Covenant Logistics (CVLG) One-Off $16.5M Loss Sparks Earnings Quality Reassessment

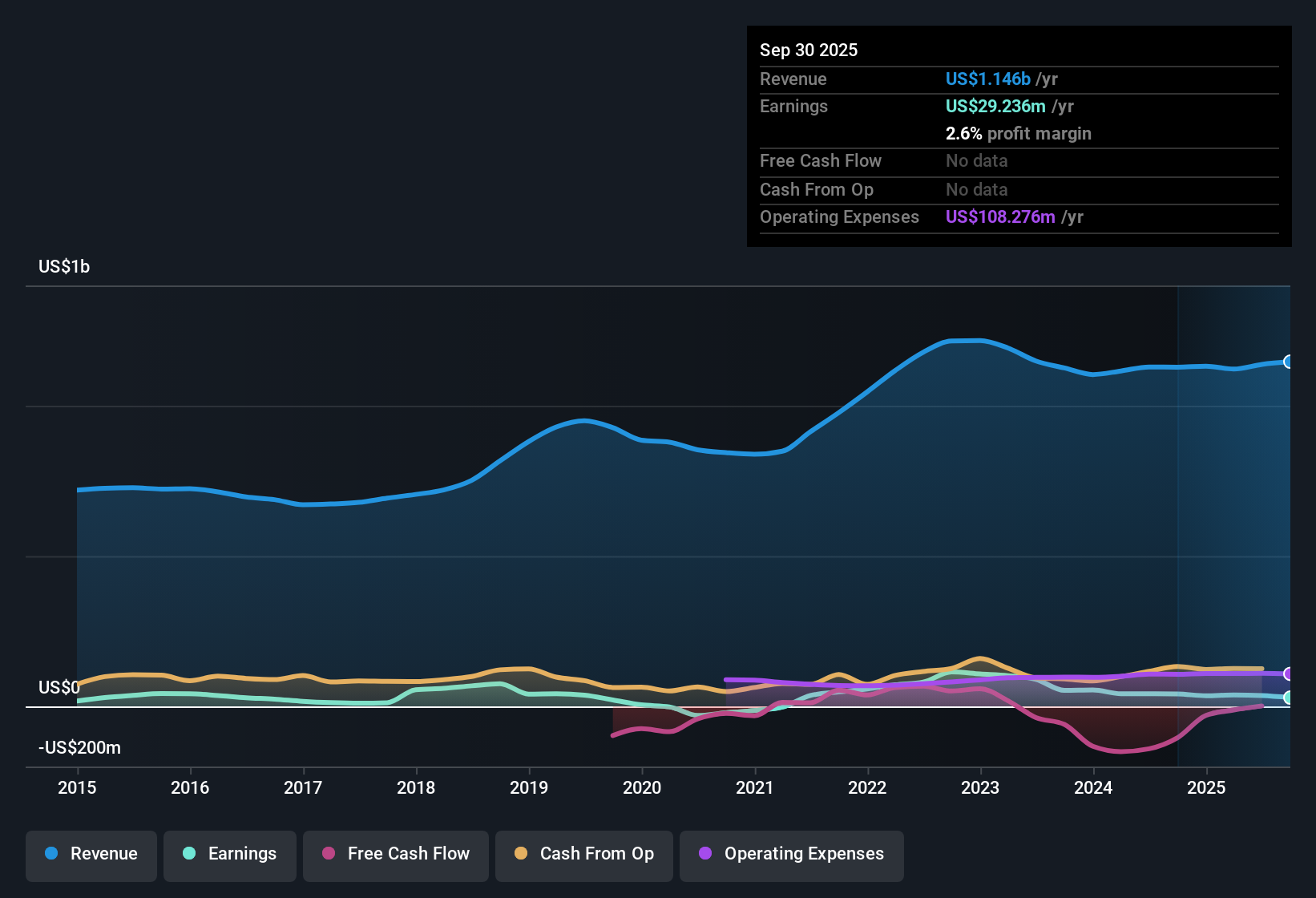

Covenant Logistics Group (CVLG) reported a net profit margin of 2.6%, down from last year’s 3.7%, reflecting softer earnings performance. Despite profitability growth at an annualized rate of 7.9% over the past five years, the company posted a negative earnings trend in the most recent year, further affected by a one-off $16.5 million loss that weighed on reported results. With shares still trading below internal fair value estimates and analyst price targets, investors are left weighing discounted valuations against recent margin pressures and the quality of current earnings.

See our full analysis for Covenant Logistics Group.Now, let’s see how these earnings results stack up against the broader narratives, where expectations are confirmed and where the numbers prompt a rethink.

See what the community is saying about Covenant Logistics Group

Specialized Contracts Drive Higher Margin Focus

- The company has shifted toward specialized, higher-margin contracts in its Dedicated segment, with analysts expecting profit margins to increase from 3.4% today to 8.0% in three years.

- Analysts' consensus view highlights that this transition is anticipated to drive both revenue and margin improvement.

- Operational efficiency enhancements and disciplined capital allocation, such as share repurchases and targeted M&A, are noted as catalysts for future earnings per share growth.

- However, short-term challenges such as a recent shift in business mix that increased per-mile costs and reduced fixed cost coverage illustrate that tangible results from this transition may take time to fully realize.

One-Off Loss Distorts Recent Earnings Quality

- The $16.5 million one-off loss recorded over the last twelve months has materially reduced reported net income, shifting the narrative from steady profit growth to earnings quality concerns.

- Analysts' consensus view underscores that, despite a five-year annualized earnings growth of 7.9%, the recent negative earnings growth and margin drop highlight the impact of non-recurring costs.

- Warehouse segment inefficiencies and cost increases resulted in a 42% reduction in adjusted operating profit, compounding concerns about near-term margin stability.

- Continued economic headwinds and delays in freight market recovery are seen as risks to anticipated improvements, which consensus expects to gradually ease as operational adjustments take effect.

Discounted Valuation Points to Upside if Targets Are Met

- With shares trading at $19.96, both the DCF fair value of $55.54 and analyst target of $30.00 suggest a substantial valuation gap relative to longer-term expectations.

- Analysts' consensus view stresses that for the stock to close this gap, the company must achieve forecasted revenue of $1.3 billion and earnings of $100.3 million by 2028, supported by a projected margin improvement to 8.0%.

- The implied 50% plus upside from current prices depends on delivering much faster profit growth than the current 3.1% revenue forecast, especially as the US market is expected to grow at 10% per year.

- Consensus recognizes Covenant’s attractive peer-relative valuation, but also warns that discount alone is not enough if margins do not recover as projected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Covenant Logistics Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these numbers? In just a few minutes, you can shape your own evidence-based perspective and share it with the community. Do it your way

A great starting point for your Covenant Logistics Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Covenant Logistics Group faces headwinds with recent margin contraction, earnings volatility, and uncertainty about how quickly its profit quality will improve.

If you want to focus on reliability, use stable growth stocks screener (2088 results) to find companies that consistently deliver steady revenue and earnings while avoiding the unpredictability seen here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com