Is Teladoc's (TDOC) Slowing Revenue Growth Revealing a Deeper Shift in Consumer Health Demand?

- In late September 2025, Teladoc Health faced renewed investor caution as reports highlighted ongoing slow revenue growth, declining average revenue per user, and flat sales forecasts.

- An important insight is that these company-specific trends coincided with a broader decrease in U.S. consumer confidence, raising questions about demand for discretionary and consumer-driven health services like those offered by Teladoc.

- We'll now explore how Teladoc's muted revenue growth and falling revenue per user affect its investment narrative and long-term prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Teladoc Health Investment Narrative Recap

To have conviction in Teladoc Health as a shareholder, you need to believe the company can reignite growth and scale its mix of virtual care, mental health and chronic care offerings despite muted revenue momentum and negative earnings. The latest reports of slow sales expansion and declining average revenue per user sharpen focus on demand risk, but given Teladoc’s stable quarterly guidance and lack of material downward revisions, the near-term catalysts and biggest risks remain largely unchanged for now.

Among recent announcements, the July 2025 launch of Teladoc’s new employee assistance program “Wellbound” stands out, as it directly connects to the goal of deepening client engagement and diversifying revenue sources in a time of weakened consumer sentiment. How quickly initiatives like Wellbound contribute to reversing flat revenue trends could influence whether Teladoc can restore a stronger investment narrative.

By contrast, one ongoing challenge investors should be aware of is the persistent headwind facing Teladoc's core BetterHelp segment, where a shift toward lower-margin insurance business and high churn...

Read the full narrative on Teladoc Health (it's free!)

Teladoc Health's narrative projects $2.7 billion in revenue and $235.6 million in earnings by 2028. This requires 1.9% yearly revenue growth and a $443 million increase in earnings from -$207.4 million today.

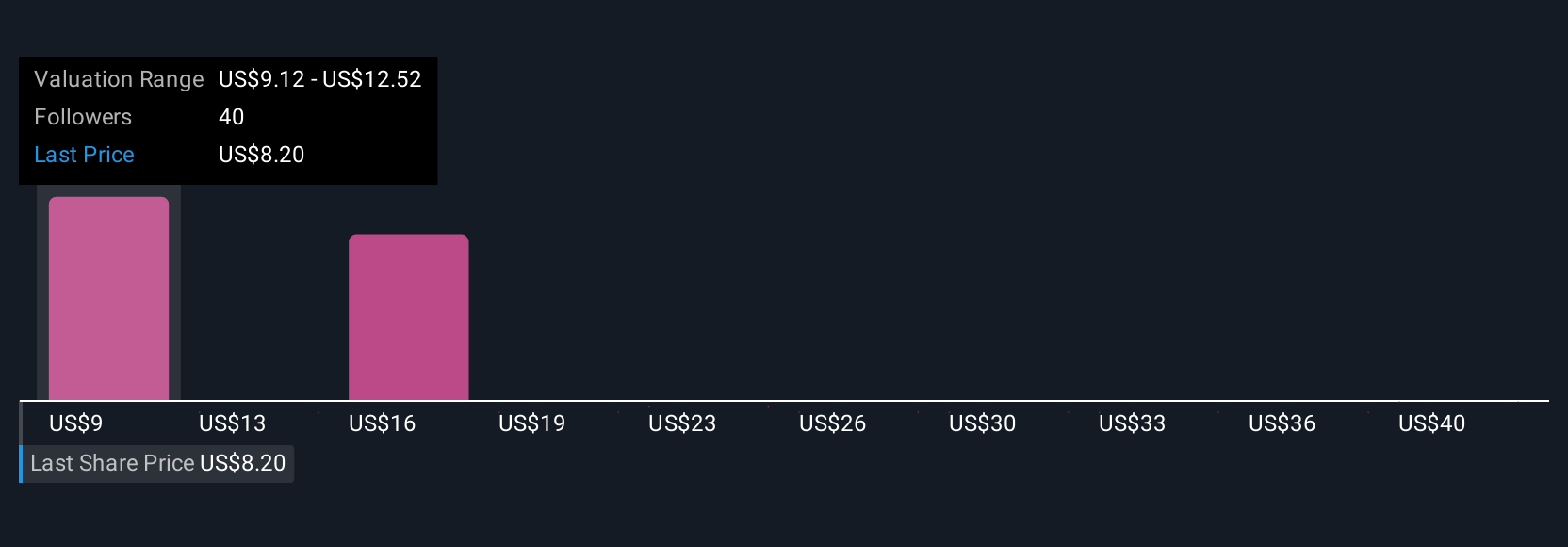

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Teladoc’s fair value between US$9.13 and US$42.04 across five different estimates. While this variety highlights differing outlooks, the current risk of declining average revenue per user may weigh on future recovery, making it important to consider several viewpoints before making any conclusions.

Explore 5 other fair value estimates on Teladoc Health - why the stock might be worth over 4x more than the current price!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com