Insteel Industries (IIIN): Earnings Jump 53.3%, Net Margins Reinforce Value Bull Narratives

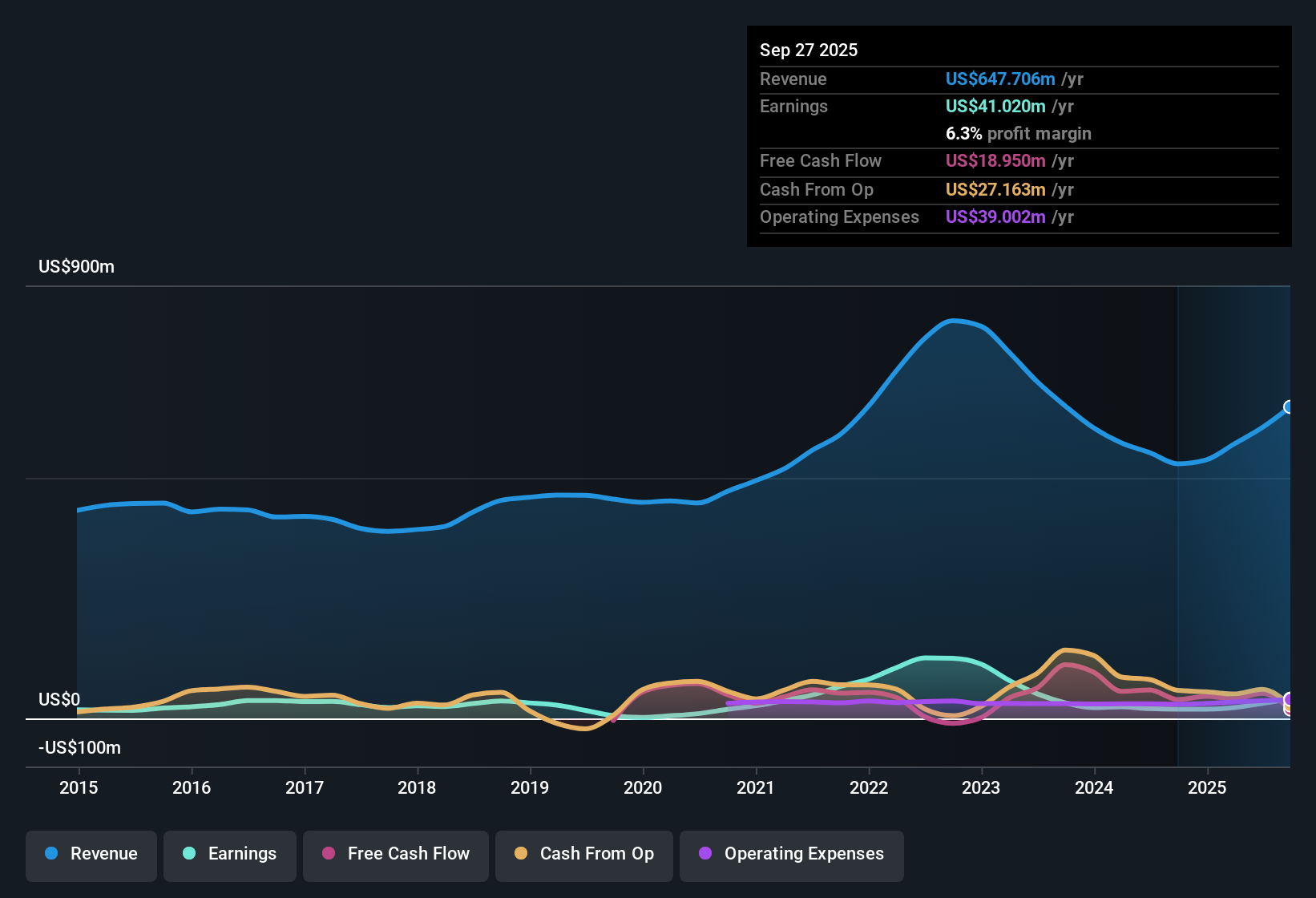

Insteel Industries (IIIN) delivered a 53.3% jump in earnings growth over the past year, reversing a long-term trend of 15.9% yearly declines. Net profit margins improved to 5.2% from last year’s 3.7%. The company’s PE ratio is now 18.9x, which is below both the US Building industry average of 21.8x and the peer average of 19.7x. Shares are trading at $30.32, below an estimated fair value of $35.71. Reported earnings remain high quality, putting the current balance of risks and rewards in focus for investors.

See our full analysis for Insteel Industries.Up next, we’re comparing these results with the market’s most widely-held narratives to see which storylines get confirmed and which ones might need an update.

See what the community is saying about Insteel Industries

Infrastructure Surge Fuels 11.5% Revenue Growth Outlook

- Analysts expect Insteel’s revenues to climb by 11.5% each year over the next three years, based on increased federal infrastructure spending and resilient construction demand.

- According to the consensus narrative, momentum in public works and data center projects is expected to drive shipment volumes up. This supports steady cash flows and improves the predictability of revenue and earnings.

- Planned facility modernization and recent acquisitions are positioned to boost operating margins and allow entry into higher-margin segments, highlighting optimism for long-term profitability.

- Ongoing investments in logistics and product expansion are expected to provide flexibility and competitiveness that underpin the revenue growth assumptions.

- Analysts’ consensus points to infrastructure wins giving management more options and profit levers than seen throughout the previous five years.

- They note that strong quoting activity and backlogs may help offset normal downturns in nonresidential construction, mitigating volatility even if some sectors soften.

- A conservative balance sheet and low debt add to the company’s ability to manage raw material ups and downs without eroding profitability.

See the deeper drivers behind analysts’ expectations in the full company consensus case. 📊 Read the full Insteel Industries Consensus Narrative.

Margin Recovery Faces Cost and Supply Threats

- While net profit margins have improved to 5.2%, supply constraints in domestic wire rod force Insteel to rely more on costly imports, which exposes gross margins to volatile input costs and unpredictable tariffs.

- Critics highlight several persistent risks that could limit gains, as described by the consensus narrative:

- Heavy dependence on U.S. nonresidential and infrastructure construction creates vulnerability if project spending stalls or material shortages worsen.

- Ongoing labor shortages and production inefficiencies, combined with possible changes to tariff policies, risk squeezing margins just as the company appears to be turning the corner on profitability.

Valuation Still a Standout Versus Peers

- Insteel’s PE ratio sits at 18.9x, which is lower than both the US Building industry average of 21.8x and direct peers at 19.7x. Shares currently trade at $30.32, a 15% discount to DCF fair value of $35.71 and below the consensus price target of $39.00.

- Consensus narrative notes that for the analyst price target to be justified, Insteel would need to reach $77.4 million in earnings by 2028 and trade at a PE of 12.1x. This implies investors are getting a better multiple now than both historical and projected industry norms.

- This suggests that investors may view the current market price as a favorable entry point, provided the company executes on planned growth and margin expansion.

- The modest gap between current price and analyst target signals that the market views the stock as fairly valued for now, absent major upside surprises or unforeseen risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Insteel Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? It takes just a few minutes to transform your outlook into a personal narrative, so make it yours now. Do it your way

A great starting point for your Insteel Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite improving margins, Insteel’s heavy reliance on nonresidential construction and exposure to unpredictable costs create persistent threats to its revenue stability.

If you want companies that ride out volatility with steady results, use our stable growth stocks screener (2097 results) to focus on stable performers growing earnings and sales year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com