB) Shakes Things Up With Earnings Jump and CFO Exit

If you’re tracking GitLab (GTLB), this week’s news probably stopped you in your tracks. The company just released its second-quarter results, highlighting impressive revenue growth but also revealing a drop in profitability compared to last year. As investors digested those numbers, GitLab added another twist: CFO Brian Robins is stepping down, with interim leaders quickly named to steer the financial ship. Whether you’re a long-time shareholder or just looking for entry points, these developments are sure to prompt some reassessment of what comes next for GitLab.

The market has picked up on the mix of strong top-line growth and changes in the C-suite. GitLab’s share price is up over 19% in the past three months, recovering from a year marked by some decline and flat momentum overall. The company’s latest guidance points to further revenue gains, even as it faces continued net losses and undergoes a major financial leadership change. The short-term buzz may spark optimism, but the big question is how these moving parts fit into the stock’s long-term picture.

With shares rebounding but profitability and leadership still in flux, will these events present a rare opportunity for investors, or has the market already accounted for GitLab’s growth story?

Most Popular Narrative: 18.6% Undervalued

According to the most widely followed narrative, GitLab shares are trading at a notable discount to their estimated fair value. This points to potential upside if growth and margin expectations are realized. The current consensus draws on strong platform enhancements, strategic partnerships, and assumptions around future profit margins to support an optimistic view of GitLab’s longer-term trajectory.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools. This could accelerate revenue growth and expand margins as high-value features command premium pricing and upsell opportunities.

Curious about why analysts are calling GitLab nearly 20% undervalued right now? Their assessment hinges on aggressive revenue targets and bold profit margin moves, usually seen only in top-tier tech. Wondering which assumptions are doing the heavy lifting in this calculation? One key projection links margin improvement to a significant re-rating in future earnings. Could this be within reach? Uncover the formulas, forecasts, and financial leaps fueling this eye-catching valuation when you explore the complete narrative.

Result: Fair Value of $61.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and a slower pace of winning new customers could easily challenge this optimistic outlook. This reminds investors that risks remain active below the surface.

Find out about the key risks to this GitLab narrative.Another View: The Multiples Story

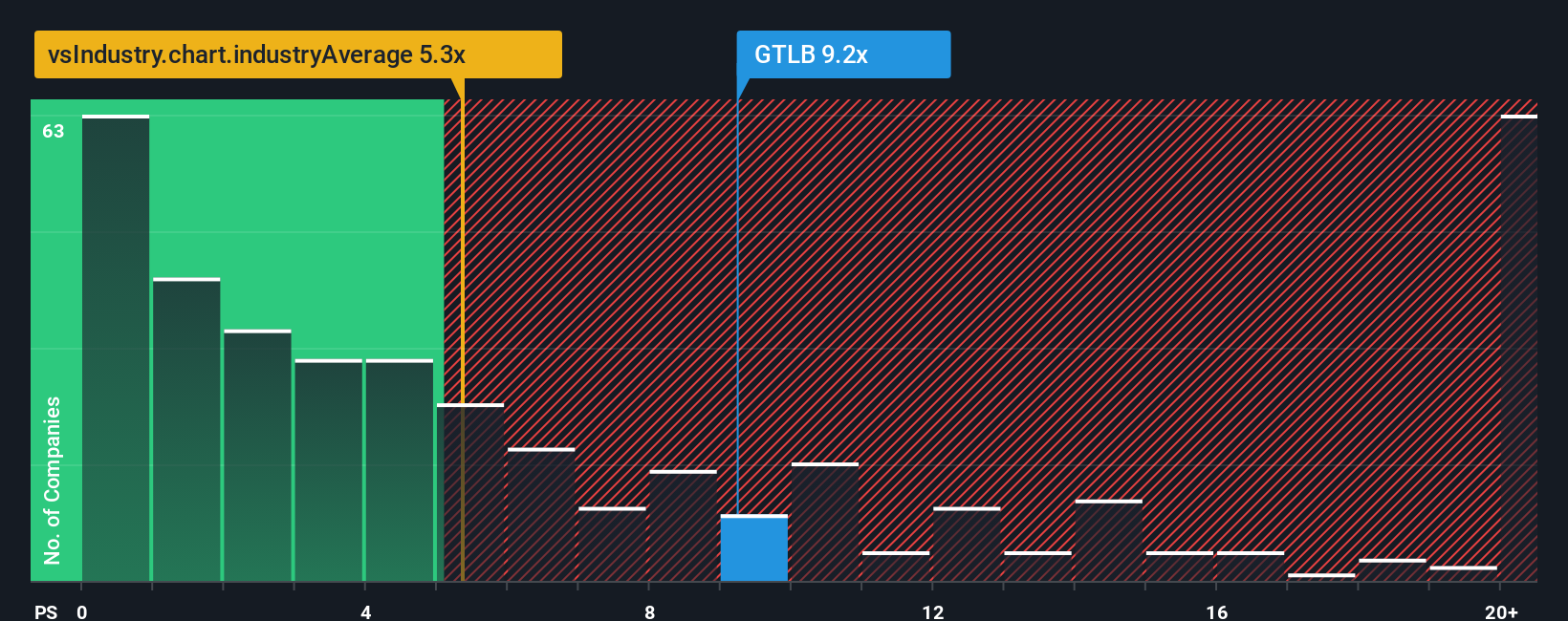

While the prevailing narrative praises GitLab for being undervalued, another approach looks at the company’s price-to-sales ratio compared with the wider industry. This view signals caution, with a valuation that appears much less generous than the optimistic fair value estimate. Could the market be warning us about lingering profit challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If you want to follow your own logic or simply see the data firsthand, you can put together your own perspective in just a few minutes. Do it your way.

A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors know it pays to keep their radar wide. Don’t limit yourself; seize the chance to spot breakthrough potential, steady earnings, or tomorrow’s trends now, before others catch on.

- Uncover up-and-coming companies with financial muscle by checking out penny stocks with strong financials, your shortcut to potential hidden gems before they’re on everyone’s radar.

- Secure attractive and reliable returns by seeing which rock-solid businesses are delivering dividend stocks with yields > 3% to reward investors like you.

- Catch the technological wave early and see which trailblazers are transforming healthcare through artificial intelligence via our healthcare AI stocks selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com