Suburban Propane Partners (SPH): How the Latest Valuation Stacks Up After a Persistent Drift

Most Popular Narrative: 7% Overvalued

According to the most-followed valuation narrative, Suburban Propane Partners is currently trading at a 7% premium to its estimated fair value. This assessment incorporates a comprehensive analysis of future earnings, revenues, and industry risks to measure where the stock stands compared to longer-term projections.

Expanding renewable natural gas (RNG) capacity through ongoing upgrades and new facilities in Columbus, Ohio and Upstate New York positions the company to access higher-growth, lower-carbon markets and capitalize on a shift in demand toward cleaner fuels. This is likely to support future revenue and margin growth once projects are operational.

Curious what numbers are driving this overvaluation? The narrative relies on bold predictions about margin growth, future earnings power, and how fast the company can tap into greener markets. Unpack the calculations and see which future scenarios could actually push the price higher or signal a tougher road ahead.

Result: Fair Value of $17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as unpredictable weather-driven demand and mounting cost inflation. These challenges could undermine earnings stability and squeeze future margins.

Find out about the key risks to this Suburban Propane Partners narrative.Another View: A Contrasting Valuation

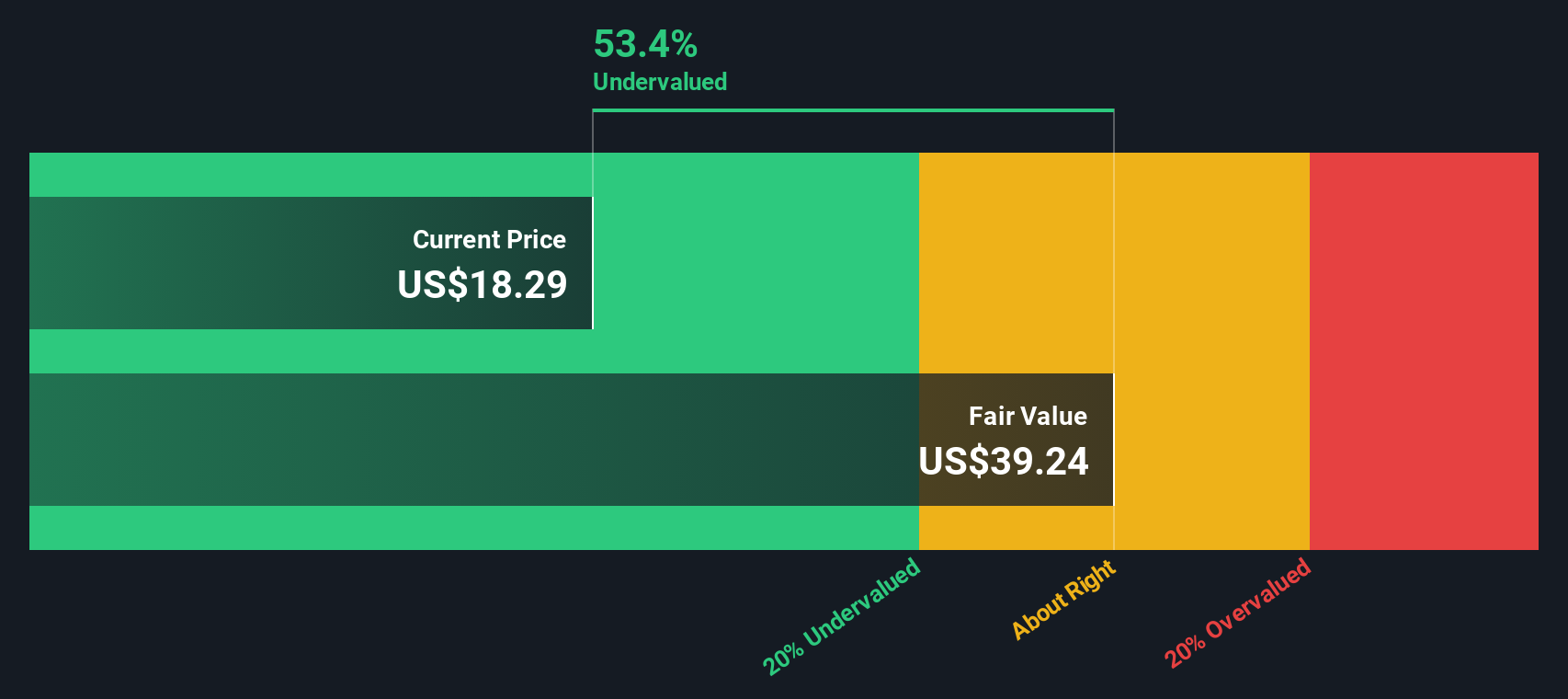

Looking at Suburban Propane Partners from a different angle, our DCF model argues the stock is actually undervalued rather than overvalued. It challenges the current market price and introduces a completely different perspective. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Suburban Propane Partners Narrative

If you see things differently or want to dig into the numbers on your own, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Suburban Propane Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest moves in today’s market might be outside your current watchlist. Tap into winning trends and spot unique opportunities before others catch on.

- Tap into global breakthroughs in medicine by screening top performers among healthcare AI stocks. Artificial intelligence is transforming patient care, drug discovery, and diagnostics.

- Unlock high-yield potential and steady returns by checking out dividend stocks with yields > 3%. This selection features standout companies delivering income plus resilience for your portfolio.

- Catch the next surge in digital finance with our focus on cryptocurrency and blockchain stocks. Connect with innovators in cryptocurrency, blockchain solutions, and secure payment technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com