Does Walgreens Boots Alliance's (WBA) SEC Deregistration Plan Signal a Shift in Investor Engagement?

- Earlier this month, Walgreens Boots Alliance announced it had filed a Form 15 with the SEC to voluntarily deregister its Common Stock, affecting its compliance with the Securities Exchange Act of 1934.

- This voluntary deregistration is an unusual step for a major public company and could have significant consequences for its trading status and how investors engage with the stock.

- We'll now explore how the voluntary deregistration announcement could influence Walgreens Boots Alliance's investment narrative and future outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Walgreens Boots Alliance Investment Narrative Recap

To be a Walgreens Boots Alliance shareholder, you need to believe in the company’s ability to execute its healthcare-focused transformation and store optimization strategy, despite ongoing retail headwinds and regulatory challenges. The recent voluntary SEC deregistration announcement follows the conclusion of the Sycamore Partners acquisition and delisting process, so this move does not materially impact current catalysts or modify the biggest risk: lingering pressures on retail sales and profitability.

The most directly relevant announcement is the August 28 closure of Walgreens' merger with Sycamore Partners, which resulted in shareholders being paid out in cash and the company ceasing trading on the Nasdaq. This merger and the subsequent deregistration mark a significant chapter in the investment story, potentially reducing public market volatility around short-term catalysts like portfolio restructuring and margin improvement, but it largely formalizes steps already underway.

However, investors should not overlook the ongoing risk to profitability from front-end retail weakness and margin pressures, especially as...

Read the full narrative on Walgreens Boots Alliance (it's free!)

Walgreens Boots Alliance is projected to reach $158.5 billion in revenue and $396.2 million in earnings by 2028. This outlook assumes a 0.8% annual revenue decline and a $6.7 billion improvement in earnings from the current loss of $-6.3 billion.

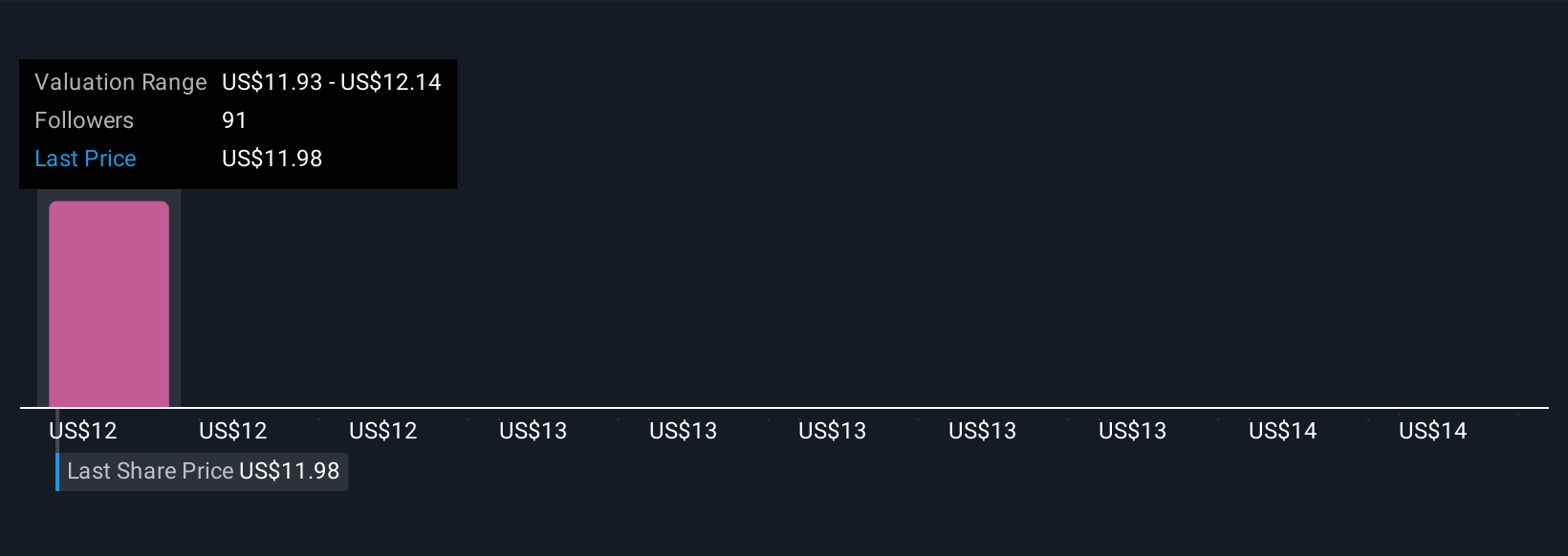

Uncover how Walgreens Boots Alliance's forecasts yield a $11.93 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced 7 fair value estimates for Walgreens Boots Alliance, ranging from US$11.93 to US$78.83 per share. Despite this wide spectrum, front-end retail business weakness and cost pressures remain key themes that could influence future performance, so consider several views before making decisions.

Explore 7 other fair value estimates on Walgreens Boots Alliance - why the stock might be worth just $11.93!

Build Your Own Walgreens Boots Alliance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walgreens Boots Alliance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walgreens Boots Alliance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walgreens Boots Alliance's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com