Can Lotus (LOT) Balance Heritage Branding and Innovation Amid Slowing Deliveries?

- Lotus Technology Inc. recently showcased a major presence at IAA Mobility 2025 in Munich, unveiling its Theory 1 concept car for its German debut, honoring Ayrton Senna with the 1987 Lotus 99T F1 car, and introducing the Emira Limited edition inspired by the race car.

- An interesting aspect of the announcement is the emphasis on advanced technology and heritage branding, despite the company experiencing a 49% year-on-year decline in vehicle deliveries for the fiscal second quarter of 2025.

- Next, we will examine how Lotus's prominent IAA Mobility debut and integration of innovative features like LOTUSWEAR impact its investment case.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Lotus Technology Investment Narrative Recap

Owning Lotus Technology stock requires confidence that the company’s emphasis on electrification, innovative features, and heritage marketing can translate into a rebound in vehicle demand and long-term revenue growth. The latest showcase at IAA Mobility, including the debut of the Theory 1 concept car, brings visibility to Lotus’s technology vision, but does not materially address the immediate challenge of declining deliveries, which remains the key near-term catalyst as well as the main risk.

The most relevant announcement to the IAA event is the unveiling of LOTUSWEAR, the real-time interactive system featured in Theory 1. While this underscores Lotus's focus on premium tech integration, the potential for such innovations to reignite sales momentum will likely depend on whether these features meet consumer expectations and drive greater market adoption.

However, despite these innovation efforts, investors should not overlook ongoing risks such as...

Read the full narrative on Lotus Technology (it's free!)

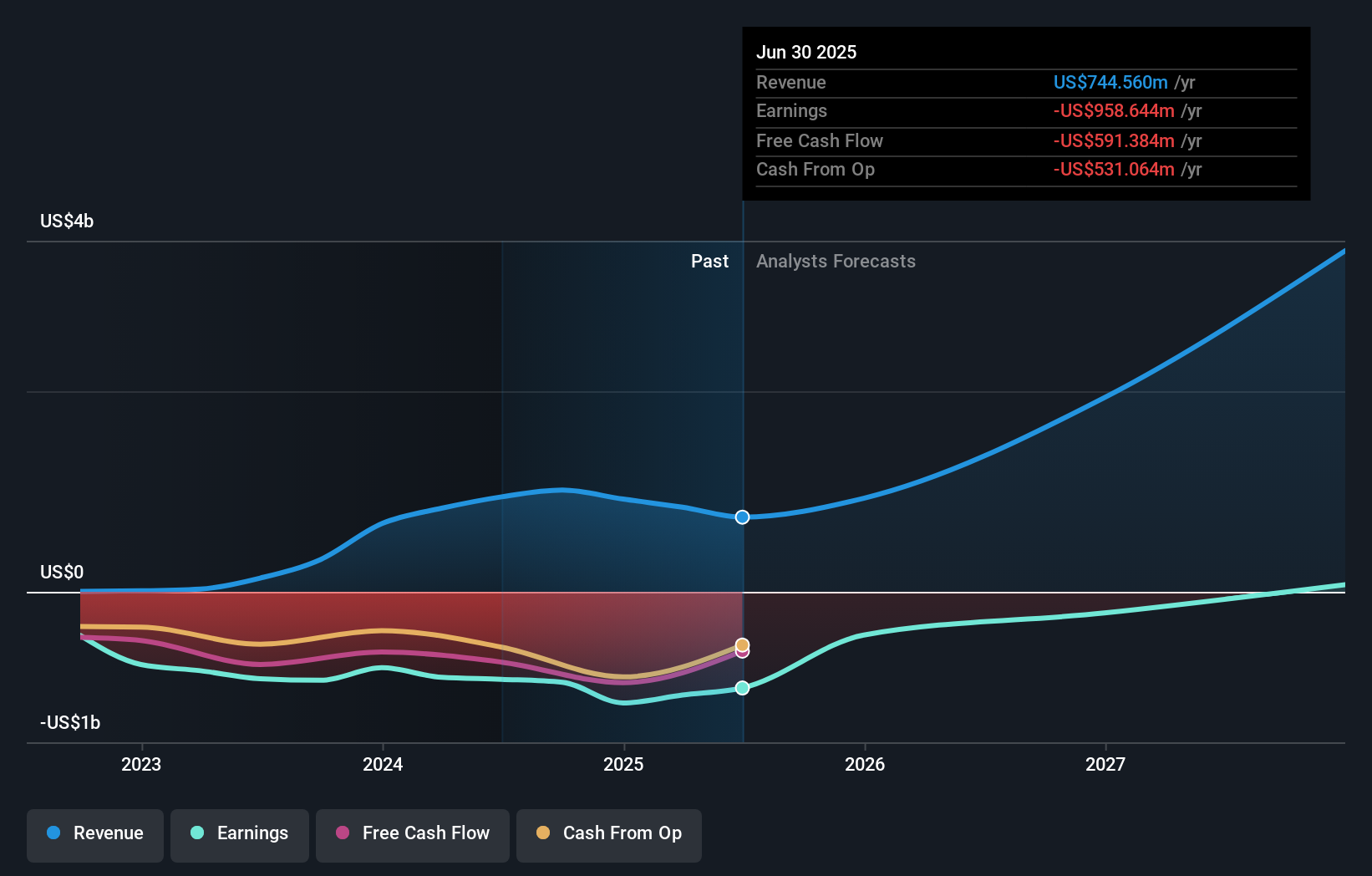

Lotus Technology's narrative projects $4.0 billion revenue and $56.5 million earnings by 2028. This requires 74.9% yearly revenue growth and a $1,015.1 million increase in earnings from -$958.6 million today.

Uncover how Lotus Technology's forecasts yield a $3.00 fair value, a 42% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community fair value estimates cluster at US$3 for Lotus Technology, with just one contributor so far. This consensus contrasts with the company’s ongoing challenge of sharply reduced vehicle deliveries, prompting the need to consider a full range of investor viewpoints on future performance.

Explore another fair value estimate on Lotus Technology - why the stock might be worth just $3.00!

Build Your Own Lotus Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lotus Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lotus Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com