Can Teladoc (TDOC) Offset Regulatory Uncertainty With Diversification Into Insurance-Based Mental Health?

- Recent news has highlighted Teladoc Health’s slow revenue growth, declining average revenue per user, and persistent uncertainty about demand, coinciding with Congressional deliberations over the extension of Medicare coverage for at-home telehealth services.

- In response to regulatory risk, Teladoc launched Wellbound, a new employee assistance program, to expand its insurance-based mental health offerings and diversify its revenue streams.

- To understand how looming regulatory decisions may shape Teladoc’s business prospects, we’ll examine the impact of these developments on its investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Teladoc Health Investment Narrative Recap

To invest in Teladoc Health, you need to believe in the long-term adoption of virtual care and the company's ability to transition its business model to insurance-based services, despite ongoing margin pressure and competitive threats. The latest headlines reinforce how short-term uncertainty around Medicare coverage remains the key catalyst, while regulatory risk and declining revenue per user stand out as the most significant near-term challenges. At this stage, neither the catalyst nor the risk has been decisively impacted by the recent news, but both remain top of mind.

Among Teladoc’s recent announcements, the launch of Wellbound, an employee assistance program focused on insurance-based mental health services, directly relates to current market headwinds. This move addresses softening consumer sentiment and the shifting industry preference for covered care, though it does not resolve competitive or regulatory uncertainties facing the company's broader prospects.

In contrast, investors should be aware that the shift toward lower-margin insurance revenue introduces ongoing earnings pressure and...

Read the full narrative on Teladoc Health (it's free!)

Teladoc Health's narrative projects $2.7 billion revenue and $235.6 million earnings by 2028. This requires 1.9% yearly revenue growth and a $443 million increase in earnings from the current -$207.4 million.

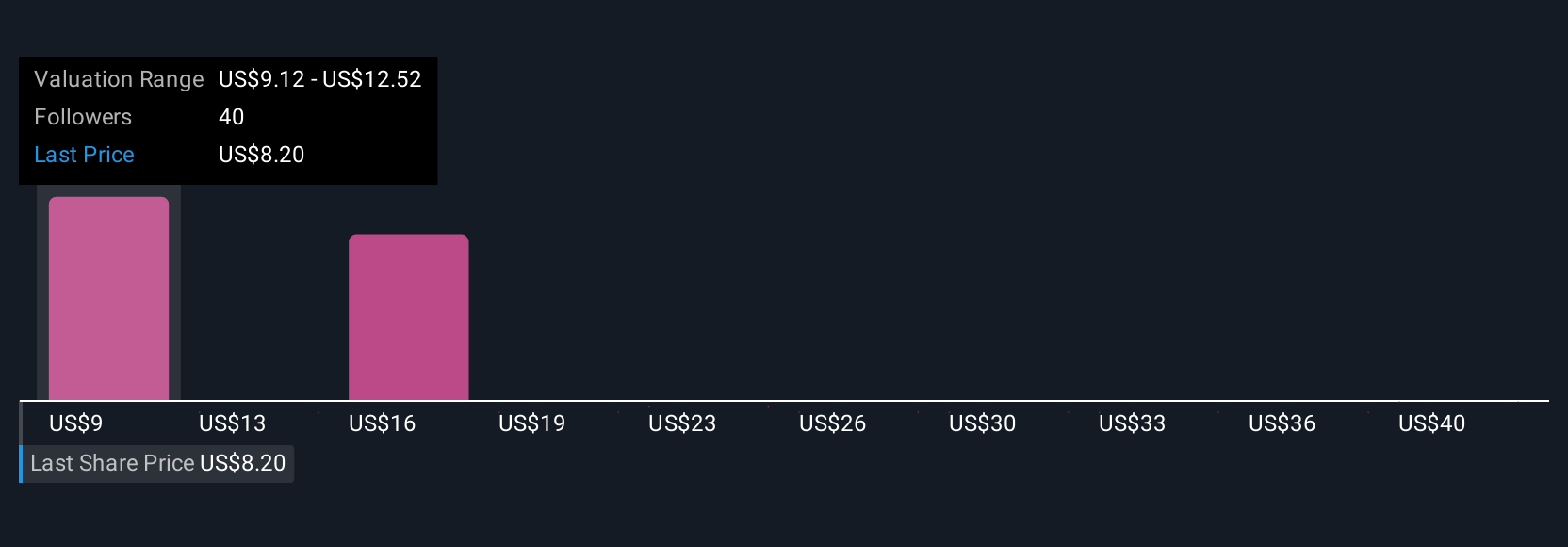

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely, from US$9.13 to US$42.04 per share. While participant opinions differ, the company’s move away from higher-margin cash pay toward insurance-based revenue is expected to keep profitability under pressure, raising broader questions about the earnings outlook.

Explore 5 other fair value estimates on Teladoc Health - why the stock might be worth over 4x more than the current price!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com