Replimune (REPL): Assessing Valuation After FDA Setback and Legal Challenges to RP1 Approval

Replimune Group (REPL) is front and center for biotech investors this week after announcing its recent Type A meeting with the FDA concluded without a defined path forward for the accelerated approval of its RP1 drug. This meeting, meant to address regulatory pushback laid out in a complete response letter, has instead left the company and investors waiting for clarity on the next steps. The situation has quickly drawn legal scrutiny as well, with several securities class action lawsuits alleging Replimune misrepresented the prospects of the IGNYTE trial for RP1 in advanced melanoma.

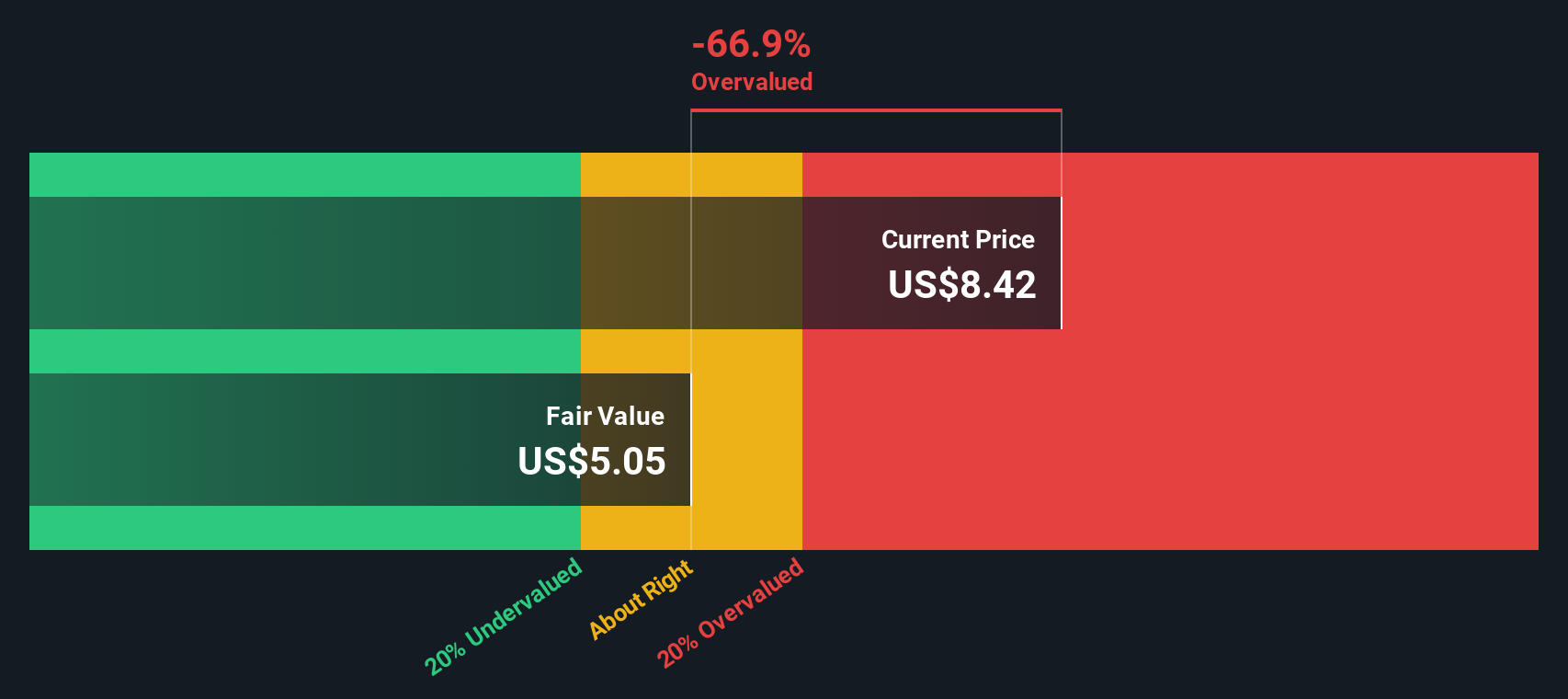

The uncertainty from this regulatory roadblock and fresh legal headwinds have coincided with a dramatic decline in Replimune’s share price. After a steep drop over the past year, shares have lost over 70% of their value, with short-term momentum showing little sign of reversal. Recent developments in both the regulatory process and the courtroom have pulled the spotlight away from what were once promising clinical results and left the market rethinking risk and reward for the stock.

So, after such a sharp slide and a rapidly shifting narrative, is Replimune now a case of undervaluation driven by fear, or are these setbacks a signal that future growth is already priced out?

Price-to-Book of 0.7x: Is it justified?

Replimune currently trades at a price-to-book (P/B) ratio of 0.7x, which is significantly lower than both the peer average (4.4x) and the US Biotechs industry average (2.2x). This suggests that, on this metric alone, the company appears undervalued compared to its sector peers.

The price-to-book ratio compares a company’s market value to its net asset value. This measure is particularly relevant for biotechnology firms like Replimune that may not yet be profitable. A low P/B can indicate undervaluation, or it could reflect market concerns over long-term prospects and near-term challenges.

While the low multiple suggests the stock is trading cheaply, it is important to remember that sustained losses and uncertain profitability could be factors causing the discount. Investors seem to be pricing in considerable risk relative to the company’s assets rather than assigning value for future growth potential at this stage.

Result: Fair Value of $4.67 (UNDERVALUED)

See our latest analysis for Replimune Group.However, ongoing regulatory delays and unresolved legal issues could further dampen investor sentiment and postpone any potential recovery in Replimune’s valuation.

Find out about the key risks to this Replimune Group narrative.Another View: What Does the DCF Model Say?

While the stock looks attractive based on its low price-to-book ratio, an updated look from our DCF model tells a different story. With insufficient data for a full discounted cash flow analysis, valuation confidence remains unclear. Could the truth about Replimune's value still be hidden beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Replimune Group Narrative

Keep in mind, if you have a different perspective or want to examine the data yourself, you can assemble your own analysis in just a few minutes. Do it your way.

A great starting point for your Replimune Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you’re eager to make your next smart move, don’t get stuck on just one opportunity. The right stock idea could be waiting for you now.

- Capture the potential of small but mighty companies shaking up the market with penny stocks with strong financials.

- Unlock high-yield opportunities and steady income streams by checking out the latest dividend stocks with yields > 3%.

- Stay ahead of the curve with companies fueling the artificial intelligence revolution through the AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com