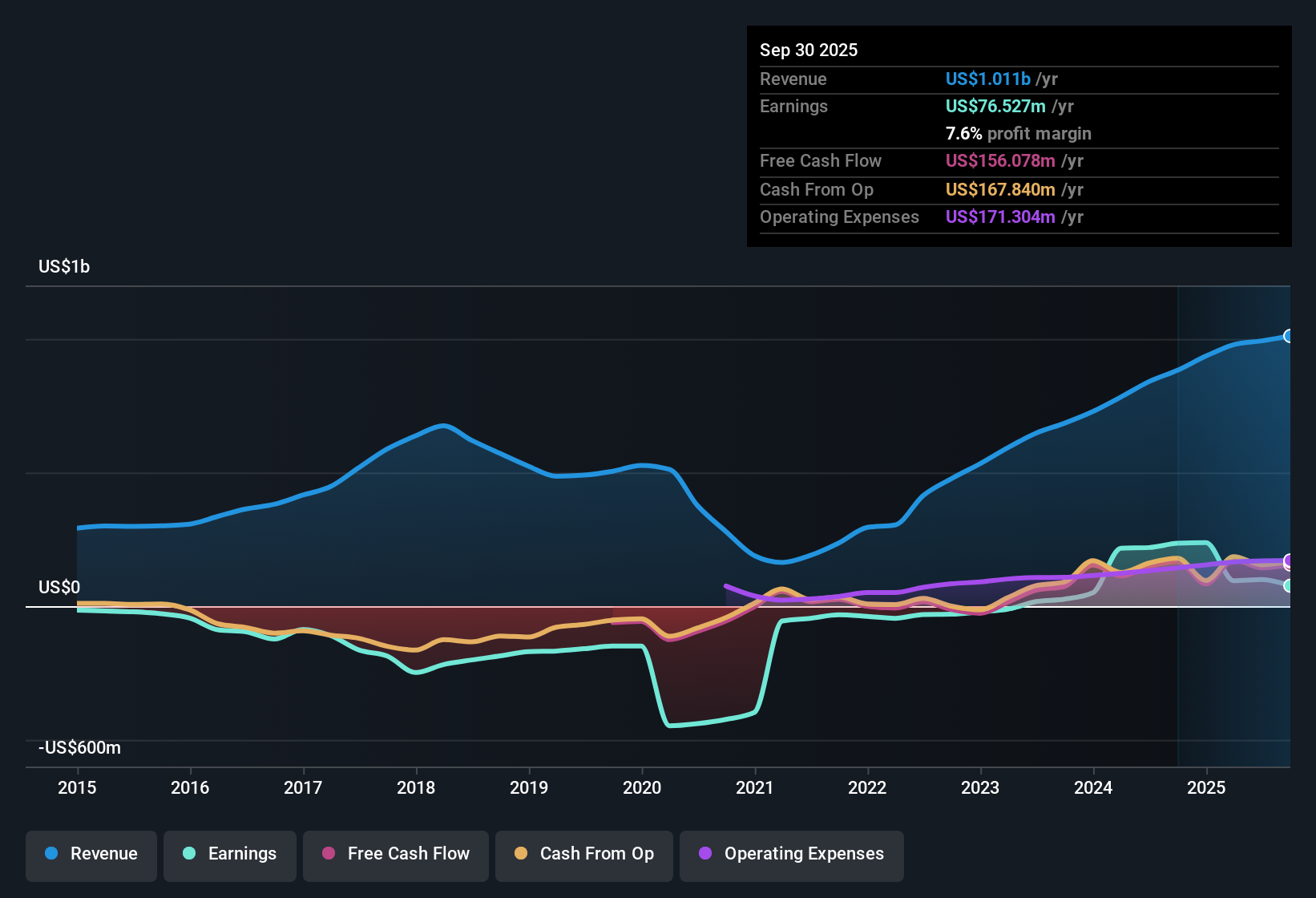

MakeMyTrip (NasdaqGS:MMYT) Margin Drop to 7.6% Challenges Growth Optimism

MakeMyTrip (NasdaqGS:MMYT) posted a net profit margin of 7.6%, a notable drop from last year’s 26.6%, despite strong five-year annualized earnings growth of 77.1%. Shares currently trade at $80.92, well above the assessed fair value of $43.78. The company is priced at a lofty 96.1x earnings, compared to its sector average of 23.9x. While revenue is forecast to rise 19.8% and earnings by 38.7% annually, the weaker margin and premium valuation have become key points of scrutiny for investors this earnings season.

See our full analysis for MakeMyTrip.Next up, we will see how these numbers stand up against the market narratives. Some will be confirmed, while others could face new questions.

See what the community is saying about MakeMyTrip

Margin Turnaround Forecasted by Analysts

- Profit margins are projected to rise from today’s 10.1% to 15.9% over the next three years, signaling a meaningful inflection despite this year’s drop to 7.6%.

- According to the analysts’ consensus view, they attribute this expected margin boost to several factors:

- Growth in higher-margin ancillary services like hotels, experiences, and ground transport is outpacing core bookings and is set to drive up overall profitability.

- Investments in product innovation and AI personalization are aimed at boosting conversion rates and customer retention, which supports longer-term operating leverage and scaling margins.

Consensus expects a major shift as margins climb, but MakeMyTrip still needs to prove it can deliver that performance in a tougher competitive landscape. 📊 Read the full MakeMyTrip Consensus Narrative.

Market Expansion Outpaces Peers

- Revenue is forecast to grow at 19.8% annually, outstripping the US market average of 10.2%. This is a clear sign that MakeMyTrip is positioned for aggressive market share gains.

- Analysts’ consensus narrative notes that expanding digital adoption in underpenetrated Indian cities and rising disposable incomes are giving MakeMyTrip a long runway for future growth:

- Demand for online travel and experiences among both domestic and international travelers is fueling broader and recurring revenues.

- Ongoing shifts toward digital booking, especially in tier-2 and tier-3 cities, increase the company’s addressable market and help sustain high top-line growth.

Valuation Premium Remains a Hurdle

- Shares trade at 96.1x earnings, which is over four times the US hospitality sector average of 23.9x, and far above the $43.70 DCF fair value. This keeps the stock’s premium firmly in focus.

- Analysts’ consensus narrative highlights this valuation risk:

- Even based on aggressive estimates for $1.8 billion in 2028 revenue and $288 million in earnings, the implied forward price-to-earnings of 60.5x remains well above peers.

- The gap between the current price of $80.92 and DCF fair value of $43.70 underscores the pressure for MakeMyTrip to outperform expectations to justify its elevated multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MakeMyTrip on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others have missed? You can frame the story your way and share a unique perspective in just a few minutes. Do it your way

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

MakeMyTrip’s elevated price and reliance on future margin improvements expose investors to valuation risk if growth expectations are not met.

Protect yourself from overpaying by using these 854 undervalued stocks based on cash flows to spot companies trading closer to their true worth and with more room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com