Polaris (PII): Evaluating Valuation as Revenue and Profitability Face Fresh Pressure from Sluggish Consumer Demand

Polaris (NYSE:PII) is facing headwinds as revenue and profitability continue to slip, partly driven by shifting consumer sentiment. Lower U.S. consumer confidence and macroeconomic uncertainty have increased the challenges for companies relying on discretionary spending.

See our latest analysis for Polaris.

Despite enthusiastic marketing efforts like the upcoming Camp RZR event, Polaris’s share price performance has been largely subdued. Short-term returns are barely in positive territory, and the one-year total shareholder return has slid nearly 0.2%. This muted momentum reflects investor caution amid sliding profitability and broader economic concerns.

If recent volatility has you curious about new opportunities, it could be the right moment to expand your search and discover fast growing stocks with high insider ownership

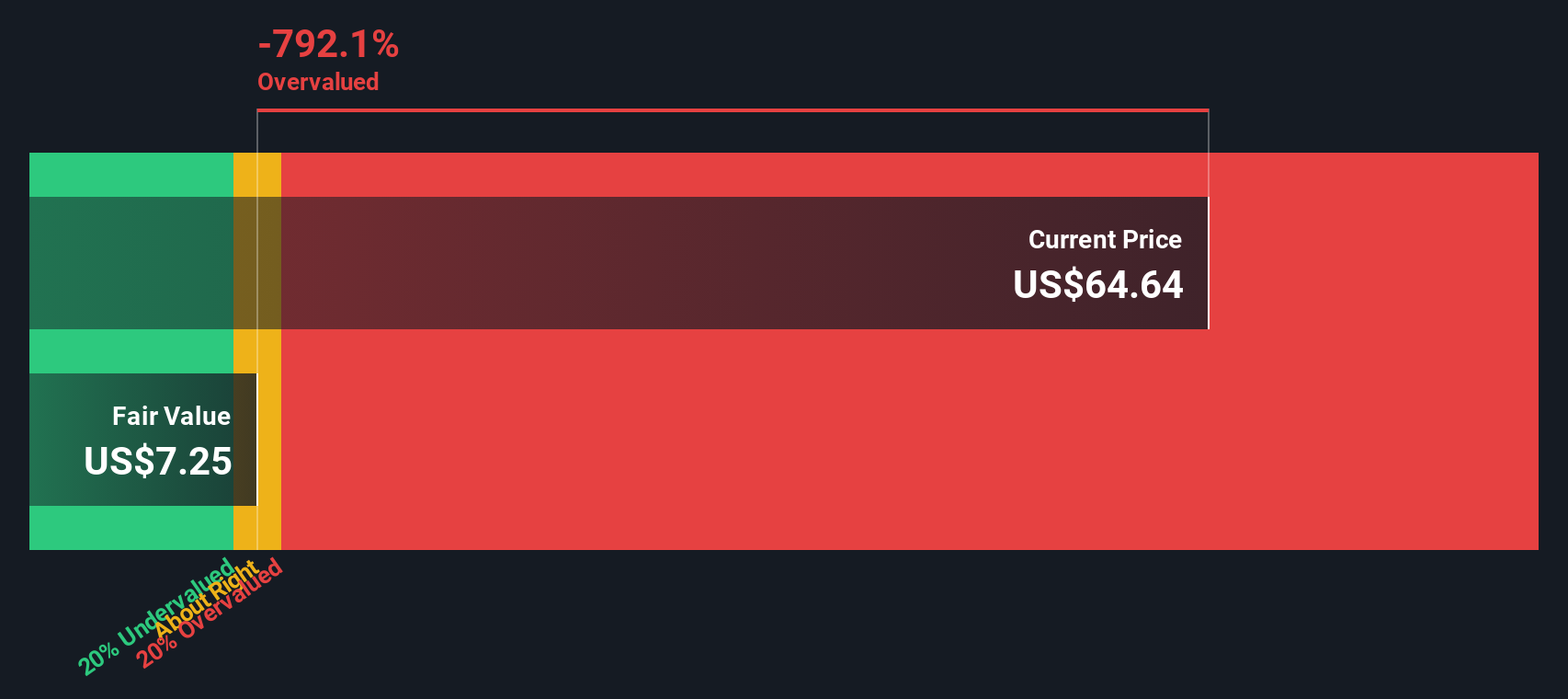

After a period of sliding revenue and profitability, investors are left to wonder: is Polaris finally trading at a bargain, or is the current stock price already reflecting the company's uphill battle to regain growth?

Most Popular Narrative: 20.5% Overvalued

Based on recent analyst projections, Polaris’s consensus fair value sits at $52.00, which is notably lower than its last closing price of $62.64. This gap between market optimism and analyst expectations sets the backdrop for a deeper dive into the story behind the numbers.

Polaris is focused on a strategic approach to mitigate the impact of tariffs through supply chain adjustments and cost control initiatives. These efforts could potentially preserve net margins and improve earnings over time.

Want to know what’s fueling this high analyst skepticism? The heart of this narrative is a bold bet on Polaris’s turnaround, involving ambitious margin recovery and a future profit profile that defies its recent losses. If you’re curious about the major financial assumptions driving this consensus, especially which forecasts have the most sway, read on to discover the real story behind the valuation.

Result: Fair Value of $52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around full-year guidance and the high forecasted tariff costs could still derail Polaris’s margin recovery and earnings outlook.

Find out about the key risks to this Polaris narrative.

Another View: What Does the SWS DCF Model Say?

Looking at our SWS DCF model, Polaris actually appears overvalued. The current share price of $62.64 is trading well above our DCF fair value estimate of $42.25. This method suggests the market may be pricing in a faster recovery or stronger margins than what the fundamentals support. Could investors be overlooking key risks, or is there untapped potential not captured in the forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Polaris Narrative

Prefer your own take on the numbers? It takes just a few minutes to craft a personalized view using our platform, so dive in and Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying ahead of the crowd. Don’t leave potential on the table. Take advantage of uniquely curated stock ideas that could fuel your next winning move.

- Pinpoint income opportunities and get a head start on market-beating yields by reviewing these 19 dividend stocks with yields > 3% yielding over 3%.

- Unlock the future of medicine by uncovering potential in these 31 healthcare AI stocks driving innovation in healthcare technology and artificial intelligence.

- Jump into technology’s hottest frontier with these 24 AI penny stocks shaping the next wave of digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com